Crypto market investors have been wondering why the long-awaited altcoin season has not started. The expected rise in low- and mid-cap altcoins has not materialized, creating questions among investors. Experts point out that this situation is not only due to market fluctuations but also influenced by changes in investor behavior and macroeconomic factors. A detailed analysis of market dynamics is crucial to understanding the reasons behind the delay in the altcoin season.

Capital Outflows and Short-Term Rallies in Altcoins

In the crypto market, altcoins are facing significant capital outflows due to an increasing risk-averse trend. Low-market-cap tokens that once stood out for high return expectations now only attract investor interest for a short period. According to an over-the-counter (OTC) crypto trading report published by market maker Wintermute, the average duration of altcoin rallies in 2025 was limited to just 20 days. In previous years, this period ranged between 40 and 60 days.

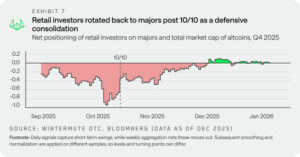

The report indicates that open positions in altcoin futures have declined by 55% since October, leading to the closure of positions worth over $40 billion. Jake Ostrovskis, Head of OTC Trading at Wintermute, stated that this trend is not only due to declining excitement but also because individual investors are redirecting speculative capital to different areas. Ostrovskis emphasized that investors now prefer larger, more established crypto assets, particularly Bitcoin and Ethereum, while playing macroeconomic developments.

You Might Be Interested In: Why Is Bitcoin Rising?

Recently, price movements in the crypto market have been largely driven by macroeconomic factors. U.S. President Donald Trump’s statements regarding tariffs and interest rate cuts caused sharp fluctuations in Bitcoin. During the tariff announcements in April and October of last year, the market experienced strong sell-offs, while the currency depreciation trend contributed to Bitcoin reaching its all-time high in October.

Altcoin Liquidity and Investor Trends

Wintermute strategist Jasper De Maere noted that altcoin liquidity has remained stagnant, with capital shifting toward new speculative areas. De Maere recalled that crypto was the primary speculation field in 2021, whereas today, individual investor interest has shifted to the stock market, particularly themes like space, quantum, robotics, and artificial intelligence.

Cosmo Jiang from Pantera Capital Management stated that the overall market outlook remains weak. Jiang commented:

“According to most indicators, the market is still volatile and in a bearish trend. For a healthy recovery, Bitcoin needs to lead the way.”

The CoinMarketCap Altcoin Season Index shows that in the past 90 days, crypto assets outside the top 10 by market capitalization have underperformed significantly compared to large tokens. During the sharp sell-off in October, altcoin investors were particularly hit hard, with $19 billion wiped from digital assets in a single day, and no strong recovery has been observed since.

Assessment

The altcoin season has not started due to a shift of investor interest toward major crypto assets and limited liquidity. While leading tokens like Bitcoin and Ethereum determine market direction, altcoins remain constrained to short-term movements. Investors may continue to take positions cautiously by closely following macroeconomic developments.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.