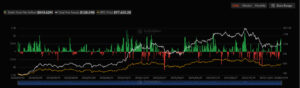

The cryptocurrency market has gained fresh momentum thanks to strong capital inflows through spot ETFs. As institutional investor interest increases, total inflows into Bitcoin, Ethereum, XRP, and Solana ETFs have reached billions of dollars. In particular, the high-volume activity in Bitcoin ETFs clearly shows that Bitcoin remains at the center of investor confidence.

Record Inflows of Hundreds of Millions into Bitcoin ETFs

Bitcoin ETFs took center stage with net inflows of $843.62 million. This figure demonstrates that institutional confidence in Bitcoin remains strong and that spot ETFs have become a permanent investment vehicle in the market. Despite price volatility in Bitcoin, these robust ETF inflows highlight a long-term investment perspective. According to experts, this trend further strengthens Bitcoin’s “digital gold” narrative.

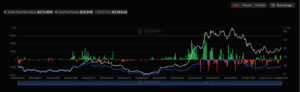

Ethereum ETFs Maintain Their Strength

Ethereum ETFs recorded inflows of $175 million, reflecting continued confidence in the network’s technological potential. Factors such as staking, Layer-2 solutions, and expanding institutional use cases continue to make Ethereum attractive to investors. Although inflows are lower compared to Bitcoin, Ethereum ETFs stand out for their steady performance, indicating that Ethereum’s long-term growth story remains strong.

Limited but Steady Inflows into XRP ETFs

XRP ETFs saw inflows of $10.63 million, representing a more modest volume but still sending an important signal to the market. As regulatory uncertainties have largely subsided, institutional interest in XRP is gradually increasing. These inflows suggest that XRP is still in the early stages on the ETF side, with investors beginning to take cautious positions.

Million-Dollar Inflows into Solana ETFs

Solana ETFs stood out among altcoins with net inflows of $23.57 million. High transaction throughput, low fees, and growing DeFi and NFT adoption continue to keep Solana on investors’ radar. Recent technical developments within the Solana ecosystem are among the key factors supporting capital inflows through ETFs.

Crypto ETFs Send Strong Signals to the Market

The capital inflows into Bitcoin, Ethereum, XRP, and Solana ETFs clearly indicate that institutional interest in the crypto market is becoming permanent. Bitcoin’s high-volume inflows reinforce its leadership, while Ethereum and Solana signal steady growth. XRP, meanwhile, presents a more cautious but positive outlook. In the coming period, crypto ETFs are expected to remain a critical indicator for price movements and overall market sentiment.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.