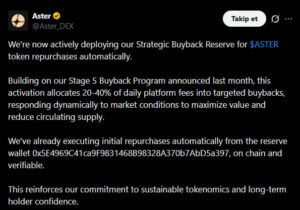

Aster DEX has officially announced the launch of its automatic ASTER buyback mechanism with the goal of strengthening its token economy and reinforcing long-term investor confidence. Under the new model, the platform plans to allocate 20%–40% of its daily trading fee revenue to strategic buybacks, aiming to gradually reduce the circulating supply. This approach is designed to create a sustainable, revenue-backed token support mechanism that dynamically adapts to market conditions.

Aster DEX Strategic Buyback Reserve Is Now Active

Building on the previously announced Phase 5 Buyback Program, this new step takes Aster DEX’s vision of a sustainable token model to the next level. The Strategic Buyback Reserve operates automatically, funded directly by platform revenues, and executes buybacks without the need for manual intervention. This structure allows for greater flexibility against market volatility while ensuring a controlled reduction of the $ASTER supply.

A key highlight of Aster DEX’s model is that buybacks are based on real platform revenues. A fixed percentage of daily trading fees is directly allocated to the buyback process, with the rate fluctuating between 20% and 40% depending on market conditions. This ensures that token value support is driven by actual performance rather than artificial mechanisms.

On-Chain, Automated, and Fully Verifiable Transactions

It was shared that the first ASTER buybacks were carried out fully automatically via the reserve wallet (0x5E4969C41ca9F9831468B98328A370b7AbD5a397), with all transactions being openly verifiable on-chain. This setup eliminates manual intervention in the buyback process and allows investors to track transactions directly on the blockchain. With its strong focus on transparency and accountability, this approach stands out as a core pillar of Aster DEX’s long-term trust-building strategy.

Official statement:

“By activating our Strategic Buyback Reserve, we are allocating 20%–40% of daily platform fees toward targeted buybacks. This structure enables us to respond dynamically to market conditions, reduce the circulating supply, and further strengthen long-term investor confidence.”

Aster DEX Emphasizes Long-Term Token Economy

The launch of Aster DEX’s automatic $ASTER buyback process sends a strong signal in terms of sustainable tokenomics, transparency, and investor trust. This revenue-based model prioritizes long-term value creation over short-term price movements. The development supports Aster DEX’s objective of securing a stronger position within the DeFi ecosystem, while also marking a significant step toward reinforcing supply-demand dynamics for the ASTER token.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.