Bitcoin latest pullback has gone beyond price action alone. Pressure building beneath the surface is becoming increasingly visible. As BTC retreats toward the $91,000 range, several veteran market observers argue this move may be more than a temporary pause. The “dangerous familiarity” highlighted in Peter Brandt’s charts has once again brought the $58,000–$62,000 scenario into focus. When bearish formations align with on-chain loss metrics unseen since October 2023, it suggests Bitcoin’s real test may just be beginning.

At the same time, weakening global risk appetite, sharp geopolitical signals, and deteriorating on-chain behavior have converged. This overlap has notably reduced short-term investors’ willingness to add exposure, tightening market reflexes across the board.

Charts Are Telling Different Stories

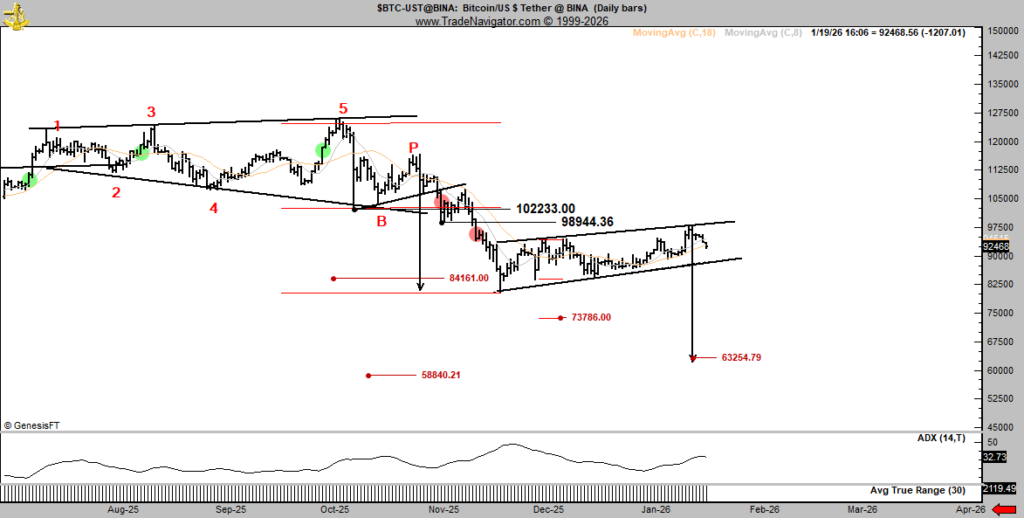

Veteran trader Peter Brandt argues that a pattern historically associated with sharp sell-offs is re-emerging on Bitcoin’s daily chart. According to Brandt, the $58,000–$62,000 range represents a technically significant zone that cannot be ignored. This area also sits just above realized price levels and the 200-week moving average, reinforcing its importance.

Other analysts echo a similar view on lower timeframes, pointing to a clear bear flag breakdown on the four-hour chart. Within this structure, the $90,400 level stands out as a critical support. A decisive move below it could accelerate downside pressure. That said, the market is not fully aligned; opposing voices remind that such patterns often fail during periods of elevated volatility.

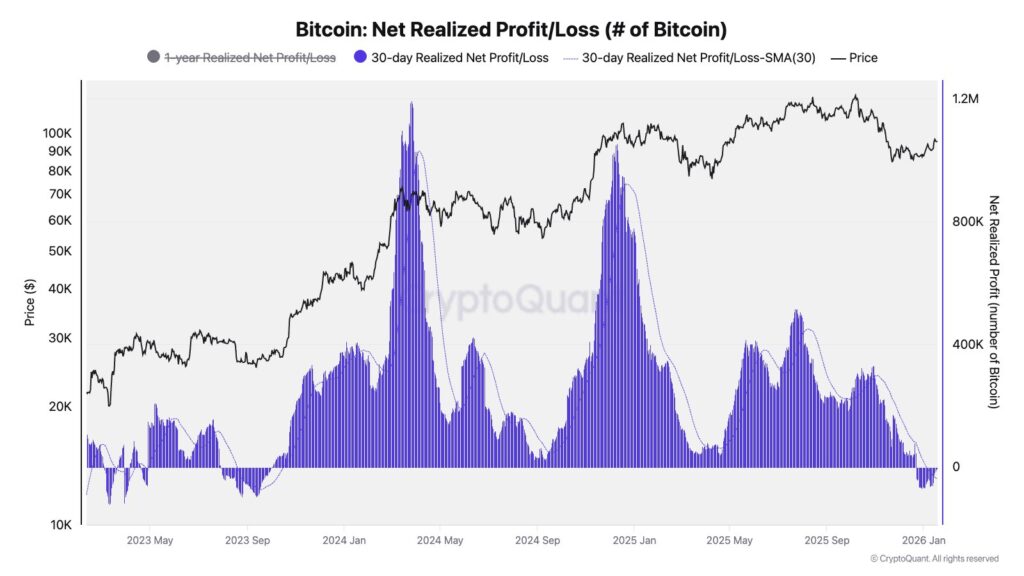

CryptoQuant data adds another layer to the concern. For the first time in roughly 15 months, Bitcoin investors have shifted into a “realized net loss” position. In other words, the conversation is no longer about profit-taking, but about panic-driven exits and loss realization.

On-Chain Metrics Flash Warning Signs

Behind the price action, the signals grow more uncomfortable. Bitcoin’s 30-day Realized Net Profit/Loss metric has dropped into negative territory for the first time since October 2023. This confirms that sellers are locking in losses rather than gains.

Short-term holders and large wallets appear to be trimming exposure after BTC failed to sustain levels above $97,000. Recent rebound attempts have been fueled largely by derivatives-driven short liquidations, not by consistent spot demand. This dynamic raises doubts about the durability of any near-term recovery.

Why does this matter? Because once realized losses resurface, market psychology becomes fragile. In such phases, price behavior is often dictated less by technical levels and more by investor sentiment and reflexive selling.

Whales Begin to Shift Positioning

On-chain monitoring platforms indicate that some large players have started opening fresh short positions. One notable whale, previously known for aggressive long exposure, has fully exited BTC, ETH, SOL, and DOGE positions, crystallizing multi-million-dollar losses in the process.

While individual moves do not define trend direction, they do highlight a growing defensive posture at the top end of the market. In periods of thinning liquidity, these shifts can exert outsized influence on price dynamics.

Consolidation or a Deeper Test Ahead?

Not all data points to an outright collapse. Certain on-chain assessments suggest Bitcoin is losing momentum in the low-$90,000 range but remains above neutral territory. From this perspective, the market may be entering a time-buying consolidation rather than an immediate breakdown.

Options traders continue to price in elevated uncertainty, while spot and futures indicators show pockets of cautious optimism. ETF inflows, meanwhile, imply that institutional interest has not vanished entirely.

Still, metrics tracking new investors reveal that short-term holders have remained in unrealized loss territory since November 2025. This leaves the door open to renewed panic selling if prices slip further.

Bitcoin is currently fluctuating between $90,800 and $93,300. How this range resolves in the coming days will determine whether the $62,000 scenario remains a fear-driven headline or evolves into a genuine roadmap. For now, the market has yet to make its choice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.