Short-term price volatility continues to keep Bitcoin investors cautious. However, on-chain data suggests that institutional demand for Bitcoin remains resilient. Recent analytical insights indicate that large-scale wallets are still accumulating BTC, signaling that long-term confidence has not been shaken despite broader market uncertainty.

Large Wallets Accumulate $53 Billion Worth of Bitcoin

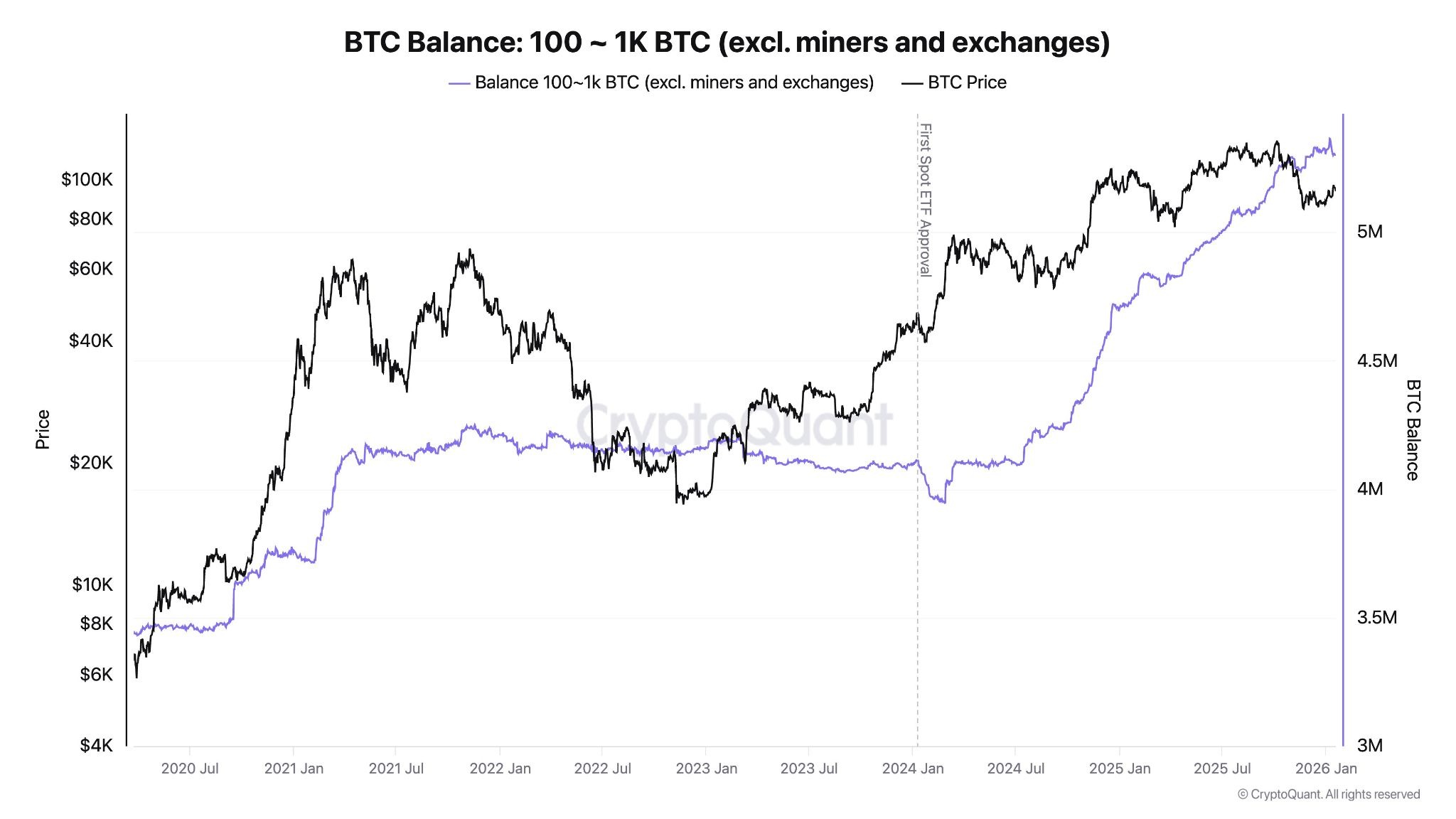

According to on-chain data, major custody wallets have accumulated approximately $53 billion worth of Bitcoin over the past 12 months. Wallets holding between 100 and 1,000 BTC added a total of 577,000 BTC during this period, a development widely interpreted as a sign that institutional participation remains intact. This wallet segment also includes spot Bitcoin ETFs.

CryptoQuant founder Ki Young Ju noted that when exchanges and miners are excluded, these figures provide a relatively clean proxy for institutional demand. The total Bitcoin held by this cohort has increased by around 33% over the past 24 months, a timeframe that closely aligns with the launch of spot Bitcoin ETFs in the United States.

Steady Inflows Into Spot Bitcoin ETFs

US-based spot BTC ETFs have recorded cumulative net inflows of roughly $1.2 billion so far this year. This comes despite Bitcoin gaining only about 6% over the same period, suggesting that institutional investors are accumulating independently of short-term price action. Some market commentators argue that large-scale adoption of Bitcoin and Ethereum by institutions is still in its early stages, with the most significant impact expected over the coming decade.

Digital Asset Treasuries Gain Momentum

Another notable driver behind rising institutional exposure is the growth of digital asset treasuries (DATs). Led by Michael Saylor’s Strategy, these entities have reportedly acquired around 260,000 BTC since July, representing purchases worth approximately $24 billion at current market prices. Data from Glassnode shows that total DAT holdings have surged by 30% over the past six months, surpassing 1.1 million BTC and outpacing new supply from miners.

Retail Sentiment Remains Cautious

While institutional metrics paint a constructive picture, retail sentiment tells a different story. The BTC Fear and Greed Index has slipped back into “fear” territory, falling to 32 out of 100 after briefly entering “greed” for the first time since October. This shift followed Bitcoin’s pullback from $97,000 to below $92,000.

Rising geopolitical tensions, particularly escalating trade frictions between the United States and Europe, have fueled risk aversion across global markets. As a result, retail investors have adopted a more defensive stance.

Despite this divergence, on-chain indicators suggest that institutional capital continues to provide a solid structural foundation for BTC, reinforcing its long-term investment narrative even amid heightened short-term uncertainty.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.