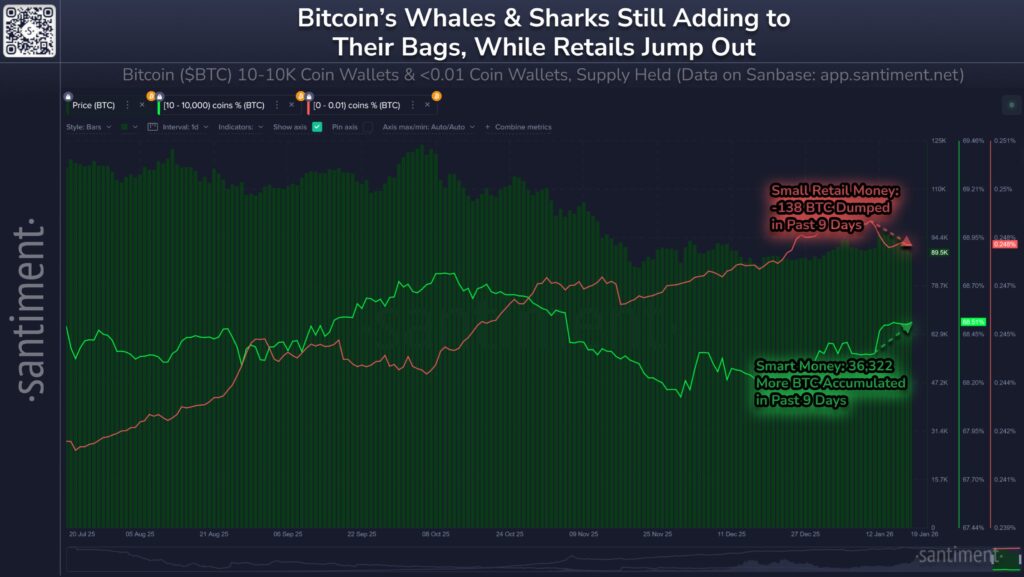

A clear divergence has emerged in the Bitcoin market over the past nine days. While price action remained under pressure, large wallets stayed firmly on the buy side, treating the pullback as an accumulation opportunity. Retail investors, by contrast, chose to scale down their positions, reinforcing short-term selling pressure across the market.

According to data from Santiment, wallets holding between 10 and 10,000 BTC — commonly described as “smart money” — accumulated a total of 36,322 BTC between January 10 and January 19. At current market prices, this accumulation is valued at approximately $3.2 billion.

Notably, this buying activity occurred while Bitcoin was trending lower, highlighting a growing disconnect between price movement and on-chain behavior.

Buying Continues Despite the Pullback

Bitcoin fell by 4.55% over the past 24 hours, briefly dipping to around $89,110. Despite the decline, Santiment reported that whale and “shark” wallets continued to add to their holdings.

This pattern suggests that large players are prioritizing longer-term position building rather than reacting to short-term volatility. Historically, periods of heightened uncertainty have often coincided with similar accumulation phases in on-chain data.

Retail Investors Move the Other Way

The most striking aspect of the current setup is the sharp directional split between large holders and retail participants. Wallets holding less than 0.01 BTC sold a combined 132 BTC during the same period. While the dollar value of roughly $11.66 million appears modest, the directional signal is hard to ignore.

As Bitcoin retreated toward the $89,400 level, traditional safe havens like gold and silver continued to test new highs. Even so, on-chain metrics indicate that large Bitcoin holders have not shifted into distribution mode.

Santiment data shows that wallets holding between 10 and 10,000 BTC increased their balances by 0.27% over the last nine days, while sub-0.01 BTC retail wallets reduced exposure by 0.28%. Excluding geopolitical noise, the platform associates this pattern with longer-term bullish divergences in crypto market structure.

Santiment also notes that the simultaneous presence of smart money accumulation and retail selling tends to increase the probability of upside divergence. However, the timing of such moves remains notoriously difficult to predict.

Tariff Rhetoric Weighs on Price

As for why Bitcoin has struggled to regain momentum, macroeconomic and political factors appear to be playing a decisive role. Comments from Donald Trump regarding potential tariffs on Europe, alongside renewed rhetoric tied to Greenland, added pressure to risk assets.

Following these remarks, Bitcoin briefly dropped by nearly 7%. Yet large wallets remaining active on the buy side has made the gap between price action and on-chain behavior increasingly visible.

The Market Remains Cautious

The Crypto Fear & Greed Index currently sits at 32, reflecting elevated levels of investor anxiety. A similar picture emerges from the Altcoin Season Index, which stands at 29 out of 100. Capital rotation into altcoins remains limited, suggesting the market is still heavily Bitcoin-centric.

Analysts Remain Divided

CryptoQuant CEO Ki Young Ju has pointed out that retail investors appear to have largely stepped away, leaving accumulation activity dominated by whales.

Meanwhile, analyst Will Clemente argues that current price action has failed to generate meaningful excitement around Bitcoin. The ongoing divergence between on-chain signals and market behavior suggests that the broader directional bias has yet to fully resolve.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.