After months of regulatory gridlock, U.S. crypto policy has reached a sensitive turning point. The Securities and Exchange Commission and the Commodity Futures Trading Commission are scheduled to hold a joint meeting on January 27, signaling a renewed effort to align oversight of digital assets. The timing is notable. As Washington reshapes its stance on crypto, regulatory fragmentation is increasingly viewed as a market risk rather than a technical inconvenience.

For investors, the key question is whether this coordination marks a structural shift or remains a symbolic gesture.

A Push for Regulatory Alignment

The decision by the SEC and CFTC to meet reflects growing pressure to clarify long-standing jurisdictional overlaps. Under President Trump’s digital asset agenda, crypto policy is no longer framed solely as a compliance issue but as a strategic positioning tool. SEC Chair Paul S. Atkins openly acknowledged that legacy regulatory boundaries no longer match how modern crypto markets operate.

From the CFTC’s perspective, alignment is also tied to competitiveness. Officials have emphasized that regulatory uncertainty risks pushing innovation offshore. Still, markets remain cautious. Coordination between agencies does not automatically translate into legislative progress, and that gap continues to weigh on sentiment.

CLARITY Act Delays Add Pressure

At the center of the debate sits the CLARITY Act, which has struggled to advance in the Senate. A draft released by the Banking Committee earlier this year triggered strong backlash from parts of the crypto industry, leading to postponed markups. Meanwhile, the Senate Agriculture Committee introduced a separate, more partisan draft.

Notably, its planned markup date coincides with the SEC–CFTC meeting, intensifying the sense of a compressed and fragile timeline. With the Banking Committee shifting attention to other priorities, expectations that the bill could move forward quickly have faded. Some lawmakers now point to March, though confidence remains thin.

Market Confidence Continues to Erode

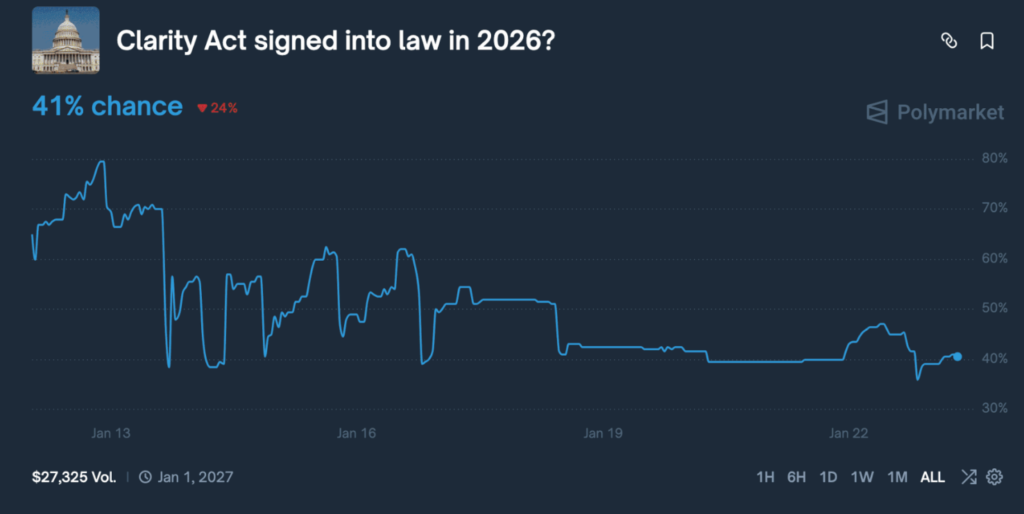

Prediction market data from Polymarket highlights the growing skepticism. Odds that the CLARITY Act will be signed into law in 2026 have dropped sharply from recent highs, reflecting doubts about political alignment and industry consensus.

Internal divisions have become more visible. Cardano founder Charles Hoskinson recently criticized Ripple CEO Brad Garlinghouse’s support for the bill, rejecting the argument that a flawed framework is better than regulatory limbo. These disagreements reinforce the perception that U.S. crypto regulation remains unsettled at its core.

White House Optimism Meets Market Caution

The White House has maintained that crypto legislation will eventually pass, urging industry leaders and policymakers to find common ground. Yet markets have not priced in that optimism. As delays persist, uncertainty premiums remain elevated, challenging the narrative of the U.S. as a future global crypto hub.

The outcome of the SEC–CFTC talks may influence short-term expectations. However, without a clear legislative roadmap, coordination alone may struggle to restore confidence.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.