Forecasts for Bitcoin price trajectory in 2026 are becoming increasingly polarized. Estimates from global banks, asset managers, and market strategists now span a remarkably wide range, with projections clustering anywhere between $75,000 and $250,000. Such dispersion underscores a central reality: despite growing institutional participation, uncertainty remains a defining feature of Bitcoin’s medium-term outlook.

At the heart of this debate lies a critical question—can institutional demand meaningfully compensate for weaker retail participation and potentially tighter global liquidity conditions?

ETF-Driven Optimism Shapes the Bullish Case

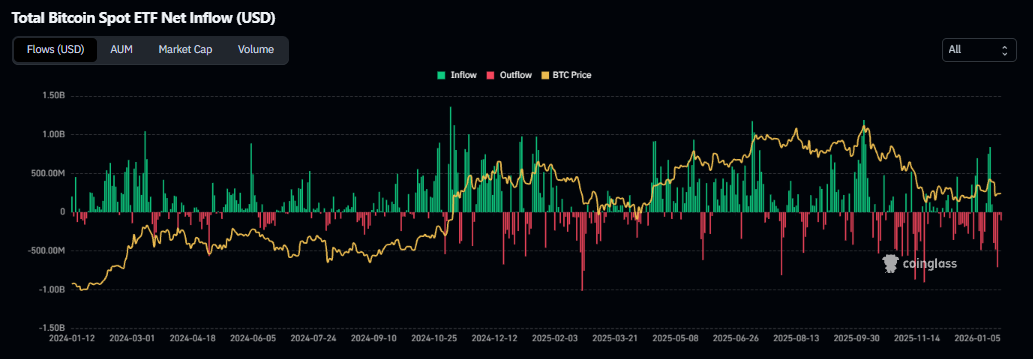

The constructive scenario for Bitcoin rests heavily on continued inflows through exchange-traded funds. Under this framework, prices above $150,000 are achievable if institutional buyers absorb available supply at scale. Several projections suggest crypto ETF inflows could range from $15 billion to $40 billion throughout 2026, while more optimistic assumptions place the figure above $50 billion if market conditions improve.

Standard Chartered recently revised its 2026 Bitcoin target downward from $300,000 to $150,000, emphasizing a slower appreciation path dominated by ETF accumulation rather than corporate balance-sheet adoption. Bernstein echoes this view, arguing that sustained institutional buying could offset retail-driven volatility and potentially disrupt the traditional four-year market cycle. JPMorgan, using a gold-adjusted valuation framework that accounts for Bitcoin’s higher volatility, places fair value near $170,000.

On-chain data further supports this narrative, with signs that long-term holders resumed accumulation toward the end of 2025—often interpreted as a transition from distribution to longer-duration positioning.

Downside Risks and the Bearish Framework

More cautious perspectives point to meaningful downside risks. Some on-chain analytics platforms suggest Bitcoin entered a bearish regime late in 2025, raising the possibility that weakness could persist into 2026. Within this view, downside targets between $35,000 and $70,000 are considered plausible if demand fails to stabilize.

ETF flows are also viewed as inherently momentum-sensitive, tending to weaken during risk-off environments and strengthen only once confidence returns. From a technical standpoint, traders continue to monitor prior cycle highs, realized price zones, and long-term moving averages as potential support areas if volatility accelerates.

Why 2026 Could Be Pivotal

The exceptionally broad forecast range highlights how finely balanced Bitcoin’s outlook remains. Whether institutional capital proves durable, ETF inflows remain consistent, and global liquidity conditions ease or tighten will collectively determine market direction.

Rather than representing a guaranteed outcome, Bitcoin in 2026 appears positioned as a high-conviction but high-risk asset—one increasingly shaped by macro forces and institutional behavior rather than purely crypto-native dynamics.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.