While weakness in the crypto market has kept retail investors cautious, institutional sentiment tells a different story. Recent data suggests that a strong majority of professional investors view Bitcoin as undervalued when trading within the $85,000–$95,000 range, highlighting a growing gap between short-term price action and long-term conviction.

Market Crash Did Not Shake Long-Term Confidence

Following the sharp market downturn in October, Bitcoin declined by nearly 30%, falling from its all-time high of $126,080 to around $87,600. Since then, the broader crypto market has largely moved sideways or lower, struggling to regain upward momentum.

The October 10 sell-off marked a major turning point, triggering the liquidation of more than $19 billion in leveraged positions. This event significantly weakened market sentiment and reduced risk appetite across digital assets. However, despite these conditions, institutional investors appear largely unfazed in terms of their long-term outlook.

Where Institutions See Fair Value for Bitcoin

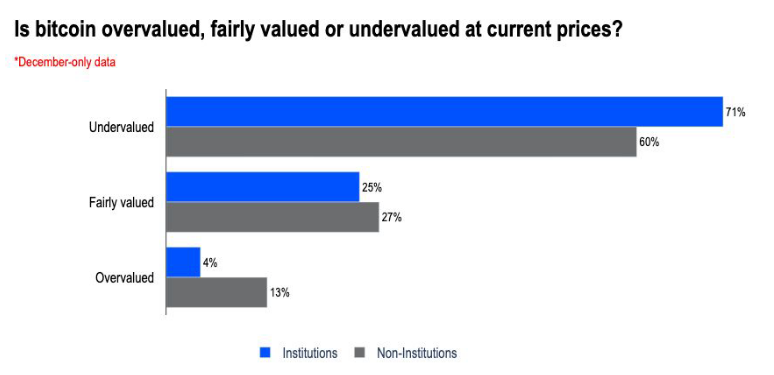

Survey results show that 71% of institutional investors believe Bitcoin is undervalued at current levels. Among independent investors, 60% share the same view. Meanwhile, roughly 25% of institutions consider Bitcoin fairly valued, and only 4% believe it is overpriced.

During the survey period, Bitcoin traded almost entirely within the $85,000–$95,000 band, reinforcing the perception that this range represents a key valuation zone for the market.

Precious Metals Outperform as Bitcoin Lags

While crypto assets remain under pressure, traditional safe havens have delivered strong performance. Gold surged past $5,000, reaching record highs, while silver’s total market value has doubled since October. In comparison, the S&P 500 index gained just 3% over the same period.

Ongoing geopolitical risks, renewed tariff threats, and escalating tensions in the Middle East have continued to limit appetite for risk assets, contributing to Bitcoin’s relative underperformance.

Institutions Prefer Holding and Buying Dips

Rather than exiting the market, institutions appear prepared to increase exposure. Eighty percent of surveyed institutional investors stated they would either hold their positions or buy more crypto if prices fell another 10%.

Additionally, more than 60% reported that they have either maintained or expanded their crypto holdings since Bitcoin reached its October peak. This behavior suggests strong confidence in the asset class despite short-term volatility.

Macroeconomic Conditions Could Support Crypto Ahead

Although uncertainty around monetary policy remains, expectations of two interest rate cuts in 2026 could provide a favorable backdrop for risk-oriented assets like crypto. Inflation holding steady at 2.7% and US real GDP growth exceeding 5% in the fourth quarter indicate that broader economic conditions are not inherently hostile to digital assets.

Taken together, these factors suggest that while price action remains subdued, institutional conviction in Bitcoin’s long-term value remains firmly intact.

You can join our Telegram channel to not miss the news and stay informed about the crypto world.