One of the most frequently asked questions in the crypto market today is whether a traditional “altcoin season” can still emerge. When current data and market structure are examined, the likelihood of a broad-based altcoin rally in 2026 appears limited. Strong Bitcoin dominance combined with structural shifts in the crypto ecosystem continues to weigh heavily on alternative cryptocurrencies.

Market Indicators Point to Ongoing Bitcoin Dominance

The Altcoin Season Index currently sits at 29, well below the 75 threshold that would indicate altcoins outperforming Bitcoin. This index measures whether at least 75% of the top 50 cryptocurrencies—excluding stablecoins and asset-backed tokens—have exceeded Bitcoin’s performance over the past 90 days.

Longer-term indicators reinforce this trend. The Altcoin Month index stands at 49, while the Altcoin Year index has dropped to 29. In addition, the market has gone 122 consecutive days without an altcoin season, and it has been 1,456 days since the last full altcoin year. These figures suggest more than a temporary cycle; they point to a meaningful transformation in market dynamics.

Four Structural Barriers Limiting Altcoin Rallies

Analysts highlight four major structural challenges preventing a widespread altcoin surge. The first is capital dilution. Over the past year, the number of tracked tokens has expanded dramatically from 5.8 million to 29.2 million, dispersing investment capital across an ever-growing universe of assets and reducing the impact of concentrated buying.

The second obstacle lies in tokenomics. Many projects operate with low circulating supply and high fully diluted valuations. As locked tokens gradually unlock, consistent selling pressure emerges, making sustained price appreciation difficult even when demand exists.

A third challenge comes from new sources of competition. Memecoins continue to attract speculative capital with the promise of rapid gains. At the same time, derivatives such as perpetual futures and prediction markets allow traders to express directional views without holding spot tokens, further weakening demand for traditional altcoins.

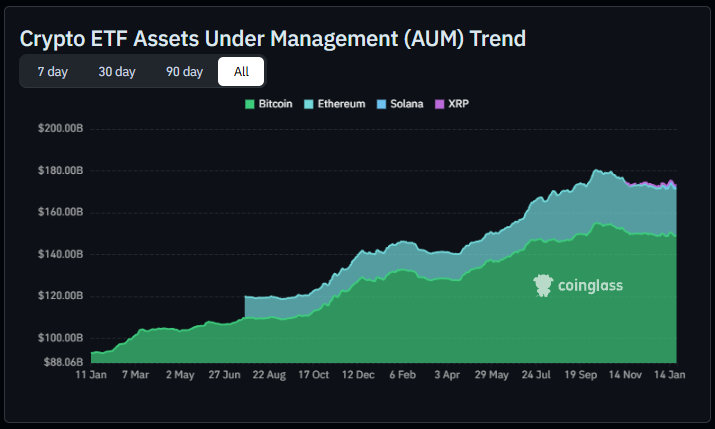

Finally, institutional capital allocation plays a decisive role. Large investors remain focused on established assets such as ETH, SOL, and XRP, primarily through ETF structures. This concentration leaves mid- and small-cap altcoins struggling to attract meaningful inflows.

Token Unlocks Add Persistent Selling Pressure

Bitcoin dominance remains elevated at 59%, while more than $1 billion in token unlocks are scheduled within a single week. The steady introduction of new supply makes it increasingly difficult for altcoins to build the sustained buying momentum required for synchronized rallies.

In earlier market cycles, a smaller token universe allowed capital to concentrate among the top projects, fueling classic altcoin seasons. Today’s fragmented market structure suggests that, unless these conditions change, a broad altcoin season in 2026 remains unlikely. Whether this represents a new normal or a prolonged transition phase will become clearer over time.

In the comment section, you can freely share your comments about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.