The transformation that crypto markets have undergone in recent years goes far beyond just new tokens or Layer-2 solutions. Today, the core topic of discussion is how traditional financial markets will be rebuilt on crypto infrastructure. tradeXYZ stands out as a decentralized, non-custodial perpetual DEX at the center of this transformation.

tradeXYZ aims to make a wide range of products—including not only crypto assets but also traditional financial instruments such as US stocks, indices, commodities, and forex pairs—available 24/7 on the Hyperliquid blockchain.

Core Vision of tradeXYZ

The tradeXYZ ecosystem views the restriction of global capital markets by specific hours, intermediaries, and geographic limitations as inefficient. The platform’s fundamental approach is to enable everyone to access liquid markets from anywhere, at any time.

This vision is built on three main pillars:

- Full control over user assets through a non-custodial structure

- Merging traditional and crypto markets into a single interface

- A decentralized, high-performance orderbook architecture

tradeXYZ represents a new generation trading infrastructure that combines decentralized finance with traditional market logic.

With 24/7 markets, a non-custodial structure, advanced orderbook architecture, and a wide range of products, tradeXYZ stands out as a key player within the Hyperliquid ecosystem.

Relationship Between Hyperliquid and tradeXYZ

All transactions on tradeXYZ occur on the Hyperliquid network. Hyperliquid is a high-capacity, fully on-chain, and decentralized perpetual trading network.

One of the most critical components of this network is the decentralized orderbook system called HyperCore. Order matching, liquidations, funding payments, and settlement processes are executed on-chain by validators.

tradeXYZ provides a user interface (frontend) that operates on top of this infrastructure. In other words:

- tradeXYZ is not an exchange

- It does not hold user funds

- It does not execute trades itself

Users access markets on Hyperliquid directly through the tradeXYZ interface.

What are HIP-3 and the XYZ Protocol?

Within the Hyperliquid ecosystem, there are network upgrades called Hyperliquid Improvement Proposals (HIP). Among them, HIP-3 enables independent developers to create their own perpetual markets on Hyperliquid.

At this point, the XYZ Protocol is a HIP-3 deployment.

The XYZ Protocol determines:

- Which assets will be listed

- Oracle sources

- Leverage limits

- Market parameters

tradeXYZ is the user interface that provides access to these XYZ markets.

Important note: tradeXYZ is not the only way to access XYZ markets. However, it offers one of the most comprehensive and integrated user experiences.

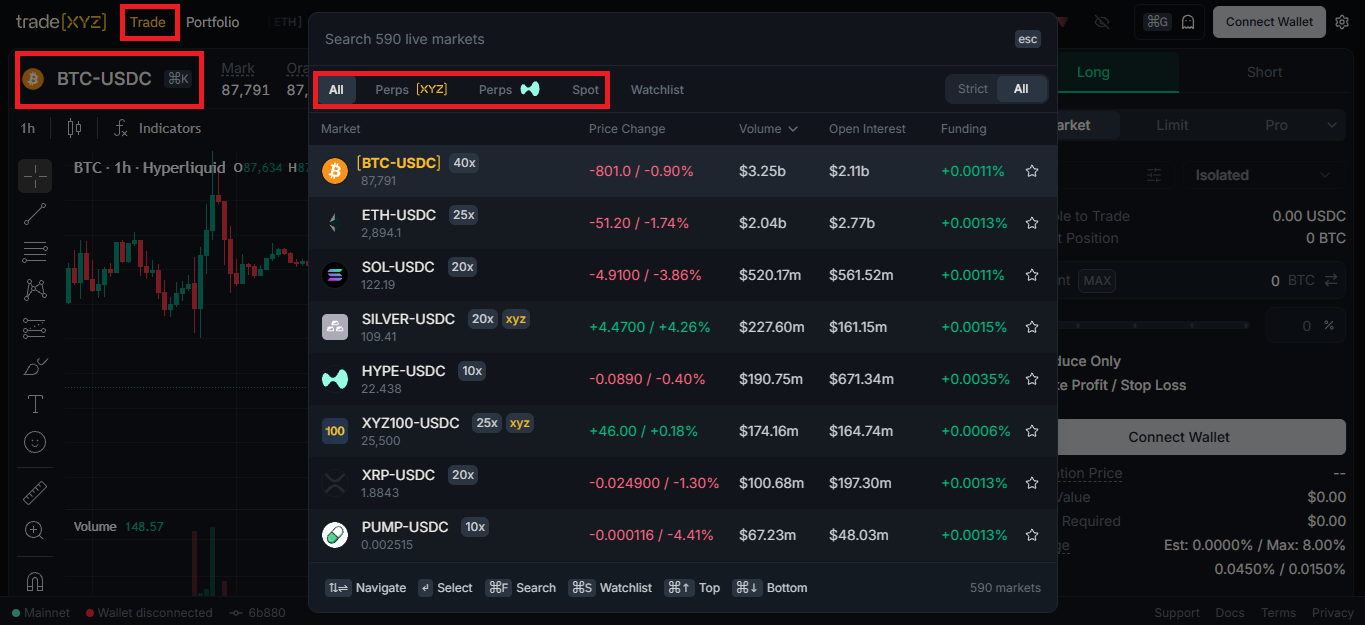

Markets Available on tradeXYZ

tradeXYZ brings together three main types of markets on a single platform.

- Crypto Perpetual Markets

These are Hyperliquid’s native perpetual markets. On major crypto assets such as BTC, ETH, and others:

- Perpetual contracts with no expiry

- USDC collateralized

- Funding mechanism-based

Users can choose between isolated or cross margin and manually adjust leverage levels.

- XYZ Equity Perpetuals (Stock and Index Perps)

One of the most striking features of tradeXYZ is the conversion of traditional stocks and indices into perpetual contracts.

Notable example:

- XYZ100: An index perp representing 100 major US companies, similar to Nasdaq-100

These contracts:

- Are collateralized with USDC

- Use USD-based oracle prices

- Are cash-settled

Even when traditional markets are closed, they continue to trade thanks to internal pricing mechanisms.

- Spot Crypto Markets

Thanks to Unit Protocol integration, tradeXYZ also supports spot crypto trading.

- Native assets such as BTC, ETH, SOL

- Tokenized on their own blockchains

- Traded as spot on Hyperliquid

These assets cannot be used as collateral but offer low-fee spot buying and selling.

24/7 Oracle and Pricing Mechanism

Especially for stock and commodity perps, the biggest challenge is determining the price outside of market hours. tradeXYZ and the XYZ Protocol adopt a hybrid approach here:

- When markets are open: Institutional liquidity providers and oracle networks (e.g., Pyth)

- When markets are closed: Continuous time-weighted EMA-based internal pricing

The mark price is calculated by taking the median of oracle price, perp mid-price difference, and components derived from recent trades. This structure is restricted with specific bands to limit sudden price jumps.

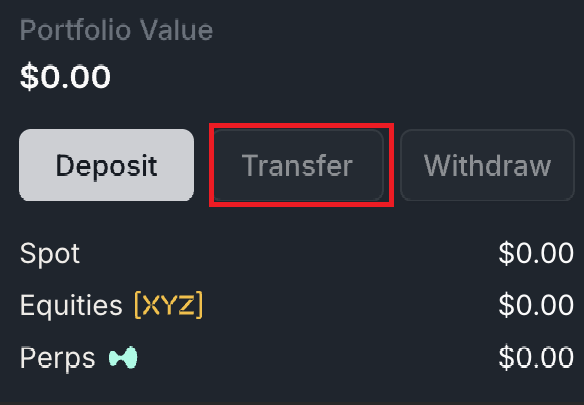

Account Structure and Fund Management

On tradeXYZ, a single wallet address can have multiple account types:

- Crypto Perps Account

- Equities [XYZ] Account

- Spot Account

Instant and free transfers can be made between these accounts. However, collaterals are independent; equity perps and crypto perps do not share the same margin.

How to Use tradeXYZ?

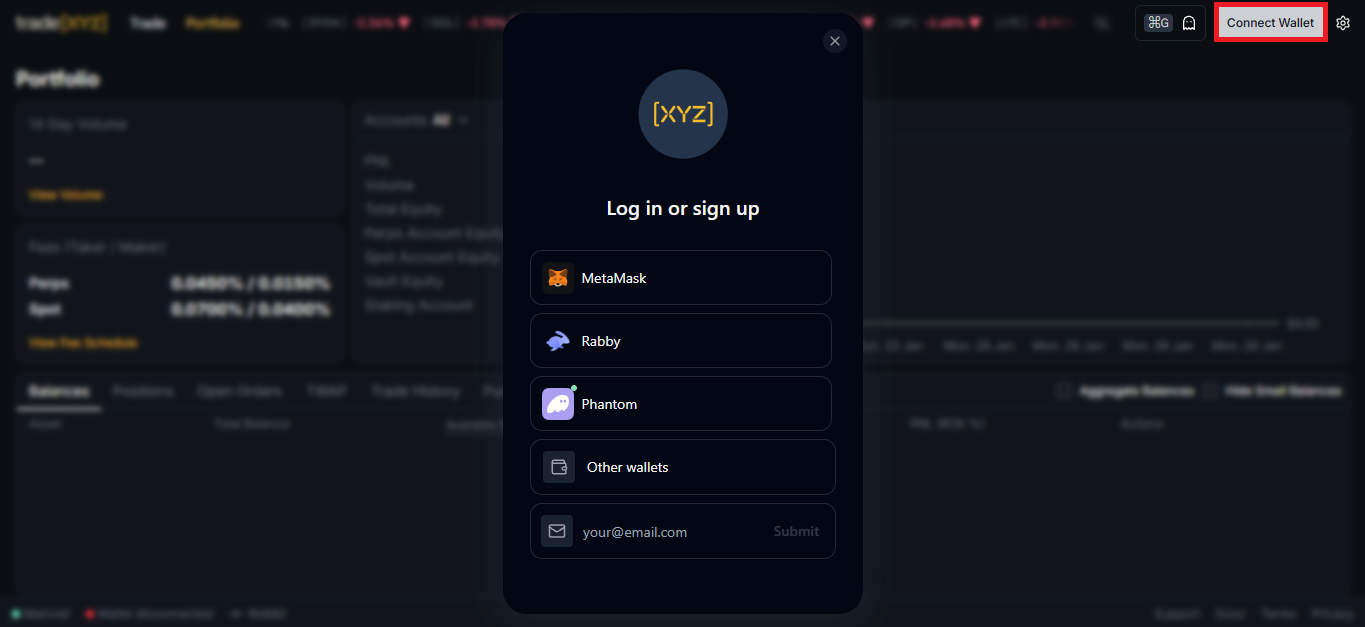

tradeXYZ Wallet Connection

The platform operates completely non-custodially. Users can:

- Connect existing wallets such as MetaMask, Phantom, Rabby

- Or create a new wallet via email through Privy

You can also click here to read our guide titled “What is MetaMask? How to Use It?”.

After connecting the wallet:

- Deposit USDC or supported spot assets

- Enable trading

- Transfer to the relevant accounts

tradeXYZ may be restricted in certain jurisdictions (including the US) due to regulations, and wallets may undergo sanctions screening.

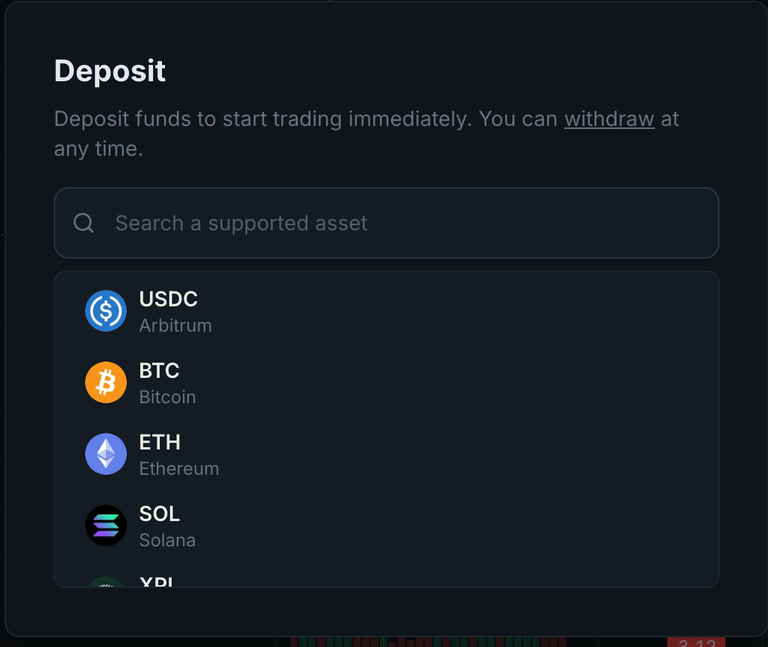

Depositing Spot Crypto Assets

tradeXYZ allows users to deposit spot crypto assets via the Unit Protocol infrastructure. Deposits are made through the native blockchain of the relevant asset.

The process can be summarized as follows:

- User selects the asset from the “Deposit” tab

- The system generates an asset-specific deposit address

- Transfer is made from an external wallet using the correct network

- After blockchain confirmations, the asset appears in the Spot Account

Using the wrong network or missing memo can result in loss of funds. Spot assets cannot be used as collateral in perpetual trading.

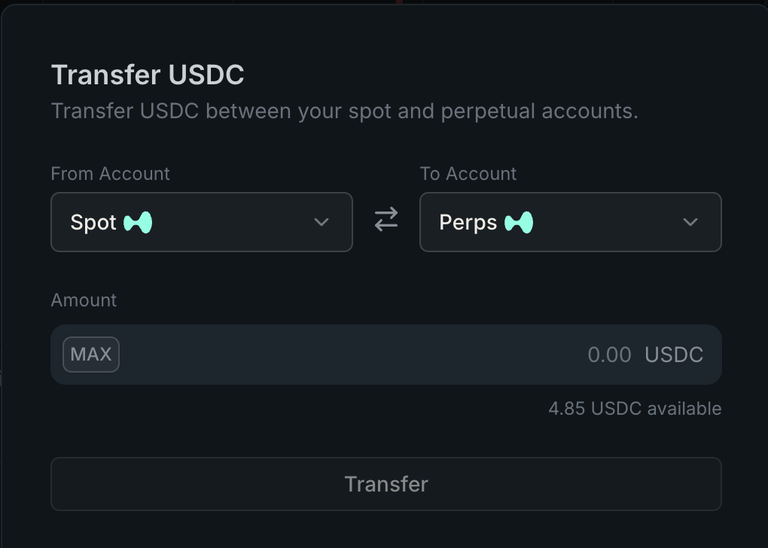

Transfers Between Accounts

Transfers between accounts are free and require only a signature.

For example, USDC received in the Spot Account can be transferred to the Crypto Perps or Equities account in seconds.

Withdrawal Operations

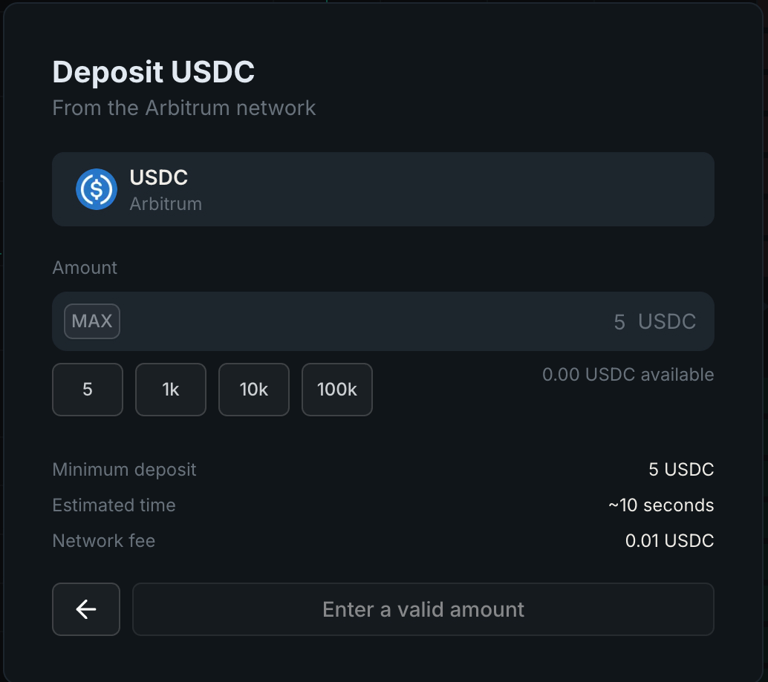

USDC (Arbitrum) Withdrawals

USDC withdrawals are processed via the Arbitrum network.

There is no gas fee, but a minimum protocol fee of 1 USDC applies. Therefore, at least 1 USDC must be present in the Crypto Perps account for withdrawal.

Spot Crypto Asset Withdrawals

Assets such as BTC, ETH, and similar are withdrawn via their native networks. Failure to provide the correct address, correct network, and minimum amount can result in loss of funds.

Order Types and Professional Tools

tradeXYZ offers advanced order types beyond simple buy-sell operations:

- Market & Limit

- Stop Market / Stop Limit

- TWAP

- Scale Orders

- Reduce-only

- TP / SL integration

This structure provides a comprehensive toolkit especially for professional traders and users taking hedge positions.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.