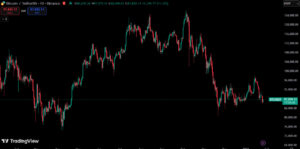

The crypto market started the new week under growing macroeconomic uncertainty and a risk-off mood. Bitcoin slipped below the $88,000 level on Sunday evening amid selling pressure, falling to around the $87,000 range. Analysts point to the rising risk of a potential U.S. government shutdown, political gridlock, and funding uncertainty as the main drivers behind the decline. As risk aversion across crypto markets strengthened, Bitcoin extended its losses. Over the past 24 hours, the world’s largest cryptocurrency fell by approximately 1.93% to $87,158, while Ethereum dropped 3.17% to trade around $2,847.

Why Is Bitcoin Falling?

The primary reason behind Bitcoin’s decline is the near-certainty of another potential U.S. government shutdown at the end of the month. Ongoing budget disputes and political deadlock in Congress have intensified risk-off sentiment in financial markets. This environment is putting pressure on risk assets, including cryptocurrencies. Vincent Liu, CIO of Kronos Research, noted that according to Polymarket data, the probability of a U.S. government shutdown has risen to 78%, reinforcing cautious positioning across markets.

In addition, U.S. President Donald Trump’s threat of imposing tariffs on Canada has added another layer of uncertainty. Trump stated that high tariffs would be applied if Canada were to sign a new trade agreement with China. These remarks have revived concerns over global trade wars, creating additional downward pressure on Bitcoin’s price.

ETF Outflows and Institutional Demand

The prevailing cautious, risk-averse sentiment has also clearly reflected in U.S.-listed spot Bitcoin ETFs. According to SoSoValue data, the week ending January 23 saw net outflows of approximately $1.33 billion, marking the weakest weekly performance since February 2025. These significant ETF outflows indicate that institutional investors’ short-term risk appetite has weakened.

Vincent Liu described the current situation by saying, “Institutional demand is cautious, but not completely out of the market.” While broad ETF outflows reflect risk aversion, ARK Invest’s purchases of shares in Coinbase, Bullish, and Circle suggest that some institutional players maintain long-term confidence in sector leaders and core infrastructure. This points to selective and strategic positioning continuing despite near-term uncertainty.

Losses Deepen in the Altcoin Market

Bitcoin’s pullback has had an even sharper and faster impact on the altcoin market. Ethereum, the largest altcoin by market capitalization, has been at the center of selling pressure, losing around 15% over the past week alone. This weakness in Ethereum quickly spread to other large- and mid-cap altcoins. Many projects recorded double-digit losses, while investors’ risk-off behavior further increased volatility across the altcoin space.

These sharp price moves also triggered a significant wave of liquidations. Over the past 24 hours, a total of $675 million in positions were liquidated across the crypto market. Of this amount, $604 million came from long positions, showing that the market caught bullish traders off guard. The assets with the highest liquidation volumes were Ethereum with $220 million, Bitcoin with $192 million, and Solana with $63 million. These figures once again highlight how sudden price movements can lead to severe outcomes in highly leveraged market conditions.

Assessment

According to analysts, macroeconomic developments will remain the key drivers of the crypto market in the short term. Investors are expected to closely follow this week’s Federal Reserve interest rate decision, U.S. Producer Price Index (PPI) data, and ETF flow figures. Whether Bitcoin can hold its current support levels will be critical in determining the market’s short-term direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.