Global financial markets are locked onto the U.S. Federal Reserve’s (Fed) first interest rate decision of 2026. The Fed is set to announce its first rate decision of the year on Wednesday. While market expectations are largely aligned around the policy rate remaining unchanged, the real focus is expected to be on the statements of Fed Chair Jerome Powell. For investors, Powell’s messages during the press conference are seen as more decisive than the rate decision itself.

Dovish or Hawkish? Powell’s Tone Will Be Key

After the rate decision, Jerome Powell is expected to provide important clues about the Fed’s monetary policy stance for the rest of 2026. The language he uses and the issues he emphasizes could have a greater impact on market sentiment than the decision itself. A dovish tone could strengthen expectations of renewed rate cuts, providing support for risk assets. Conversely, hawkish messaging could reinforce the perception that tight monetary policy will be maintained for longer, increasing pressure on markets.

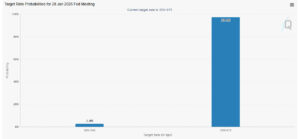

In this context, references to inflation trends, labor market balance, wage growth, and the trajectory of economic growth will be closely monitored. Current market pricing indicates a 97.2% probability that the Fed will keep rates unchanged, further amplifying the importance of Powell’s remarks. His assessments could offer critical signals not only about the current decision, but also about the Fed’s policy roadmap throughout 2026.

Trump Administration and Investigation Agenda

Powell’s agenda this week extends beyond monetary policy and interest rates. Ongoing tensions with the Trump administration and an investigation launched by the U.S. Department of Justice have also drawn close market attention. The Justice Department recently initiated a probe into spending related to the renovation of Fed buildings, reigniting debates over the central bank’s independence.

Powell has previously argued that the investigation is less about technical expenditures and more closely linked to political pressure over the Fed’s interest rate decisions. This situation has heightened sensitivity around central bank independence, and journalists are expected to raise direct questions on this issue during Wednesday’s press conference. Powell’s responses will be closely watched, not only for economic implications but also for their impact on political risk perceptions.

Expectations from Major Banks

Leading financial institutions such as Morgan Stanley have stated in their latest analysis that they do not expect a near-term rate cut from the Fed, but anticipate that Jerome Powell’s communication tone could be relatively dovish. According to the bank, under current market conditions, Powell’s language, highlighted risks, and forward-looking messages may have a greater influence on markets than the rate decision itself. As a result, investors are expected to scrutinize subtle signals embedded between the lines.

It is worth recalling that the Fed delivered a 25 basis point rate cut at its December 10 meeting. The first Fed meeting of 2026 therefore represents a critical test of continuity and consistency in monetary policy. The key question for markets remains whether Powell will completely close the door on further rate cuts and how he will outline the policy path for the rest of the year.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.