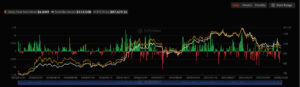

In recent weeks, selling pressure on the ETF side of the cryptocurrency market has begun to give way to clear net inflows as of January 26. U.S. spot Bitcoin ETFs ended a five-day streak of net outflows, recording net inflows of $6.84 million. This development points to a short-term recovery in institutional investor sentiment. Despite Bitcoin’s volatile price action, the return of inflows into ETFs is interpreted as a sign that institutional investors are starting to view current price levels as a balance or accumulation zone.

Bitcoin ETF Outflow Streak Comes to an End

The consecutive outflows from U.S. spot Bitcoin ETFs in recent days had increased pressure on the market. However, the $6.84 million net inflow recorded on January 26 indicates that this negative trend has at least paused in the short term. According to experts, these inflows suggest that institutional investors are not completely exiting the market, but instead are beginning to make selective and cautious purchases while limiting risk.

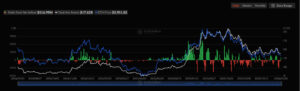

Strong Recovery in Ethereum ETFs

The most striking data of the day came from spot Ethereum ETFs. After four consecutive days of net outflows, Ethereum ETFs recorded a strong net inflow of $116.99 million. This figure signals a much more pronounced recovery compared to Bitcoin ETFs. The movement on the Ethereum side is interpreted as a sign that investor appetite toward leading altcoins could increase again in the medium term. Expectations surrounding the Ethereum ecosystem appear to be strengthening once more through ETF inflows.

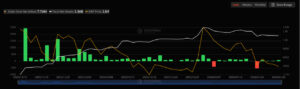

Net Inflows in Solana ETFs

As of January 26, Solana ETFs recorded net inflows of $2.46 million. This data shows that institutional investor interest in SOL continues and that there is cautious but steady demand for the Solana ecosystem. Although the inflow amount is relatively limited, it indicates that despite high volatility and uncertainty in the market, Solana remains on the radar of institutional investors. This is considered an important signal that investors will continue to closely monitor Solana in the medium term.

Stronger Positive Flows in XRP ETFs

XRP ETFs, meanwhile, recorded net inflows of $7.76 million on the same day, delivering a stronger performance compared to Solana. This positive flow on the XRP side shows that investors continue to closely follow the asset’s market position and the ongoing regulatory process. Seeing net inflows of this magnitude despite persistent uncertainties indicates that institutional interest in XRP remains intact. This picture once again demonstrates that the focus of institutional investors is not limited solely to Bitcoin and Ethereum.

What Does Institutional Sentiment Indicate?

When ETF data is evaluated overall, it appears that institutional investors are not in a fully risk-off position toward the market. The resumption of net inflows may not have a strong direct impact on prices in the short term, but it stands out as an important signal that selling pressure is gradually weakening. This suggests that a stabilization process may be beginning in the markets and that institutional capital is cautiously re-entering in a more selective manner. The ETF data from January 26 indicates that institutional capital is once again becoming cautiously active in the cryptocurrency market.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.