The integration of Real-World Assets (RWA) into blockchain represents one of the most critical transformations in modern finance. At the center of this shift, DigiFT, licensed by the Monetary Authority of Singapore (MAS), operates as a digital market operator for tokenizing real-world assets and facilitating secondary market trading.

DigiFT is more than an exchange; it is a Singapore-based platform that legally tokenizes real-world assets—such as bonds, equities, and cash funds—and enables their trading on secondary markets. The platform’s core mission is to bring institutional-grade financial assets onto blockchain, increasing liquidity while providing investors with 24/7 access. As a licensed market operator, DigiFT offers both tokenization and secondary market access under a single roof.

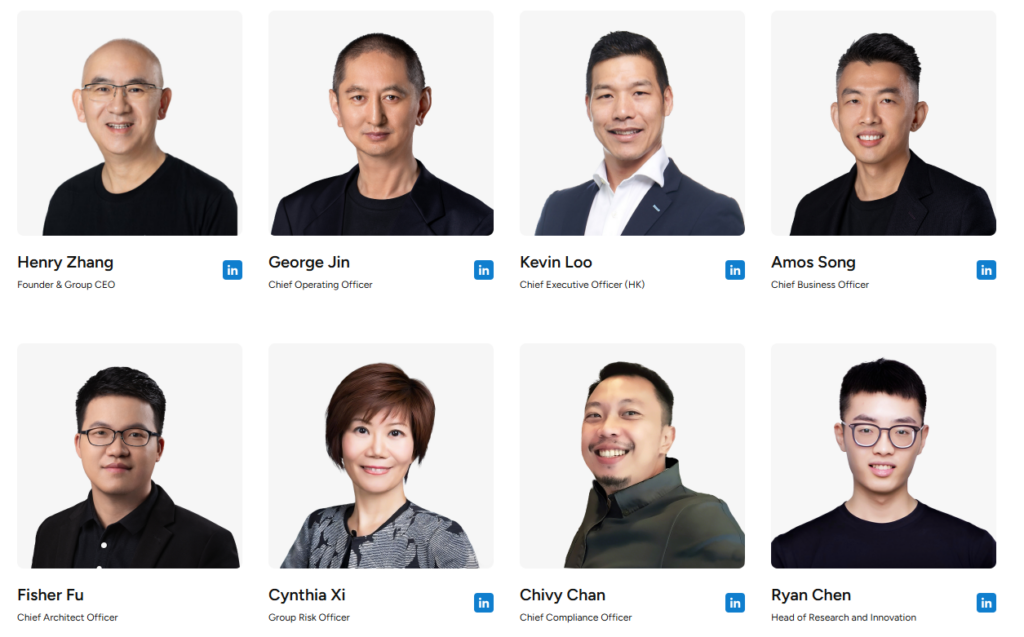

Management Team and Operational Leadership

The project draws strength from deep expertise in traditional banking and fintech.

-

Henry Zhang (Founder & CEO): With leadership experience at global banks including Citibank and Standard Chartered, Zhang has built the platform’s compliance backbone.

-

Executive Team: Comprised of professionals specializing in financial law, blockchain architecture, and risk management, enabling DigiFT to navigate regulatory barriers effectively.

Capital Structure and Strategic Partnerships

Institutional investors backing DigiFT include SBI Holdings, HashKey Capital, and Mirana Ventures, demonstrating its positioning in corporate finance and regulatory compliance.

Key corporate partnerships feature UBS Asset Management, Invesco, and Wellington Management. DigiFT collaborates with these institutions to tokenize real funds and list them on-chain.

On the infrastructure side, GSR develops OTC market solutions for tokenized RWAs, while custody is handled by licensed providers such as State Street Bank and Komainu.

How the Platform Operates

DigiFT provides a regulatory-compliant infrastructure allowing investors to access tokenized products backed by real-world assets. Listed products represent actively managed real funds rather than speculative crypto assets.

Investment conditions vary by product, with minimum amounts generally starting at $1,000 and, for certain structures, reaching $100,000. This framework targets qualified and institutional investors rather than short-term traders.

Tokens are issued on Ethereum, Arbitrum, Plume, Solana, and BNB Chain, enabling multi-chain distribution and wider reach.

Tokenized assets include money market instruments, fixed-income products, and equity-based strategies. Returns are based on fund structure, such as regular income, redemption value, or credit rating.

Asset backing and redemption rules are clearly defined, with custody provided by licensed institutions like State Street Bank and Komainu.

Operational Infrastructure

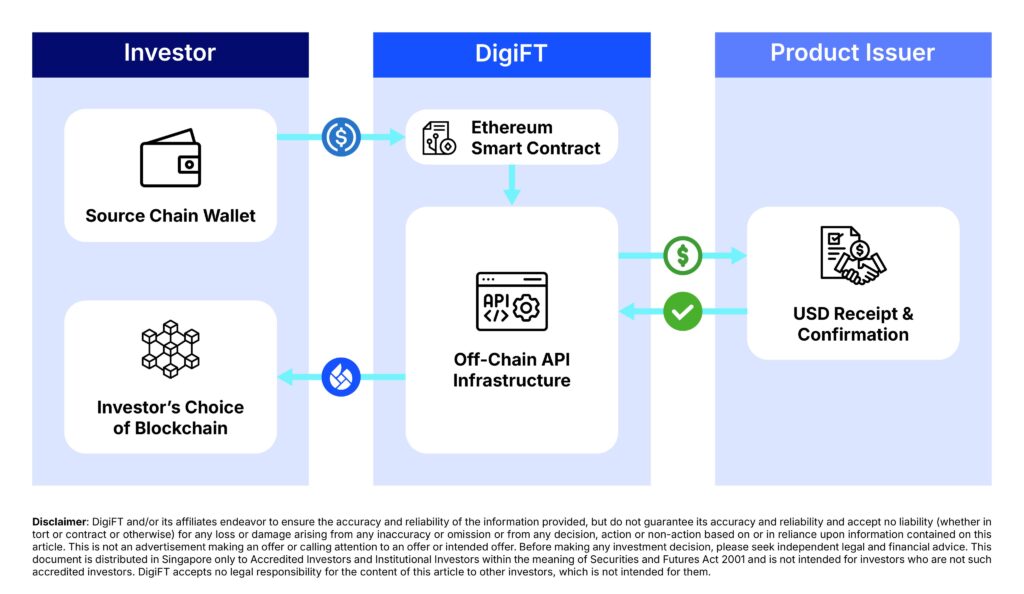

The platform is supported by an Ethereum-based architecture with a proprietary liquidity mechanism. Tokenized assets are structured based on legally defined ownership or beneficiary rights. Transactions can be executed using both fiat and stablecoins.

On-chain settlement eliminates T+2 delays typical in traditional markets, reducing costs and time.

DigiFT’s hybrid structure initiates investor transactions on-chain while completing asset approval and reconciliation off-chain. Tokens are minted post issuer approval and legal reconciliation, and the same process is mirrored during redemption.

Strategic Mission and Future Vision

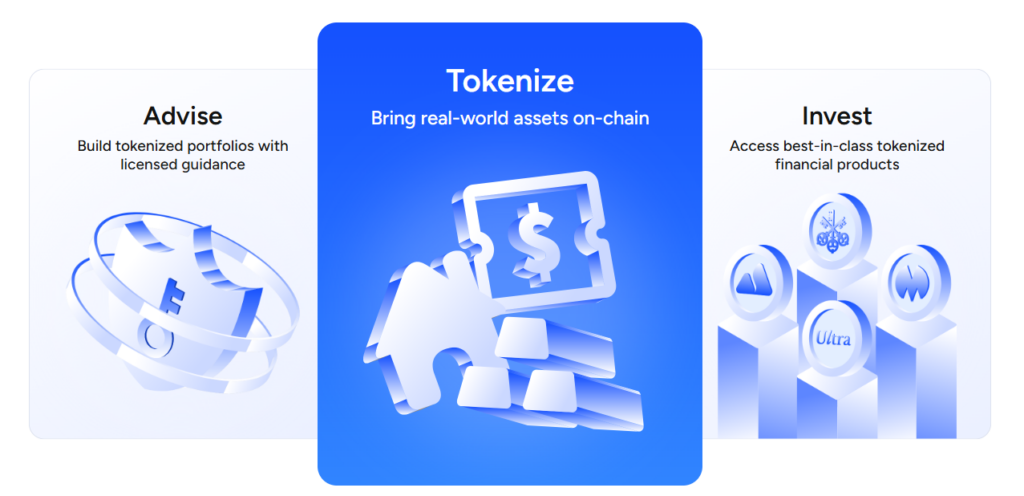

DigiFT aims to remove barriers to high-quality financial opportunities by bringing regulated investment products on-chain. At the intersection of TradFi discipline and DeFi infrastructure, the platform rests on three pillars:

-

Transparent and Open Architecture: Assets are accessible via digital wallets on public blockchain rails.

-

Operational Efficiency: Programmable, on-chain execution bypasses traditional bureaucracy.

-

Integrated Ecosystem: Disparate financial systems are unified into a seamless, interoperable global network.

Key Milestones and Timeline

DigiFT has expanded regulated RWA tokenization step by step rather than focusing on a single product, with progress shaped by licenses and corporate partnerships.

2022:

-

Launched regulated STO listing and digital asset exchange.

2023:

-

Introduced Matrixdock short-term US Treasury Bond token (STBT).

-

Obtained MAS market operator and capital markets licenses.

-

Pre-Series A raised $10.5M.

2024:

-

Issued depository receipt tokens backed by US Treasuries.

-

Enabled multi-chain architecture for DRUST (Ethereum and Arbitrum).

-

Launched high-yield bank bond token and global USD money market fund.

-

Expanded ecosystem integrations with Plume, BounceBit, Unitus, and WSPN.

2025:

-

Acquired Hong Kong SFC Type 1 and Type 4 licenses.

-

Strategic funding led by SBI Holdings raised total funding to $25M.

-

Launched CMBI USD money market fund and other institutional RWA products on BNB Chain.

-

Formed liquidity, custody, and distribution partnerships with RedotPay, GSR, Hash Global, and Copper.

-

Announced tokenization of an HKEX-listed corporate equity.

2026:

-

Initiated tokenization of VCS-certified carbon credits.

-

Announced new partnerships to expand corporate RWA product suite.

Asset Utility and Ecosystem Value Proposition

DigiFT’s digital assets are not speculative instruments but financial products backed by treasury bills, commercial papers, and physical assets.

-

International Standards: All token issuances comply fully with securities regulations.

-

Accessibility: Fractional ownership allows institutional investors to access high-barrier assets easily.

Where DigiFT Stands Out

DigiFT positions itself as a controlled gateway for institutional capital to transition on-chain, rather than a retail-facing showcase. End-to-end infrastructure integrates KYC, smart contracts, compliance, and exchange-level trading. Its structure spans fixed-income to private equity, customizable for each asset class.

This approach enables large-scale, licensed products to be distributed with blockchain flexibility, clearly differentiating DigiFT from DeFi-like yield platforms.

Links and Social Media

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.