After the approval of Bitcoin and Ethereum ETFs in the US, interest in altcoin ETFs has been growing, and Bitwise has taken a noteworthy step in this area. The company officially registered a Uniswap (UNI) ETF in the state of Delaware. This development has brought the possibility of a Uniswap-focused ETF into the spotlight and is being closely monitored by the market as a key signal.

What Does the Delaware Registration Mean?

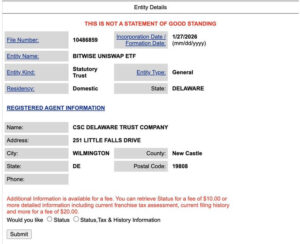

According to official filings, Bitwise registered a Uniswap (UNI) ETF entity in Delaware. However, this step does not mean that a formal ETF application has been submitted to the US Securities and Exchange Commission (SEC). Instead, it is considered a preparatory move, signaling that the fund manager is laying the groundwork for a potential S-1 registration statement, which is a core document required for SEC ETF approval.

Such registrations are common in the early stages of launching ETFs in the US. They help establish the fund’s legal structure, naming, and organizational framework. Market experts stress that a Delaware registration does not automatically trigger SEC review or imply that the ETF will be launched in the near term. In other words, it signals “readiness,” but the timeline and outcome of any approval process remain uncertain.

Vincent Liu, CIO of Kronos Research, evaluated Bitwise’s move with caution. He emphasized that the registration should be seen as a strategic step to keep options open, rather than evidence that SEC approval is imminent. Liu also highlighted that Uniswap’s structure could present specific challenges in the ETF approval process.

What Are the Challenges for a Uniswap ETF?

According to Liu, while Uniswap holds a strong position thanks to its robust ecosystem and deep on-chain liquidity, it also comes with complexities from an ETF perspective. Trading activity is spread across multiple networks, exchanges, and liquidity pools, which can create fragmented liquidity and price discovery issues. This raises important questions around how a reliable reference price would be determined and whether the market would meet regulatory standards for being considered “orderly.”

Liu further noted that Uniswap’s decentralized governance model and reliance on smart contracts introduce additional operational risks compared with traditional financial products. Smart contract vulnerabilities, potential technical exploits, and the unpredictability of governance decisions are factors likely to receive close scrutiny from regulators like the SEC, particularly from an investor protection standpoint. As a result, any Uniswap ETF initiative would likely require extensive evaluation not only in terms of demand, but also from technical and regulatory perspectives.

Timing Draws Attention

The timing of Bitwise’s move is also notable. It comes after the SEC closed its investigation into Uniswap Labs in February 2025, potentially reducing regulatory uncertainty and creating a more favorable backdrop for ETF-related preparations. Overall, Bitwise’s decision to register a Uniswap ETF in Delaware stands out as an important signal that UNI is on the radar for institutional investment products. While it does not imply near-term approval, it highlights the continued expansion of the altcoin ETF landscape and positions Uniswap as a prominent candidate in this evolving market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.