The U.S. Federal Reserve (Fed) and its chair, Jerome Powell, are once again at the center of global market attention as the first monetary policy meeting of 2026 gets underway. Signals from the January Federal Open Market Committee (FOMC) meeting are expected to influence not only traditional assets but also risk markets such as Bitcoin, Ethereum, and Solana.

When Is the Fed Meeting and Powell’s Press Conference?

The FOMC meeting takes place over January 27–28, with the policy statement scheduled for release on January 28 at 14.00 Eastern Time. Jerome Powell’s press conference will follow immediately after the announcement. Investors can watch both the decision and the Q&A session live via the Federal Reserve’s official website and YouTube channel.

For international market participants, timing remains an important detail. Outside the U.S., the announcement arrives late at night or early in the morning, depending on the region, which often coincides with thinner liquidity and heightened volatility.

Interest Rate Outlook: A Measured Pause

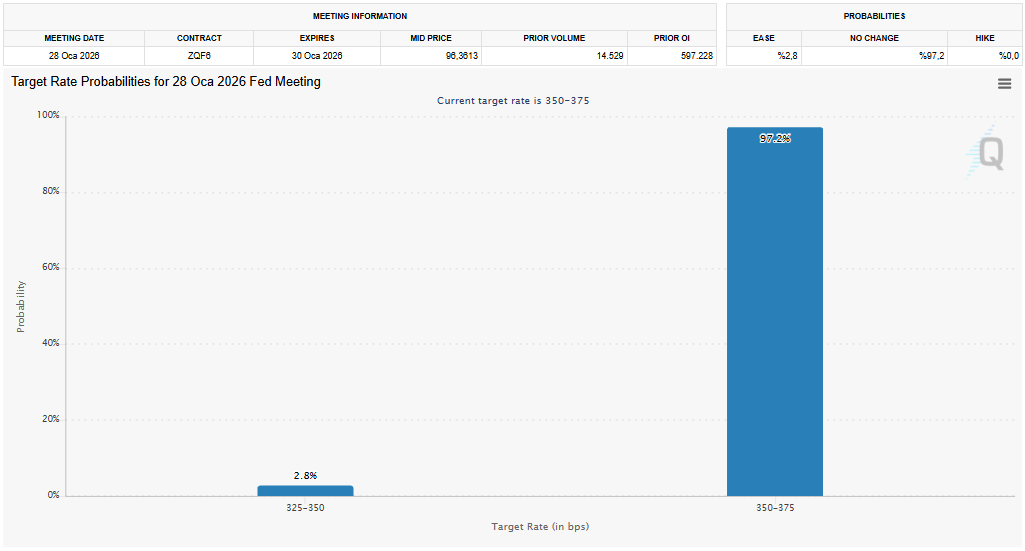

This meeting marks the Fed’s first scheduled policy decision of 2026. After delivering three consecutive 25-basis-point rate cuts toward the end of last year, the federal funds rate currently sits in the 3.5%–3.75% range. Market consensus strongly suggests that policymakers will keep rates unchanged at this meeting.

Despite ongoing political pressure to ease policy further, the Fed appears committed to a cautious stance. Analysts frame this pause not as a shift in direction, but as a deliberate pause to assess how previous easing measures are filtering through the broader economy.

Macro Backdrop: Progress, but No Clear Victory

Inflation has cooled from earlier peaks, yet it remains above the Fed’s long-term 2% target. Consumer spending continues to show resilience, while labor market conditions remain relatively tight. Financial conditions, meanwhile, have loosened modestly as investors anticipate future rate cuts.

Taken together, these dynamics support a wait-and-see approach. Policymakers are wary of moving too quickly and risk overstimulating markets or undermining progress on inflation.

Why Crypto Markets Are Watching Closely

With a rate hold largely priced in, attention has shifted to Powell’s tone and forward guidance. Subtle changes in language around future cuts or economic risks could influence risk appetite across markets. For crypto assets, which have remained rangebound in recent weeks, messaging matters more than the headline decision itself.

Bitcoin and other major digital assets are currently consolidating, but Powell’s remarks could shape expectations for liquidity conditions in the months ahead.

Communication May Matter More Than the Decision

In this meeting, the Fed’s message is likely to carry as much weight as the policy outcome. Investors across asset classes will be listening closely, as Powell’s words may set the narrative for the early months of 2026.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.