Global markets are once again being shaped by a powerful rally in precious metals. Gold latest surge has not only pushed prices to fresh record highs but has also widened the visible gap between traditional safe havens and crypto assets, particularly Bitcoin.

Gold Hits a New All-Time High

Over the past 24 hours, gold prices climbed by 4.4%, breaking above the $5,500 level for the first time. This move marked a new all-time high and reinforced gold’s status as the preferred refuge in the current macro environment.

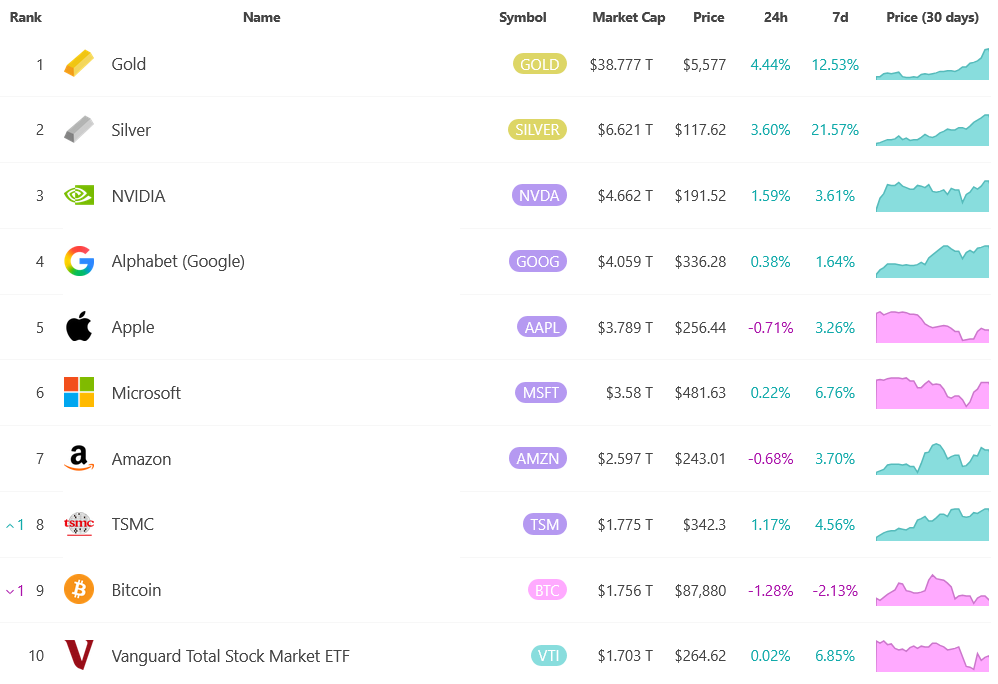

The scale of the rally is striking. Gold’s total market capitalization expanded by roughly $1.65 trillion in a single day, reaching approximately $38.77 trillion. That one-day increase alone is almost equivalent to Bitcoin’s entire market cap, which stands near $1.75 trillion. While gold surged, Bitcoin prices moved lower, remaining under notable selling pressure.

Why Gold and Precious Metals Are Winning the Safe-Haven Trade

The sustained rally in gold and silver reflects a broader “debasement trade” narrative. Rising geopolitical tensions, concerns over fiscal discipline, and expectations of continued monetary easing have driven investors toward assets perceived as long-term stores of value.

Bitcoin has often been framed as a digital alternative to gold during such periods. However, in this cycle, it has failed to attract the same level of defensive capital. A key reason lies in the crypto market shock earlier in October, when a sharp sell-off triggered more than $19 billion in liquidations. That event significantly weakened Bitcoin’s momentum and investor confidence.

Long-Term Performance Shows a Narrow Gap

A broader, five-year comparison highlights how unusual the current divergence is. Over that period, gold has risen by approximately 173%, while Bitcoin has gained around 164%. Historically, Bitcoin has outperformed most traditional assets over longer horizons, making this reversal particularly notable.

Silver has also delivered exceptional performance. Over the past week alone, silver prices jumped 21.5%, pushing its market capitalization to $6.6 trillion. This valuation now exceeds that of Nvidia, the world’s largest publicly traded company, underscoring the strength of the precious metals complex.

Institutions Still See Value in Bitcoin

Despite recent underperformance, institutional sentiment toward Bitcoin remains constructive. A recent survey showed that 71% of institutional investors believe Bitcoin is undervalued in the $85,000–$95,000 range. Additionally, roughly 80% indicated they would hold or increase their exposure if the crypto market were to fall another 10%, signaling long-term conviction.

Sentiment Indicators Tell Two Different Stories

Market psychology further illustrates the divergence. Crypto sentiment gauges currently sit firmly in “fear” territory, while gold-focused sentiment indexes point to “extreme greed.” This contrast helps explain why capital continues to flow into precious metals in the short term, even as some investors quietly position for a potential rebound in Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.