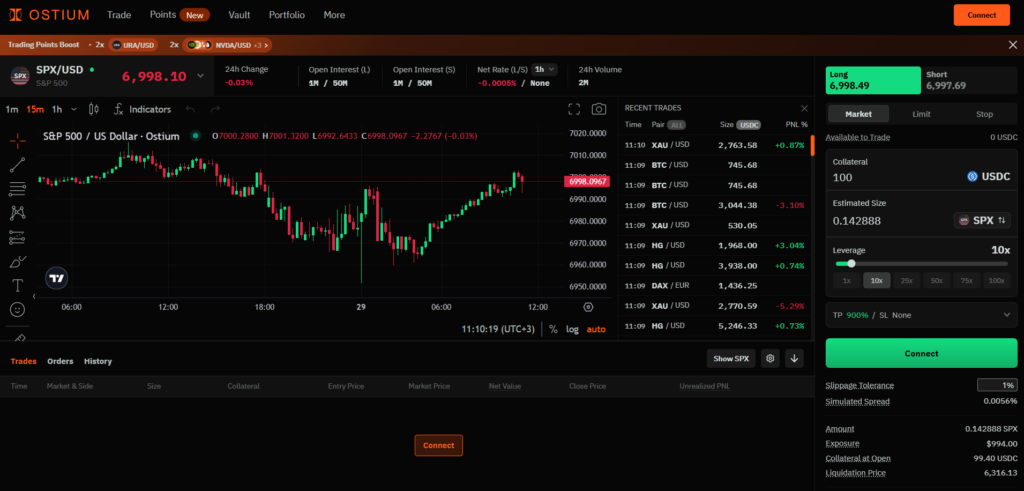

Ostium is a decentralized perpetual trading protocol that provides fully on-chain, non-custodial access to price movements of traditional financial assets. Built on Ethereum Layer-2 network Arbitrum, the project enables leveraged trading across forex, commodities, indices, equities, and crypto assets.

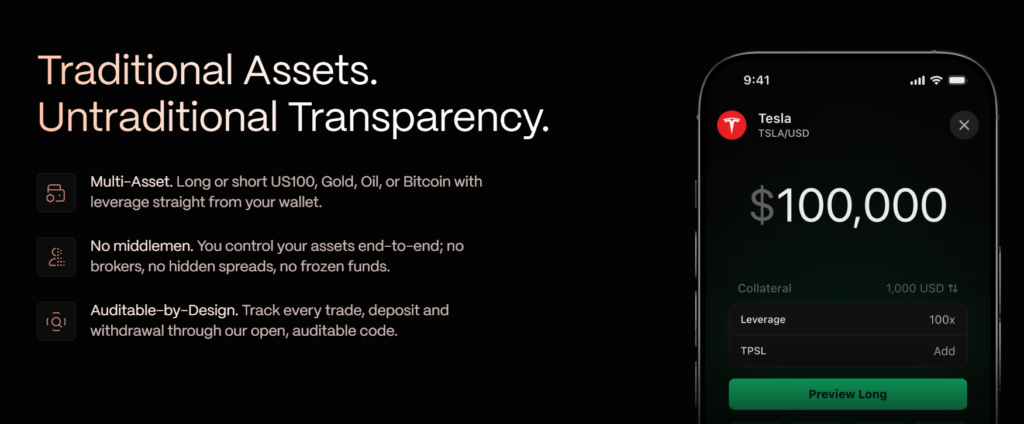

Rather than tokenizing real-world assets, Ostium creates virtual price exposure to them. Users do not trade the underlying asset itself, but its price movement. All transactions are settled in USDC, and the entire process is executed transparently on-chain from start to finish.

Purpose Behind the Project

Ostium focuses on three core issues inherent to traditional brokers and CFD platforms: custodial risk, lack of transparency, and access restrictions.

Unlike centralized intermediaries, funds on Ostium remain in the user’s wallet at all times. Trading cannot be halted, accounts cannot be frozen, and pricing or fee structures are never hidden. The goal is to merge traditional market instruments with DeFi’s open and verifiable architecture.

How the Ostium Ecosystem Is Structured

Functionally, Ostium is composed of three distinct layers.

- Ostium Labs is the company responsible for technical development. The oracle infrastructure, risk engine, and trading architecture are designed by this team.

- Ostium Protocol is the suite of smart contracts that governs all trading logic. Liquidity pools, position accounting, fees, and liquidations are handled at this layer.

- Ostium Interface is the web-based frontend that allows users to interact with the protocol. However, access is not limited to this interface; third-party applications can interact directly with the smart contracts.

While governance has not yet been fully launched, the project aims to transition toward a progressively community-driven model over the long term.

How Does Ostium Work?

Ostium operates on an oracle-based synthetic model rather than traditional order books.

Ostium Engine: This is the core of the protocol. When a user opens a trade, smart contracts fetch the latest oracle price and collateralize the position via the protocol vault.

Dual Oracle Security: Commodity and forex markets differ significantly from crypto in terms of trading hours and volatility. To minimize slippage and manipulation, Ostium uses a hybrid oracle setup combining Chainlink and high-speed Stork Network feeds. Latency risk is significantly reduced through this structure.

Non-Custodial Design: Funds are never controlled by Ostium. Trades are executed directly from the user’s wallet and managed entirely by smart contracts.

Key Features

The platform enables seamless switching between indices, commodities, forex pairs, and crypto assets within a single infrastructure. Users can open long or short positions on assets such as US100, gold, oil, or Bitcoin directly from their wallets.

- Market Diversity: Beyond crypto, Ostium supports hard commodities like gold and silver, as well as soft commodities tied to agricultural markets.

- Dynamic Funding Rates: Designed to balance long and short exposure, funding rates incentivize arbitrage and help keep prices aligned with spot markets.

- Flexible Leverage: Leverage of up to 200x is available, particularly suited for professional traders targeting low-volatility forex markets.

Liquidity Structure and Vault Mechanism

Ostium uses a single on-chain liquidity pool (Vault) across all assets. Liquidity providers deposit USDC and mint OLP tokens, earning proportional returns based on vault performance.

Vault behavior depends on system collateralization:

-

When collateralization is at or above 100%, the vault earns only opening fees

-

When it drops below 100%, the vault temporarily becomes the counterparty to trader PnL

This structure is designed to limit excessive one-sided market exposure.

Oracle Infrastructure and Pricing

Ostium employs two oracle systems depending on asset type.

For real-world assets, a custom pull-based oracle developed by Ostium Labs and operated by Stork Network is used. This system accounts for market closures, holidays, contract rolls, and price gaps.

For crypto assets, Chainlink Data Streams provide low-latency pricing for continuously traded, high-volatility markets.

With the pull-based model, prices are written on-chain only when required, reducing costs and improving scalability.

Orders, Liquidations, and Automation

Stop-loss, take-profit, limit orders, and liquidations are executed by independent automation networks such as Chainlink Automations and Gelato.

This ensures that:

-

Order execution is not centralized

-

Trades are processed in a predictable and reliable manner

For real-world assets, traditional market hours apply. Market orders cannot be placed when markets are closed, but limit and stop orders can be set in advance.

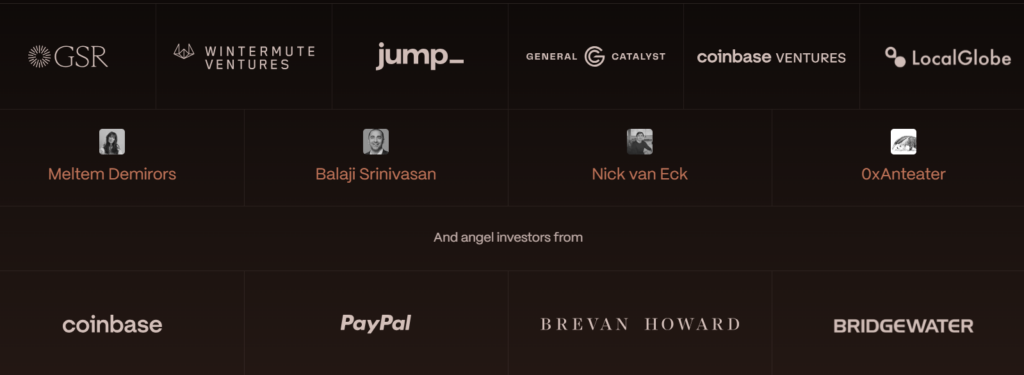

Investors and Backers

Ostium is supported by prominent figures from both the crypto and traditional finance sectors.

Notable backers include General Catalyst, Marc Bhargava, Meltem Demirors, Balaji Srinivasan, and Nick van Eck, signaling a long-term infrastructure vision rather than a short-term product play.

Overall Assessment

Ostium is a technically ambitious project that blurs the line between DeFi and traditional markets. Its single-vault architecture, custom oracle system, and risk-adjusted fee model distinguish it from competitors.

Rather than chasing short-term trends, Ostium aims to build a global, on-chain trading infrastructure

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.