Investor interest in spot ETFs within the cryptocurrency market continues to vary significantly by asset. According to the latest data, Bitcoin spot ETFs have experienced net outflows, while Ethereum, Solana, and XRP spot ETFs have seen notable net inflows. This divergence indicates that investors are evaluating market conditions more selectively and reallocating capital across assets with different risk profiles. The data reflects not only a shift in short-term risk perception but also a meaningful transformation in portfolio preferences.

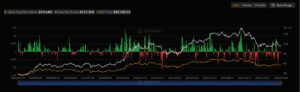

Net Outflows in Bitcoin Spot ETFs

The latest data shows a total net outflow of $19.64 million from Bitcoin ETFs. This development is attributed to Bitcoin’s recent sideways price movement and increasing global macroeconomic uncertainties, which have led investors to adopt a more cautious stance. Experts suggest that these outflows do not indicate a complete withdrawal from the market but rather represent a short-term profit-taking phase following strong gains. Therefore, this activity does not imply a weakening of long-term expectations for Bitcoin.

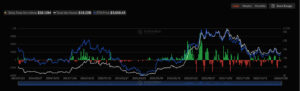

Strong Inflows into Ethereum Spot ETFs

In contrast to Bitcoin, Ethereum ETFs recorded a net inflow of $28.10 million. Growing investor interest in Ethereum is linked to the expanding use cases on its network, the growth of the smart contract ecosystem, and expectations for onchain financial products. Analysts note that institutional investors continue to view Ethereum not just as a crypto asset but as a key infrastructure component for blockchain-based financial systems. This perspective highlights that Ethereum’s long-term growth potential remains strongly recognized by investors.

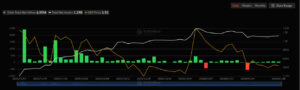

Notable Inflows in Solana Spot ETFs

A significant signal of increasing investor interest in altcoins is seen in Solana ETFs, which recorded a net inflow of $6.69 million. This reflects positive investor sentiment toward Solana’s expanding ecosystem, high transaction capacity, and scalability advantages. Analysts suggest that ETF inflows into Solana indicate investors’ tendency to focus on networks with higher growth potential.

Positive Flows Continue in XRP Spot ETFs

Demand for XRP ETFs is also strengthening. According to the latest data, XRP spot ETFs recorded a net inflow of $6.95 million. This positive flow is associated with XRP’s payment-focused use cases and its potential integration with the global financial system. Experts note that investors continue to view XRP as a strategic asset for portfolio diversification.

Investor Preferences Are Diversifying

The latest ETF data shows that capital movements in the crypto market are increasingly asset-specific and selective rather than one-directional. While Bitcoin spot ETFs are experiencing outflows, Ethereum, Solana, and XRP spot ETFs are seeing net inflows, indicating that investors are seeking alternative growth stories. In the coming period, macroeconomic data and market conditions will continue to play a key role in shaping ETF flow trends.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.