Tether Gold (XAUT) is a gold-backed digital asset that combines the value of physical gold with blockchain technology. Each XAUT token represents one troy ounce of physical gold from a gold bar that meets the London Bullion Market Association (LBMA) Good Delivery standards. These gold bars are stored in secure vaults in Switzerland and are allocated 1:1 to token holders.

Launched in 2020, Tether Gold aims to bring together the safe-haven characteristics of traditional gold with the accessibility and ease of transfer offered by crypto assets. This allows investors to hold a digital asset directly pegged to the price of gold without dealing with the challenges of physical gold storage and logistics.

What Does Tether Gold (XAUT) Aim to Achieve?

Tether was founded in 2014 to address high volatility in crypto markets and initially launched the US dollar-pegged stablecoin USDT. Over time, this approach expanded beyond fiat currencies to include real-world assets.

Tether Gold was developed as a product of this vision. The goal was to make gold—historically used as a store of value—more accessible to both individual and institutional investors by representing it on the blockchain.

How Does XAUT Work?

XAUT is an ERC-20 token operating on the Ethereum network. When an investor purchases XAUT, the system automatically allocates a specific physical gold bar to that wallet. Token holders can verify the serial number, purity level, and weight of the gold bar allocated to them by entering their Ethereum address on the platform.

Tokens can be divided up to six decimal places, offering far greater flexibility compared to physical gold. While the gold itself is stored in large bars, investors can own even a very small fraction of an ounce.

Combination of Physical Gold and Digital Asset Advantages

One of the most striking features of Tether Gold is that it combines the advantages of physical gold and digital assets in a single structure:

- Physical gold is stored in secure vaults, and investors do not bear additional storage costs

- Digital tokens enable 24/7 buying and selling

- Gold can be transferred and moved easily on the blockchain

- Tokens can be divided into small fractions, reducing liquidity issues

This structure eliminates limitations commonly encountered in traditional gold investments, such as transportation, storage, and trading hours.

XAUT and Price Stability

Gold has long been regarded as one of the strongest stores of value throughout history. It stands out as investors’ safe haven during periods of inflation and global uncertainty.

Because XAUT is directly pegged to the price of gold, it offers a more stable structure against sharp fluctuations in crypto markets. Compared to fiat-backed stablecoins, gold’s long-term track record of preserving purchasing power places XAUT in a distinct position.

Use Cases

Tether Gold can be used for various purposes, primarily as a store of value:

- Portfolio diversification

- Protection against inflation

- Safe transition asset between crypto holdings

- Trading on exchanges

Additionally, in countries where access to physical gold is difficult or costly, XAUT provides a global alternative.

Purchasing and Minimum Limits

For users who wish to purchase directly through the Tether Gold platform, the minimum purchase limit is set at 50 XAUT, and transactions are conducted only in US dollars. This makes direct platform purchases more suitable for institutional or high-net-worth investors.

However, XAUT can be bought and sold in smaller amounts on many crypto exchanges.

Redemption to Physical Gold

XAUT holders can request physical gold when they accumulate a sufficient amount of tokens. However, this process is only carried out on a full gold bar basis. An LBMA-standard bar typically weighs around 430 ounces.

When requested:

- Gold is delivered to a specified address in Switzerland

- Or the gold can be sold and converted to US dollars

Certain processing and delivery fees apply during this process.

Scudo: On-Chain Gold Measurement Unit

In the Tether Gold ecosystem, the Scudo unit has been introduced to facilitate the on-chain use of gold. 1 Scudo equals 1/1000 XAUT. This structure enables gold to be represented in smaller and more practical units.

Tether Gold for Institutional Investors

XAUT provides institutional investors with direct exposure to gold prices while also bringing the transaction and custody convenience of crypto assets. The absence of custody fees and 24/7 access are significant advantages for institutional portfolios.

How to Buy Tether Gold (XAUT)?

Tether Gold exists within a broad ecosystem involving various exchanges, custody solutions, and DeFi protocols. This structure makes XAUT globally accessible for both investment and custody purposes.

Platforms supporting XAUT:

- Anchorage Digital, Aave, Bitfinex, Bitget, Bitkub Exchange, Bybit, CoinDCX, Coinmena, Coins.ph, Crypto.com ,Fasset, Flow Traders, Gate, Kraken, KuCoin, MEXC, Mobee, OKX, Paribu, PDAX, Rain, Satoshi Tango, Transak, Uniswap, VALR, WhiteBIT, Zengo

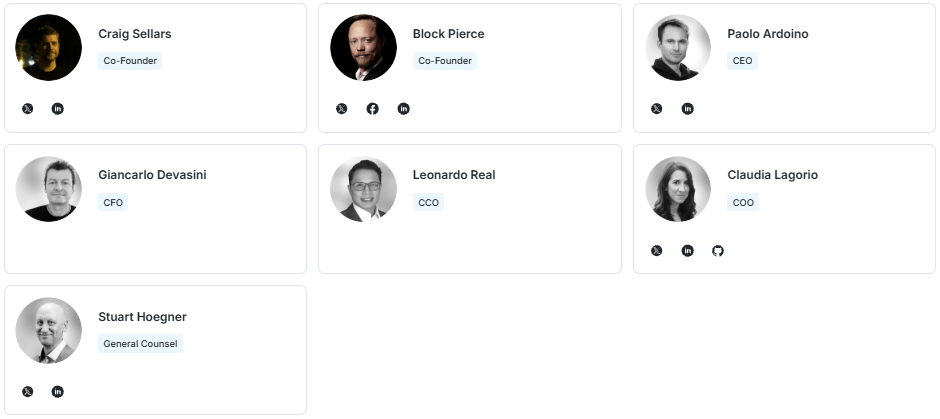

Tether Gold (XAUT) Team

Tether Gold is developed and managed by an experienced team that oversees the Tether ecosystem. Individuals with many years of experience in finance, law, and operations play active roles in the project.

Tether Gold team:

- Craig Sellars (Co-Founder)

- Brock Pierce (Co-Founder)

- Paolo Ardoino (CEO)

- Giancarlo Devasini (CFO)

- Leonardo Real (CCO)

- Claudia Lagorio (COO)

- Stuart Hoegner (General Counsel)

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.