As the US dollar continues to lose value, investors are once again reassessing how to protect their purchasing power. While Bitcoin has long been marketed as a hedge against inflation and monetary debasement, recent market behavior suggests a different reality: capital is flowing decisively toward gold. This shift is visible not only in traditional markets but also across blockchain-based financial products.

A Weakening Dollar Revives Gold’s Safe-Haven Status

With the US dollar index falling to its lowest levels in four years, investors are increasingly turning to assets with a long-standing reputation for preserving value. Gold, historically the ultimate safe haven, is reclaiming that role amid growing concerns over inflation and currency erosion.

The rally is not limited to physical bullion. Blockchain-enabled gold exposure is also gaining momentum, bridging traditional store-of-value dynamics with digital accessibility. Gold prices climbing above $5,300 per ounce — nearly a 90% increase year over year — reinforce the idea that this move reflects a structural trend rather than short-term speculation.

Tokenized Gold Gains Traction in Crypto Markets

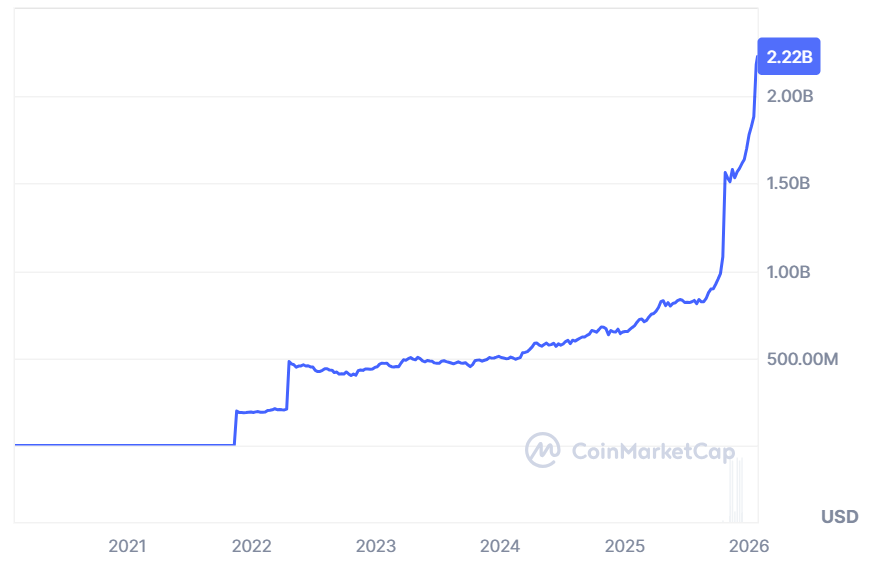

Crypto-native investors are also participating in gold’s resurgence through tokenized gold products. Gold-backed stablecoins offer a hybrid solution: direct exposure to physical gold combined with the liquidity and portability of digital assets.

Among these, Tether Gold (XAUt) has emerged as a dominant vehicle in the tokenized gold market. Each token is fully backed by physical gold on a one-to-one basis, a structure that appeals to investors seeking transparency, verifiable reserves, and reduced counterparty risk within the crypto ecosystem.

Bitcoin Shifts From Hedge to Complementary Asset

Bitcoin has not disappeared from inflation-hedging strategies, but its role is evolving. Rather than standing alone as a primary hedge, Bitcoin is increasingly positioned alongside gold within diversified portfolios.

Actively managed ETFs now combine Bitcoin exposure with gold and other precious metals, framing BTC as a higher-volatility companion asset rather than a direct replacement for traditional safe havens. This approach reflects a growing recognition that Bitcoin’s price behavior does not consistently mirror inflation or currency stress in the same way gold historically has.

Institutional Momentum: ETFs and Stablecoins

Institutional players are reinforcing this trend. Hybrid ETFs blending Bitcoin and gold are gaining traction, while major financial institutions are accelerating their stablecoin initiatives. Dollar-pegged stablecoins are increasingly viewed as foundational infrastructure for real-time settlement and round-the-clock payments, extending crypto’s role beyond speculation.

Crypto Moves Closer to Regulated Finance

At the regulatory level, a more accommodating US environment is encouraging digital asset firms to pursue banking charters and regulated trust structures. These efforts aim to integrate crypto services more deeply into the traditional financial system, signaling a maturation phase for the industry.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.