The cryptocurrency market has entered a new phase, reflecting a clear shift in how digital assets are viewed by both institutions and governments. One of the most consequential developments in recent years was the decision by the United States to formally recognize Bitcoin and several other cryptocurrencies held by the government as strategic reserve assets. This move helped redefine crypto’s role, elevating it beyond pure speculation and placing it within the framework of state-level value preservation. What’s the Fidelity predictions for 2026?

As 2026 unfolds, the key question is whether this shift marks the beginning of a structurally different era for digital assets—or simply another stage in crypto’s evolving cycle. Here is the Fidelity Report!

Could Governments Turn to Crypto Reserves? Fidelity Answers!

While many governments already hold limited amounts of cryptocurrency, only a small number have formally integrated these assets into their national reserve strategies. That reality has started to change. The U.S. decision has established a reference point that other nations may increasingly feel compelled to consider.

Some countries have already taken notable steps. Kyrgyzstan has moved forward with legislation to establish a crypto reserve, while Brazil has advanced a proposal that would allow Bitcoin to make up as much as 5% of its foreign exchange reserves. Analysts increasingly view this as a form of geopolitical and financial game theory, where nations may feel pressure to avoid lagging behind peers adopting digital assets at the sovereign level. Should this trend continue, sustained government-driven demand could become a meaningful long-term factor in crypto pricing.

Corporate Balance Sheets and Digital Assets

Governments are not the only entities shaping demand dynamics. Corporate participation in crypto has continued to grow, with more publicly traded companies treating Bitcoin as a strategic balance-sheet asset rather than a short-term trade.

As the market enters 2026, more than 100 publicly listed companies globally hold cryptocurrencies, and roughly 50 of them collectively control over one million Bitcoin. This structure has also created indirect exposure opportunities for investors who are unable—or unwilling—to hold crypto directly. At the same time, it introduces additional risk: in periods of market stress, corporate liquidations could intensify downside pressure.

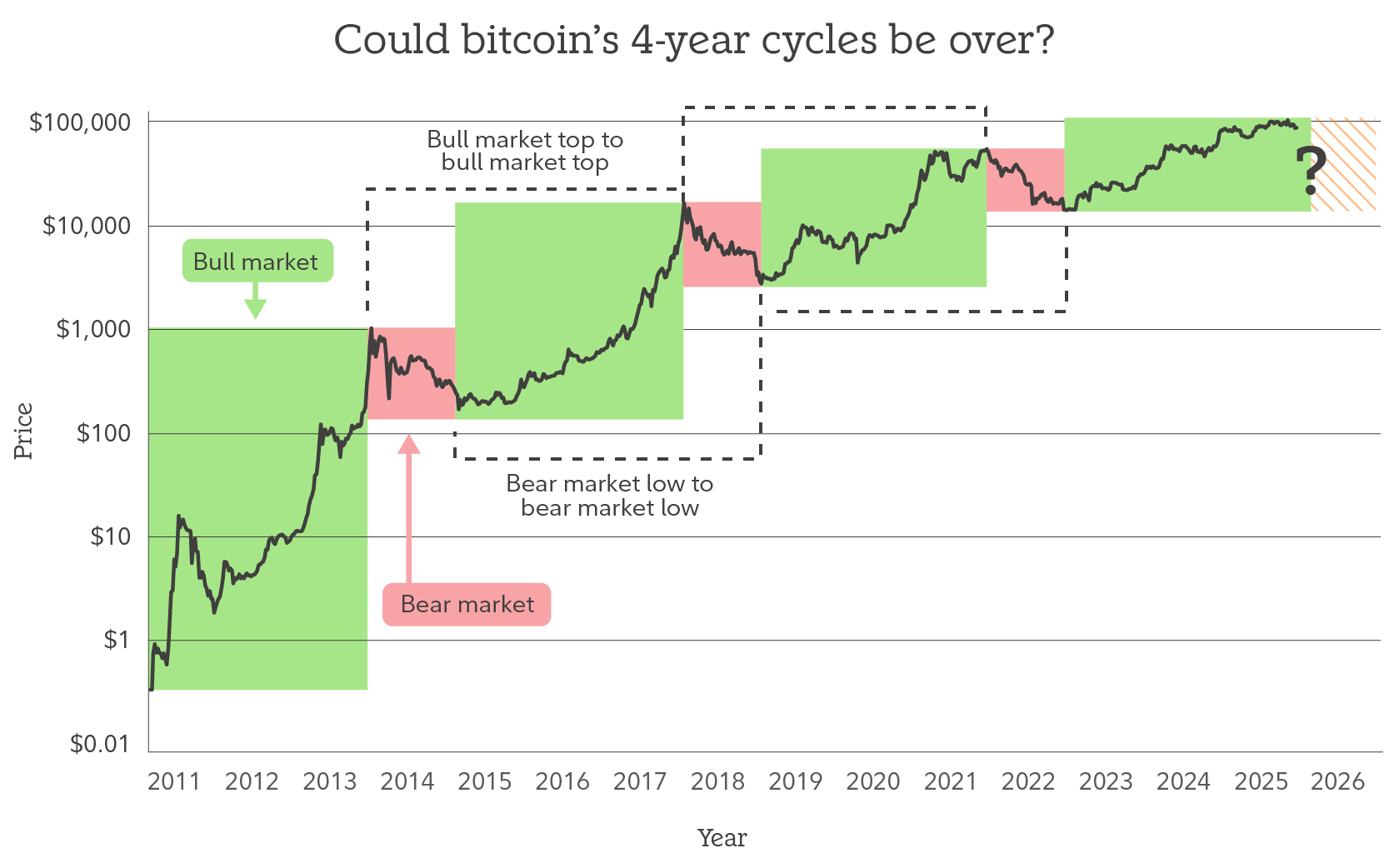

Do Bitcoin’s Four-Year Cycles Still Apply?

Historically, Bitcoin has followed relatively consistent four-year cycles marked by powerful bull markets and sharp corrections. With the last major peak occurring in late 2021, the market is now well past the traditional cycle midpoint.

Some investors argue that deeper institutional involvement could smooth future drawdowns, making extreme bear markets less likely. Others believe the market may be transitioning into a longer-lasting expansion phase, sometimes described as a “supercycle.” Still, fundamental market psychology—driven by fear and greed—remains intact, suggesting that cycles may be evolving rather than disappearing altogether.

Is Bitcoin Still Attractive in 2026?

For short- and medium-term participants, uncertainty remains a defining feature of the market. However, from a long-term perspective, Bitcoin’s fixed supply continues to support its positioning as a hedge against inflation and monetary expansion.

As 2026 progresses, the crypto market appears to be navigating a critical transition—one shaped by broader adoption, structural maturation, and a gradual redefinition of digital assets within the global financial system.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.