One of the biggest problems in the crypto finance world is that value transfer between fragmented infrastructures is still complex, expensive, and inefficient. Transacting across different blockchains, bridges, exchanges, payment networks, and traditional financial systems creates a serious operational burden for both users and developers. Tria (TRIA) stands out as a next-generation financial execution and routing layer designed to solve this problem.

Tria offers a self-custodial neobank experience on the surface, while providing an interoperable payment and execution infrastructure built for modern finance in the background. It delivers a “single app – single account” experience for users, while creating a system that enables the most efficient cross-chain execution for developers and AI agents.

What Does Tria Aim to Achieve?

Tria is a fully self-custodial neobank and cross-chain payment infrastructure that combines spend, trade, and earn functions under a single primitive.

On the user side, Tria provides an experience as simple as a traditional digital bank. However, the underlying structure is completely different from classic banks:

- No gas fees

- No seed phrase requirement

- Chain-agnostic

- Full self-custody

- No bridge usage required

Tria eliminates the need for users or developers to think about which chain, which exchange, or which liquidity pool to use. The user simply states their intent: send, spend, convert, earn. Tria automatically handles the rest of the execution process.

Tria Vision

What sets Tria apart from an ordinary neobank is that it is fundamentally a routing and execution layer.

Today, financial transactions are scattered across:

- Multiple blockchains

- Different virtual machines (VMs)

- Various DEXs and CEXs

- Bridges

- Legacy financial infrastructures

Tria aims to make this fragmented structure function as a single system.

Thanks to this structure, Tria automatically selects:

- The fastest path

- The lowest-cost route

- The most reliable execution

Users or developers never have to deal with this complexity.

What is BestPath?

BestPath is the routing and execution infrastructure at the heart of the project.

BestPath is an intent-based system. It operates not on “how to do it,” but on “what is intended to be done.” For example:

- “Send USDC”

- “Convert to ETH”

- “Spend”

- “Earn yield”

A simple command like these is executed by BestPath in the most efficient way across chains, liquidity sources, and execution layers.

How Does BestPath Work?

BestPath operates as a permissionless interoperability marketplace. In this system:

- PathFinders

- Solvers

- Relayers

- Liquidity routers

- Fast finality layers

compete with each other within a micro-market. The goal is to fulfill the user’s intent:

- At the lowest cost

- In the shortest time

- With the highest security

Strategies are ranked based on cost, speed, and security criteria, and the best execution is automatically selected. The entire process occurs gas-free and bridge-free.

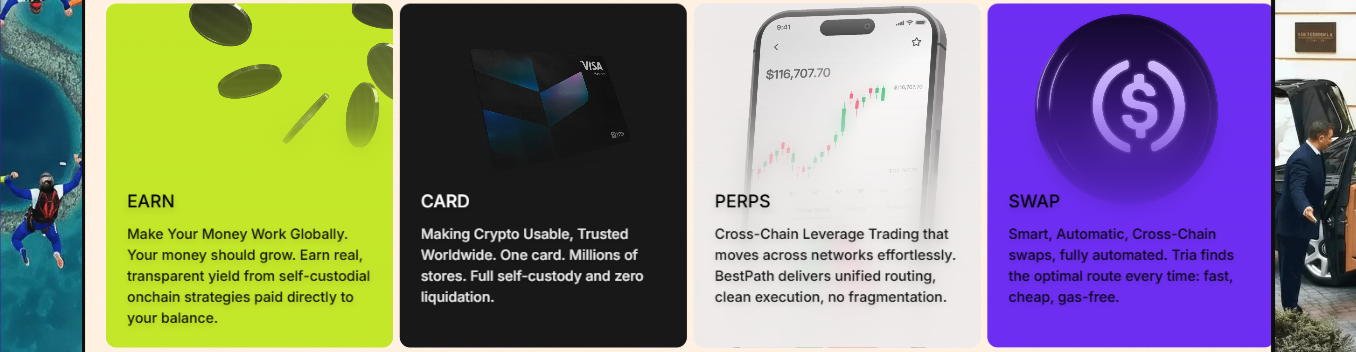

What Does Tria Offer?

- Spend Tria offers Visa-supported crypto cards usable in over 150 countries. Users can:

- Spend from balances of more than 1,000 tokens

- Make payments without having to sell their assets

- Avoid liquidation risk

All these operations are performed while preserving the self-custodial structure.

- Trade Through Tria:

- Spot token swaps

- Perpetual futures (perps) trading

can be done directly from existing balances. Users do not need to move funds to different exchanges.

- Earn Tria offers vault-based yield products. Users can park their assets to earn:

- Transparent

- On-chain

- Directly reflected in balances

yield.

- Prediction Markets Outcome-based prediction markets are integrated with the trading experience.

Tria for Developers and AI

Tria is not only targeting individual users. It also serves as an infrastructure component that provides the best execution for:

- Developers

- Institutions

- AI agents

BestPath is integrated with many ecosystems including Polygon AggLayer, Arbitrum, Injective, BitLayer, Merlin, Morph. It is also actively used by AI-focused teams such as Sentient, Talus, and Netmind.

Government pilot programs conducted with the United Nations and the UAE also demonstrate that the infrastructure has been tested at an institutional level.

Tria Growth Data and Traction

In its closed beta phase within just 4 months, Tria achieved:

- Over $100 million in transaction volume

- More than $30 million of that from card spending

- Over $75 million routed through BestPath

Users are spending an average of $2,000 per month on cards, showing that the product is actively used in daily life.

Financial Performance

- As of 2025, $20 million ARR

- $84 ARPU

- 250,000+ users

- Affiliate network of 10,000+ partners

Tria has active users in 180 countries, completely bypassing the classic “country-by-country rollout” model.

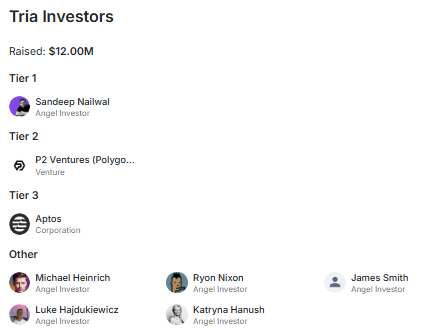

Investors and Funding

Project has raised approximately $12 million to date.

Notable Investors

- Sandeep Nailwal (Polygon founder) – Angel investor

- P2 Ventures (Polygon Ventures) – VC

- Aptos – Institutional investor

Additionally, many experienced angel investors supported the project in the early stages. The Legion sale receiving 67x oversubscription clearly demonstrates the scale of investor interest.

Tria Team

Tria is being built by a team that has previously developed large-scale products and achieved exits. Team members come from Polygon, LayerZero, Binance, OpenSea, OKX, Intel, and Nethermind.

Tria is led by founders experienced in finance and blockchain infrastructure. The team has a strong background in both consumer products and deep infrastructure development.

- Vijit Katta – Co-founder & CEO

- Parth Bhalla – Co-founder

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.