As selling pressure in the cryptocurrency market continues to intensify, Bitcoin has tested the $73,000 level, effectively wiping out all of the gains recorded after U.S. President Donald Trump’s election victory in November 2024. This pullback signals more than a simple price-focused correction; it points to a deterioration in investor psychology and a strengthening risk-off sentiment. Market data suggests that the recent decline is not driven solely by technical indicators, but is also reinforced by global macroeconomic uncertainty, rising volatility, and unmet expectations. In particular, delays in delivering concrete crypto-friendly policies under the Trump administration are cited as a key factor prompting investors to reassess their positions.

Sharp Drop in Bitcoin: 30% Loss in the Past Month

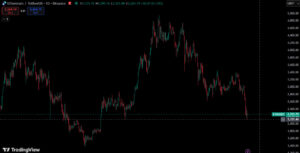

Bitcoin fell below the $74,000 level for the first time since early November 2024 and was trading around $73,000 near the time of publication. This level is considered a critical threshold both psychologically and technically. Having lost nearly 30% of its value over the past month, Bitcoin has entered a period where confidence—especially among short-term investors—is being seriously tested.

Sean Rose, account manager at on-chain data provider Glassnode, stated that with this sharp decline, 44% of Bitcoin’s supply is now underwater, meaning it is held at a loss. This has caused the share of supply in profit to fall from 78% to 56%, helping explain why selling pressure remains strong.

Rose commented:

“A large portion of investors who bought near the ATH are currently at a loss. Dense supply clustered around recent cost bases is being tested. The conviction and patience of these investors will be seriously challenged in the coming weeks.”

This situation suggests that investors who entered near peak levels may become more prone to panic selling if further declines occur, signaling that short-term volatility could persist.

Has the Trump Effect Reversed?

Donald Trump’s election victory was initially seen as a major catalyst for crypto markets. His pro-crypto rhetoric during the campaign helped drive Bitcoin to an all-time high of $126,080 in October 2025. However, sentiment has since shifted. Despite developments such as the appointment of a new SEC chair, the passage of the GENIUS Act, debates around the CLARITY Act, and the establishment of a White House crypto council, investors are still waiting for more concrete incentives. The gap between expectations and delivery is now being cited as a major driver of selling pressure.

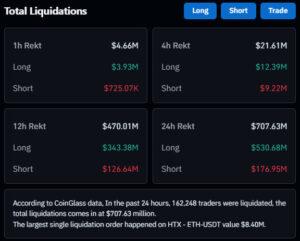

Rising Liquidations, RSI at Critical Levels

Harsh price movements in derivatives markets have played a key role in accelerating Bitcoin’s decline. Heavy use of leverage has led to cascading liquidations, intensifying selling pressure. According to CoinGlass data, $707 million in positions were liquidated in the past 24 hours, indicating that leverage remains elevated and continues to amplify downside moves.

Meanwhile, Bitcoin’s Relative Strength Index (RSI) has fallen to the 30 level, placing it firmly in oversold territory. The last time RSI reached similar levels was during the 2022 bear market bottom, after which Bitcoin experienced an additional decline of roughly 20%. If a comparable scenario unfolds, the $60,000 range could come back into focus from a technical perspective.

Altcoins Hit Hard as Well

The sell-off was not limited to Bitcoin. Market-wide pressure triggered sharp losses across large- and mid-cap altcoins as rising volatility and risk aversion pushed investors to rapidly reduce exposure. Recent price movements include:

- Ethereum (ETH): Down more than 9%, falling below $2,100

- Solana (SOL): Approximately 10% decline to around $97

- XRP: Down about 6%, trading near $1.52

These moves reflect a cautious short-term stance among investors.

Crypto-related equities were also affected. Coinbase shares fell more than 6%, while Bitcoin-focused Strategy lost over 8%. On the macro side, concerns such as a potential U.S. government shutdown and global uncertainty weighed on markets:

- S&P 500: Down 1.4%

- Nasdaq Composite: Down 2.2%

This confirms that risk aversion is not limited to crypto markets alone.

ETFs and Institutional Divergence

Despite the broader sell-off, an interesting divergence has emerged in the ETF space. On Monday, spot Bitcoin ETFs recorded $561.9 million in net inflows, reversing a two-week streak of outflows. According to Bitfinex analysts, while Bitcoin and Ethereum ETFs continue to see significant redemptions, Solana- and XRP-linked ETPs are still attracting net inflows. This suggests that investors may be rotating from larger assets into selective altcoin exposure rather than exiting the market entirely.

A Critical Turning Point

Bitcoin’s decline to the $73,000 level signals that the entire post-Trump-election rally has been erased and that the market is now searching for a new equilibrium. On-chain data, liquidation activity, and technical indicators point to continued short-term pressure, yet ETF inflows and altcoin divergence show that the market is not moving uniformly in one direction. Going forward, macroeconomic developments, U.S. policy decisions, and institutional capital flows will remain key determinants of direction for Bitcoin and the broader crypto market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.