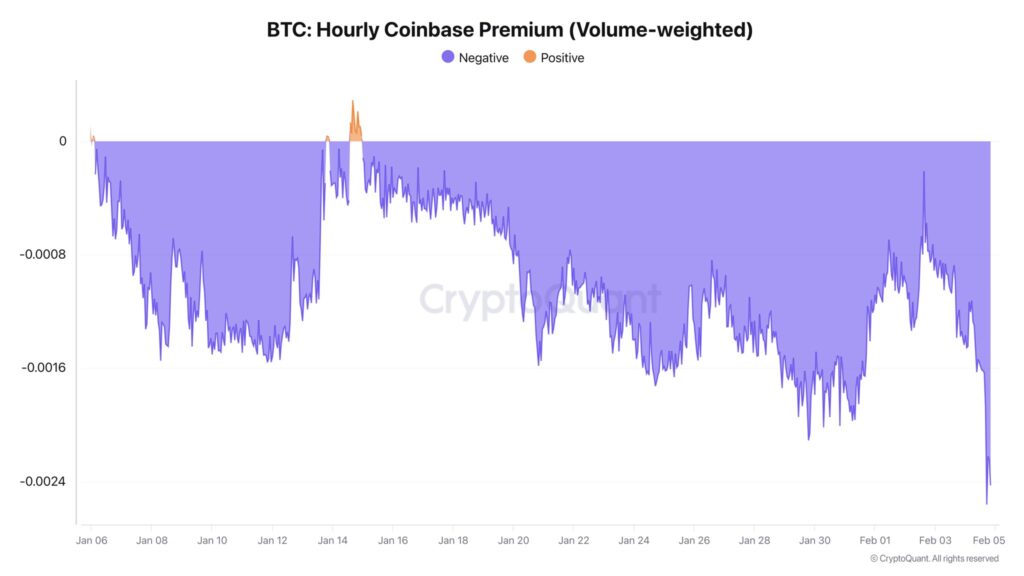

Signals from the institutional side of the Bitcoin market are becoming clear. The Coinbase Premium, which represents corporate investor appetite, has dropped to its lowest level since December 2024, sending a “sell” signal to the market. This critical indicator, measuring the price difference between Coinbase and Binance, shows that professional players are stepping away from Bitcoin and that U.S.-based selling pressure is accelerating.

This indicator measures the difference between BTC/USD on Coinbase and BTC/USDT on Binance. It is used to gauge corporate demand relative to retail investors. Deep moves into the negative zone typically coincide with periods of intensified institutional selling.

Right now, the chart is saying exactly that.

According to CryptoQuant, the Coinbase Premium Gap fell to -167.8, the lowest level in over a year. At the same time, trading volume on Coinbase Advanced Trade is below that of Binance, which is widely used by retail investors.

CryptoQuant analyst Darkfost notes this difference is not a coincidence:

“Institutional investor selling pressure is intensifying. Prices are pushed down, creating a negative gap.”

In other words, large players are exiting at lower prices.

Whales Selling at Low Premiums

Coinbase premiums have steadily declined since October. The drop accelerated significantly in the past week.

This trend shows that whales are consistently offloading Bitcoin at lower premiums. It also signals waning interest and activity on Coinbase.

Darkfost summarizes the current environment:

“The market is highly uncertain. Risk appetite is low, which prevents strong capital inflows into Bitcoin. BTC remains volatile and risky.”

Spot ETFs Turn Net Sellers

Weakness on the institutional side is not limited to Coinbase data. According to CryptoQuant’s latest market update, U.S. spot Bitcoin ETFs, which purchased over 46,000 BTC at this time last year, have become net sellers in 2026, offloading roughly 10,600 BTC so far.

This shift created a 56,000 BTC demand gap compared to 2025, sustaining selling pressure. Last week alone, spot Bitcoin ETFs saw outflows totaling $1.2 billion. Bitcoin fell below $71,000 on Thursday, testing its lowest levels in 15 months.

Institutions Pull Back, Pressure Deepens

Such a negative Coinbase Premium Gap generally means one thing: professional money is exiting the market. Retail investors may still be active, but institutions clearly set the price. Bitcoin’s continued volatility and risk perception are pushing corporate funds toward safer havens, making $70,552 a critical psychological level for market participants.

As long as this structure persists, short-term downward pressure on Bitcoin is unlikely to ease.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.