Recent volatility in Bitcoin price has not only shaken the market but has also had a visible impact on investor behavior. As Bitcoin briefly fell to the $60,000 level, online interest in the leading cryptocurrency surged sharply, signaling renewed attention from a broader audience.

Google Search Data Hits a 12-Month High

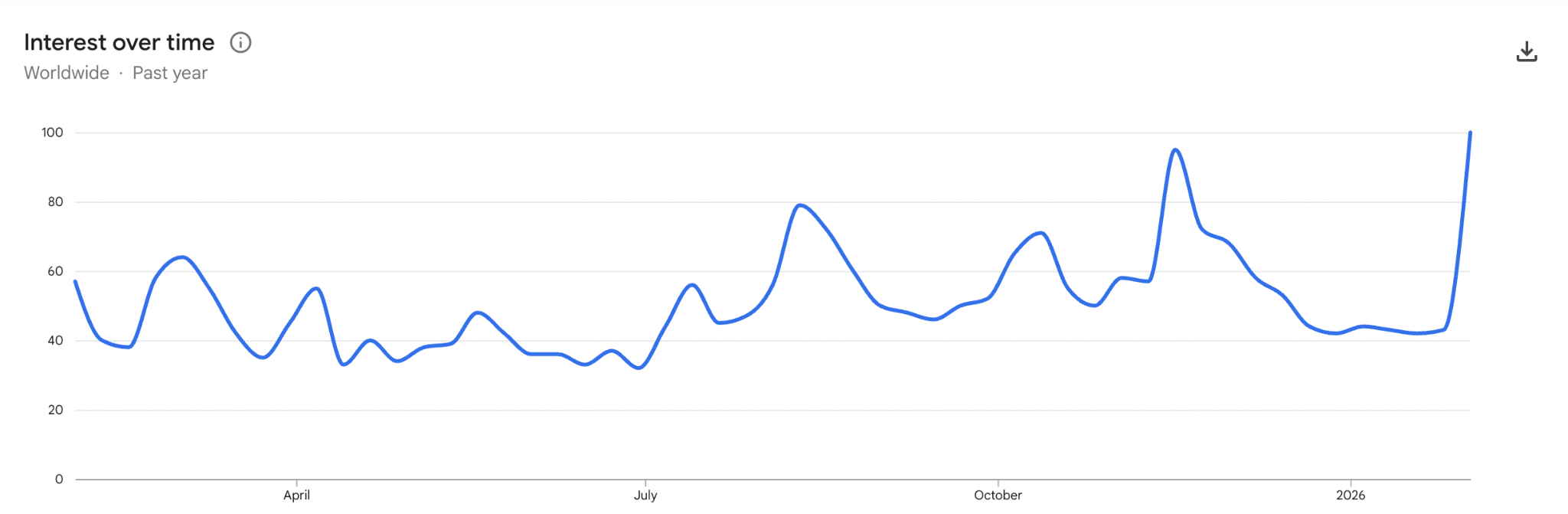

According to Google Trends, global searches for the term “Bitcoin” reached their highest point in the past year during the first week of February. For the week starting February 1, search interest hit a score of 100, marking the peak level recorded over the last 12 months.

The previous notable high occurred in mid-November 2024, when search interest climbed to 95. That spike coincided with Bitcoin slipping below the psychologically important $100,000 threshold for the first time in nearly six months, highlighting how price movements often drive public curiosity.

Price Volatility Draws Retail Attention

Search volume data is widely used by crypto analysts as a proxy for retail investor engagement. Historically, such metrics tend to rise during periods of extreme price action, whether driven by strong rallies or abrupt sell-offs.

The latest increase aligns closely with Bitcoin’s sharp decline from around $81,500 on February 1 to approximately $60,000 within a five-day period. After reaching that level, the price rebounded to about $70,740, underscoring the intensity of recent market swings and reinforcing Bitcoin’s reputation for high volatility.

Signs of Retail Participation Returning

Some market participants believe this price range is attracting renewed interest from retail investors. André Dragosch, Head of Europe at Bitwise, commented publicly that retail activity appears to be returning, suggesting that lower price levels may be encouraging investors back into the market.

Supporting this view, CryptoQuant’s Head of Research, Julio Moreno, pointed to increased buying activity among U.S.-based investors around the $60,000 level. He noted that the Coinbase premium — an indicator often used to track U.S. demand — turned positive for the first time since mid-January, signaling a shift in regional buying behavior.

Fear Indicators Remain Elevated

Despite growing interest, sentiment indicators suggest that caution still dominates the broader market. The Crypto Fear & Greed Index recently dropped to a score of 6, placing it firmly in the “Extreme Fear” category. This level is close to readings last seen in June 2022, a period associated with heightened market stress.

Such low sentiment levels are sometimes interpreted by investors as potential accumulation zones. Crypto analyst Ran Neuner argued that current data suggests Bitcoin may be trading at one of its most undervalued levels on a relative basis.

Overall, the combination of rising search interest, sharp price movements, and deeply fearful sentiment points to a critical phase where increased attention and uncertainty coexist in the Bitcoin market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.