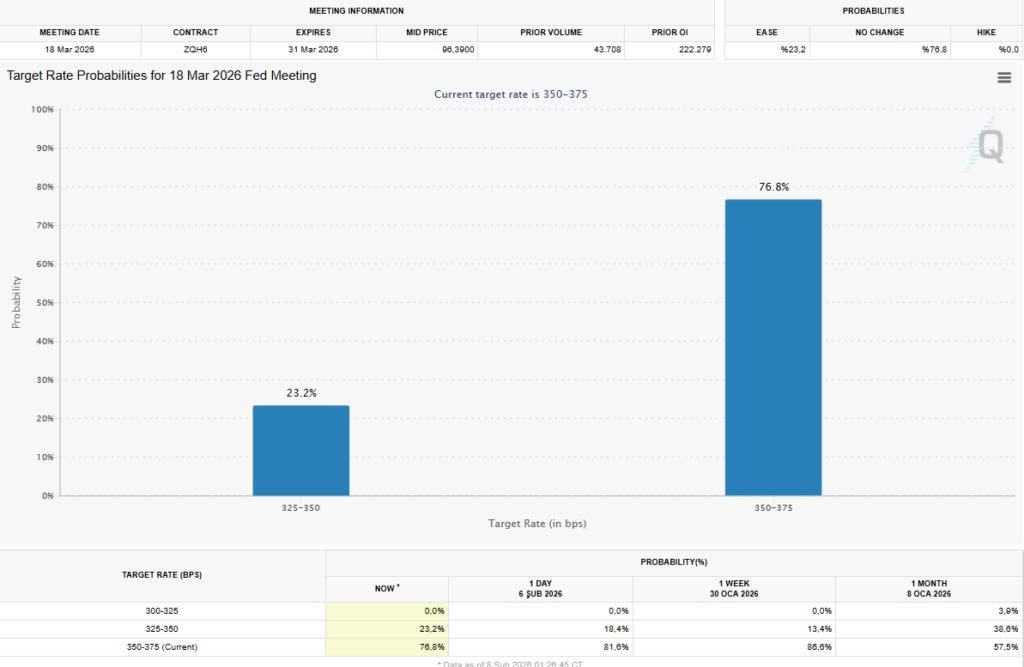

Markets are now pricing in a 23% probability of a 25-basis-point rate cut at the March FOMC meeting, up from 18.4% on Friday. The sudden shift follows Kevin Warsh’s nomination as the next Federal Reserve chair, reviving concerns over tighter liquidity conditions.

Warsh Factor: Markets Digest a More Hawkish Fed Scenario

Former Fed governor Kevin Warsh was nominated in January by President Donald Trump to replace Jerome Powell, whose term ends in May.

Since then, investor sentiment has turned cautious.

Crypto market analyst Nic Puckrin says Warsh’s nomination triggered late-January weakness in precious metals and early-February volatility across risk assets.

“Markets are digesting Warsh’s views on future Fed policy, especially the balance sheet, which he believes is ‘trillions larger than it needs to be.’ If balance-sheet reduction accelerates, investors will face a structurally lower-liquidity environment.”

In simple terms: less liquidity, tighter financial conditions. Not exactly a friendly setup for risk assets.

Crypto Markets Feel the Pressure as Liquidity Expectations Shift

Interest-rate policy remains a key driver for crypto prices. Easing financial conditions typically support Bitcoin and altcoins. Tightening cycles, however, reduce leverage, dry up credit, and dampen speculative appetite.

Thomas Perfumo, global economist at Kraken, described Warsh’s nomination as a mixed macro signal.

On one hand, it hints at policy stability. On the other, it weakens expectations for aggressive liquidity expansion — a narrative many crypto investors had quietly leaned on.

Perfumo noted that Warsh’s potential leadership suggests US liquidity and credit conditions may stabilize rather than loosen, challenging recent bullish assumptions.

Bottom Line: Small Cut Priced In, Direction Still Unclear

Heading into March, markets are balancing two competing forces.

Rate-cut expectations are rising. But the prospect of a more hawkish Fed leadership is tempering enthusiasm.

Traders are pricing only a modest 25-bps cut. There’s little conviction behind larger moves. Meanwhile, no clear liquidity expansion story has emerged.

That leaves both traditional markets and crypto assets vulnerable in the short term.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.