The Bitcoin network’s mining difficulty fell by approximately 11.16% in the last 24 hours, marking the sharpest single-period drop since China’s crypto mining ban in 2021. This reflects a temporary disruption in mining activities that secure the network and may trigger price volatility in the Bitcoin market.

Bitcoin’s mining difficulty is currently at 125.86 T, effective from block 935,429. The average block time is 9.47 minutes, slightly below Bitcoin’s 10-minute target. This indicates that the temporary drop in network hash power has accelerated block production. According to CoinWarz, the next difficulty adjustment on February 20, 2026, is projected to increase difficulty by about 5.63% to 132.96 T.

2021 China Mining Ban and Historical Comparison

The last time we saw a similar scenario was in May 2021, during the chaotic period when China banned mining operations. Bitcoin’s mining difficulty dropped between 12.6% and 27.9% from May to July 2021. At the same time, the market crashed, with Bitcoin’s price falling from a record over $125,000 to around $60,000. The ban forced a large portion of mining operations out of Asia, causing a significant decline in global hash power.

Winter Storm Disrupts U.S. Mining

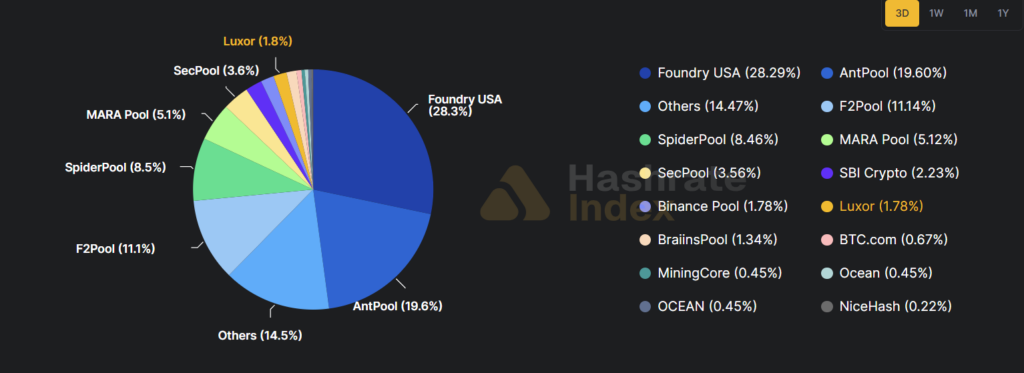

In January, Winter Storm Fern hit the U.S., affecting 34 states across 2,000 square miles with snow, ice, and freezing temperatures. Power outages forced U.S.-based Bitcoin miners to temporarily reduce energy usage and halt operations. One of the world’s largest mining pools, Foundry USA, lost approximately 60% of its hash power during the storm, dropping from nearly 400 EH/s to 198 EH/s. Currently, Foundry USA has recovered to 354 EH/s, maintaining a 29.47% market share.

Are Miners Shifting to AI?

Another notable trend is that miners are not only affected by weather but also by strategic changes. Amid worsening market conditions, many large mining facilities are moving operations to AI data centers and high-performance computing (HPC) setups. Analysts say this is one of the main reasons for the sharp difficulty adjustment. The rising difficulty in the next period is expected to help maintain Bitcoin’s network security.

Recent difficulty fluctuations serve as important signals for investors. Temporary drops in mining activity and changes in global hash power due to weather can increase short-term Bitcoin volatility. Projections indicate that during the next adjustment on February 20, difficulty may rise by 5.63% to 132.96 T, assuming miners return to full capacity. Experts emphasize that restoring the operational power of large mining pools will ensure long-term network stability.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.