Arthur Hayes, the controversial BitMEX co-founder, has recently drawn attention in on-chain analytics. According to Arkham and Lookonchain data, Hayes has started moving his DeFi token from his wallets to centralized exchanges and liquidity providers. Notably, most of these transfers are reportedly done at a loss.

Let’s break down Hayes’ wallet activity, the market impact, and the surrounding information noise.

Hayes’ Wallet Activity and Sale Details

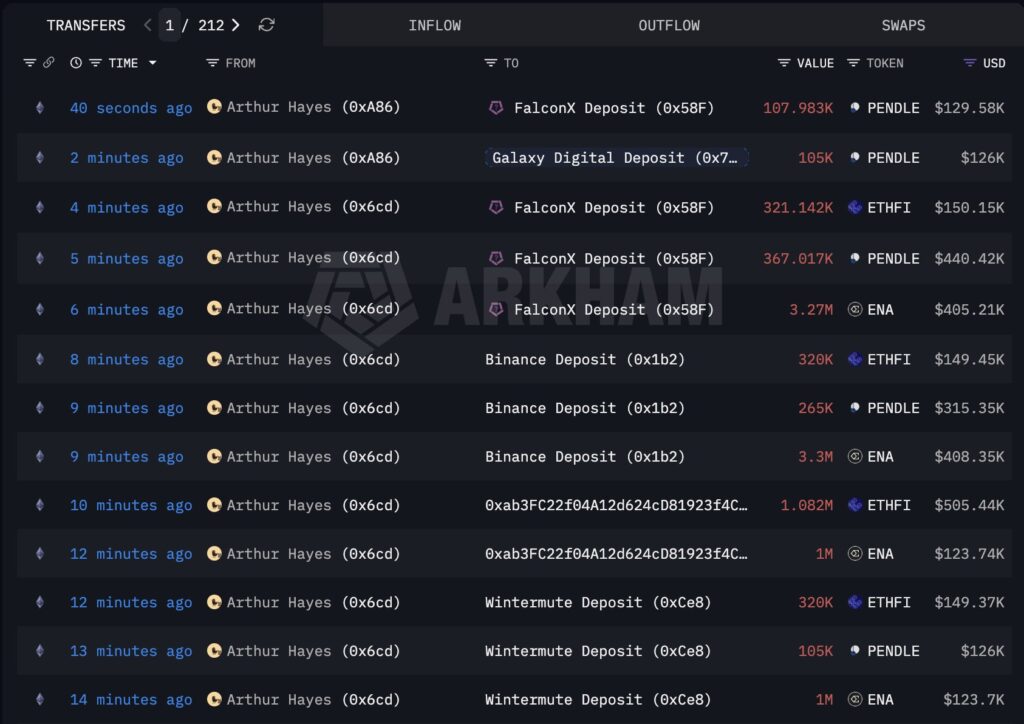

Massive token transfers over the past 15–20 minutes have been interpreted by the market as sales. Movements from Hayes’ known wallets to addresses such as Binance, Wintermute, and FalconX indicate a possible liquidation.

Lookonchain data further clarifies the situation:

Arthur Hayes (@CryptoHayes) is selling DeFi tokens.

In the past 15 minutes, he moved approximately 8.57M $ENA ($1.06), 2.04M $ETHFI ($954K), and 950K $PENDLE ($1.14M) out of his wallet — likely to sell.

Key sales are as follows:

-

ENA (Ethena): 8,570,000 tokens at $0.123 per token, total value $1,060,900

-

PENDLE: 950,022 tokens at $1.19–$1.20 per token, total value $1,137,350

-

ETHFI (Ether.fi): 2,043,142 tokens at $0.466 per token, total value $953,410

These numbers are being interpreted as significant selling pressure by the market.

$10.37 Million Loss Claim

Some reports suggest Hayes suffered a $10.37 million loss, but current verified data indicates a smaller loss. On-chain analyst Yujin reports that Hayes’ total loss on accumulated DeFi tokens since December is approximately $3.15 million.

Therefore, the $10 million figure cannot yet be confirmed without cost-basis and transaction-level verification. Hayes’ own statement reflects the uncertainty:

“I had to take it all back… I promise, I’ll never take profit again.”

While phrased sarcastically, this remark may indicate a reduced risk appetite.

Market Conditions and Strategic Retreat

CoinGecko data shows Bitcoin briefly dipped to around $68,500, with a weekly loss of about 16%. Such market conditions tend to make the movements of large wallets closely scrutinized.

Hayes’ $3.15–$3.48 million sales alone are sufficient to create short-term price pressure. However, without a transparent cost table, any interpretation remains somewhat speculative.

The data relies on Arkham-labeled wallets. Sending crypto to exchanges does not always equate to immediate sales; past actions provide a reference for possible liquidation strategies.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.