Bitcoin (BTC) continues to struggle to regain momentum as it trades near the $68,000 level, with technical indicators suggesting that downside risks have not yet fully dissipated. While short-term relief rallies remain possible, market analysts increasingly agree that broader conditions point to sustained pressure before any meaningful recovery can take hold.

Bitcoin Long-Term Technical Levels Signal Caution

From a structural perspective, Bitcoin has now closed below its 100-week moving average for three consecutive weeks and has remained under this critical trend line for 13 straight days. Historically, this level has acted as a key demarcation between bullish and bearish market phases.

Looking at previous market cycles, Bitcoin has spent an average of 267 days below the 100-week moving average during prolonged downturns. The shortest deviation occurred during the March 2020 pandemic-driven crash, when prices recovered after roughly 34 days. While the current situation does not rule out a temporary rebound, historical patterns suggest that extended consolidation below this level is more probable than a swift recovery.

Rising Share of Investors in Loss

On-chain data further reinforces the cautious outlook. The proportion of Bitcoin supply currently held at a loss has increased significantly, reaching levels typically observed only during deep bear market phases. Similar conditions were recorded near cycle lows in 2015, 2018, and 2022.

Although some analysts view these environments as long-term accumulation opportunities for patient investors, the growing share of unrealized losses also indicates that short-term selling pressure may remain elevated.

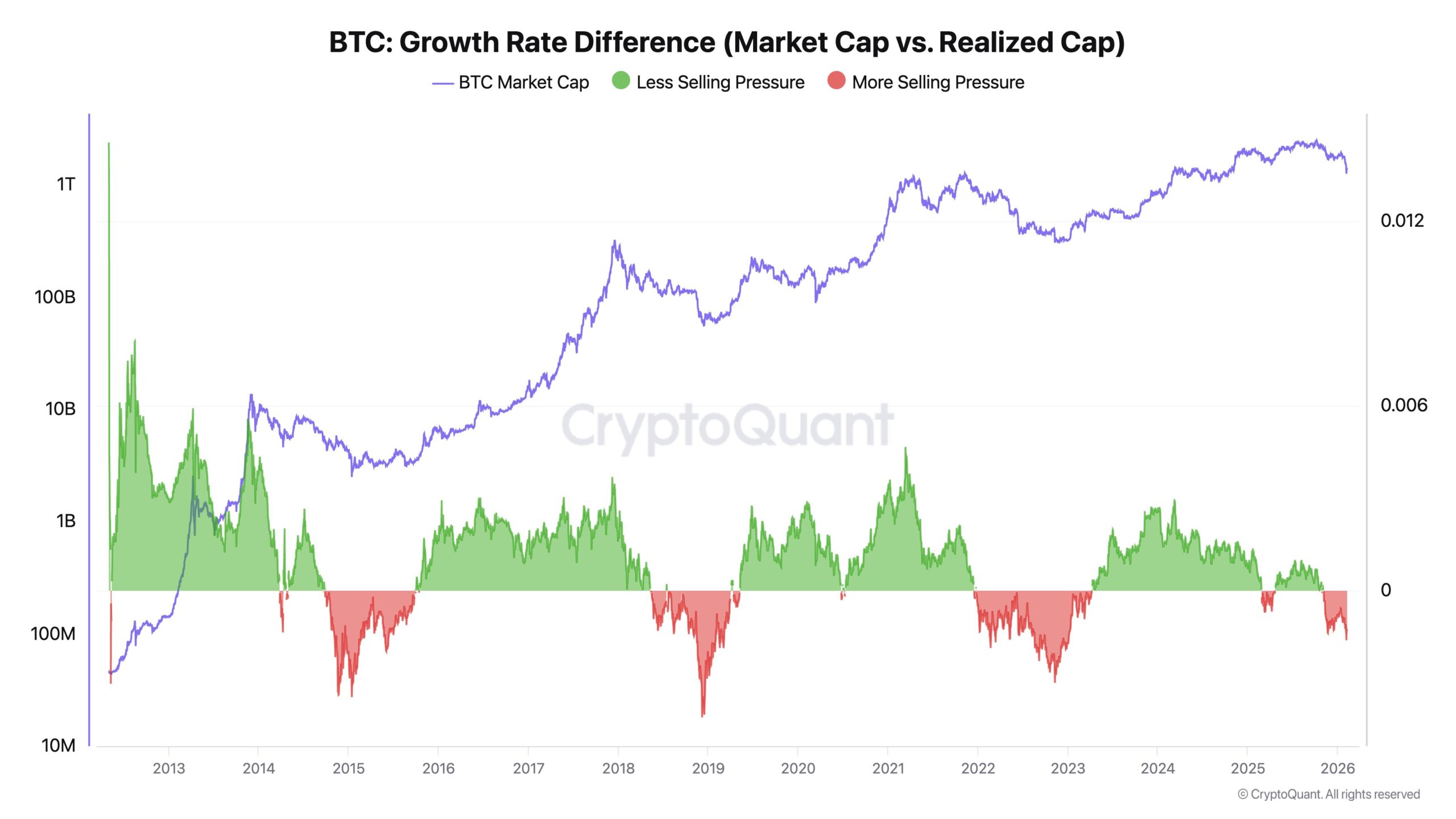

Persistent Selling Pressure Limits Upside

Market participants note that ongoing distribution has made it difficult for Bitcoin to establish a sustained upward trend. Without a clear improvement in demand dynamics, leveraged moves or sharp relief rallies are likely to remain limited. Analysts emphasize that a healthier market structure is needed before large-scale buyers return with conviction.

Volume Spike Fuels Bottom Speculation

During the recent decline toward the $60,000 level, trading volume surged to one of its highest readings since the 2022 market bottom. Historically, such volume spikes have often coincided with major inflection points, raising questions about whether the $60,000 area could represent a potential local bottom.

Bitcoin $70,000 Level Lost Again

Bitcoin briefly attempted to reclaim the $70,000 level earlier in the week but failed twice, slipping back toward $69,000 during the Asian trading session. Following the sharp drop to $60,000 on Friday, BTC has entered a period of sideways movement and now trades approximately 44% below its recent peak. Overall, current conditions suggest that downside risks remain firmly in play in the near term.

This content does not constitute investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.