Recent sharp pullbacks in Bitcoin price have unsettled short-term traders, yet on-chain data suggests a different dynamic is unfolding beneath the surface. Long-term holders (LTHs) appear to be re-entering an accumulation phase. Historically, shifts in behavior from this cohort have often preceded significant upward moves in the market.

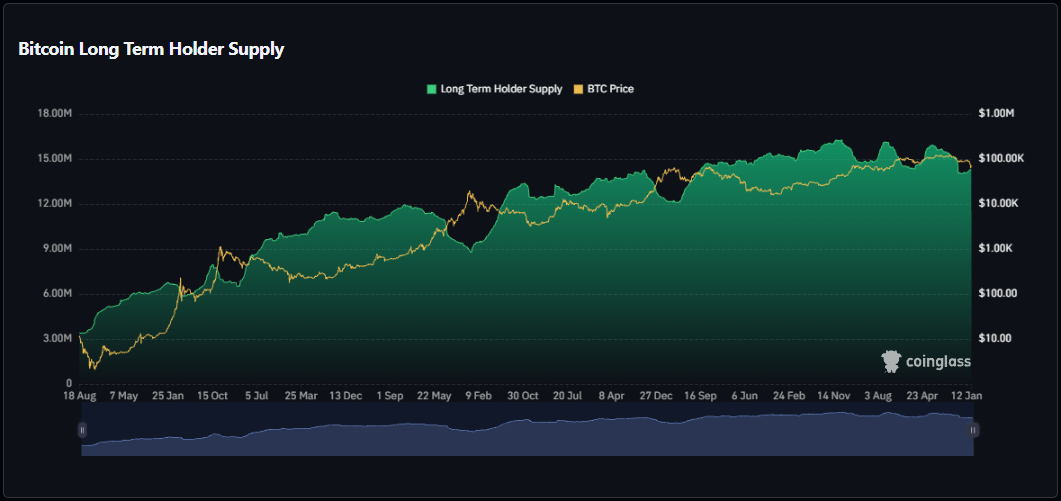

Long-Term Supply Climbs to 14.3 Million Bitcoin

According to on-chain metrics, the amount of Bitcoin held by long-term investors had declined to around 13.8 million BTC in recent months. That figure has now rebounded to approximately 14.3 million BTC, signaling renewed accumulation.

Long-term holders are typically defined as market participants who retain their assets through volatility and extended market cycles. When this group begins increasing its exposure during periods of weakness, it often reflects strategic positioning rather than reactive trading. The recent uptick suggests that current price levels may be viewed as attractive from a long-term perspective.

Historical Pattern: Rally Within 3–4 Months

Previous bull cycles reveal a recurring pattern: long-term holders tend to accumulate during or shortly after local market corrections. Roughly three to four months following these accumulation phases, Bitcoin has historically entered a notable rally.

Analysts caution against interpreting the current correction as the end of the broader uptrend. Instead, they suggest the market may be experiencing a mid-cycle pullback within a larger bullish structure. From this standpoint, the recent decline could represent consolidation rather than a structural trend reversal.

Price Action: Bitcoin Slips Below $67,000

On the price front, volatility remains elevated. After dropping to $60,000 last week, Bitcoin managed to reclaim levels above $70,000 over the weekend. However, renewed selling pressure emerged, pushing the price back below $67,000.

Technical Bitcoin (BTC) Outlook: Key Levels to Watch

Intraday, Bitcoin retraced to an untested internal structure support and found a short-term reaction at $66,750. This level now serves as a critical reference point. As long as price remains above this support and holds within the defined consolidation range, the broader structure remains intact.

The $72,000 level stands out as a major resistance and liquidity target. A move toward this area is plausible provided no new lower low forms. A decisive break above $72,000 could open the path toward the $78,000–$80,000 range, which represents the next significant resistance zone.

Overall, the behavior of long-term holders combined with key technical levels suggests that the coming months may prove decisive for Bitcoin’s next major move.

*This content does not constitute investment advice.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.