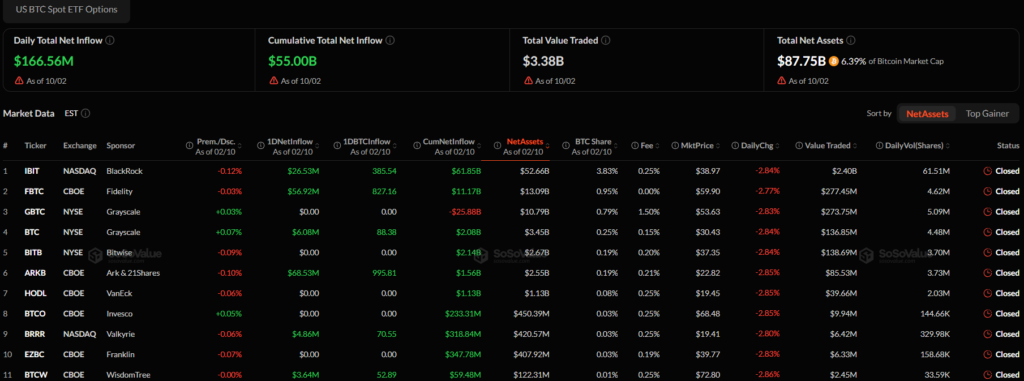

Last week, investors experienced panic with $3 billion in outflows; but this week, the situation has shifted slightly. Spot Bitcoin ETFs recorded inflows of $166.6 million on Tuesday, bringing the total for the week to $311.6 million. The market is catching its breath. BTC has dropped 13% over the past seven days and briefly slipped below $68,000, yet ETF funds continue to attract interest.

Some analysts noticed a slowdown in sales across crypto ETFs. Or maybe it’s just a short pause. Nothing is certain yet.

Goldman Move: Exiting Bitcoin, Entering Altcoins?

Goldman Sachs reduced its Bitcoin ETF positions in Q4 2025. BlackRock’s iShares Bitcoin Trust ETF (IBIT) shares fell from 34 million to 20.7 million, approximately a $1 billion sale. Goldman also reduced positions in other Bitcoin funds and Ether ETFs.

Interestingly, at the same time, the bank entered XRP and Solana ETFs. It acquired 6.95 million shares of XRP (worth $152 million) and 8.24 million shares of Solana (worth $104 million). Is Goldman seeing Bitcoin as reaching saturation, or is this just profit-taking? This move may also signal the direction of institutional investors.

Inflows in spot altcoin ETFs continued as well: Ether added $14 million, while XRP and Solana gained $3.3 million and $8.4 million, respectively.

ETF Investors Prefer Staying at the Bottom

ETF investors appear to prefer holding through the dip. According to Bloomberg analyst Eric Balchunas, most Bitcoin ETF investors have kept their positions despite the recent drop. Only about 6% of total assets exited the funds. Interestingly, BlackRock’s IBIT fund, which peaked at $100 billion, now sits at $60 billion. According to Balchunas, the fund could remain at this level for years and still hold the record as “the fastest ETF to reach $60 billion.”

In other words, even as prices fell, some investors are still holding their positions; this shows that the market is shaped not only by price but also by investor behavior.

Current Prices

-

Bitcoin (BTC): $66,742

-

Ether (ETH): $1,942

-

XRP: $1.36

-

Solana (SOL): $80.87

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.