As the crypto market hardens again, a striking move has arrived from Strategy. As of February 12, 2026, the company officially announced it has shifted to a new model to finance Bitcoin purchases. CEO Phong Le confirmed they will increase issuance of STRC perpetual preferred stock to reduce sharp volatility in MSTR shares. The message delivered at the same time was clear: Bitcoin buying will not stop.

Strategy’s move also aligns with the recent acceleration in corporate Bitcoin buying. The idea of holding BTC on company balance sheets is back on the table. Macro signals from the US are mixed, interest-rate expectations remain cloudy. After the latest jobs data, volatility in risk assets picked up. Right at this point, Strategy’s financing structure becomes more visible.

In short, while continuing its BTC accumulation strategy, the company is turning to new tools designed to partially shield investors from volatility.

Why Is MSTR Sliding While Bitcoin Falls?

In Phong Le’s interview with Bloomberg Television, the standout topic was “Stretch (STRC).” Strategy is preparing to issue more STRC perpetual preferred stock (perpetual preferred shares) to fund BTC purchases.

Le described the structure like this:

“We’ve engineered something for investors who want access to digital capital without that volatility.”

The critical detail here is STRC’s monthly-adjusted dividend structure. The goal is to keep the price trading around $100. Currently, the monthly reset dividend rate stands at 11.25%.

STRC closing at $100 today also sent a symbolic signal: more BTC buying is likely on the way from Strategy.

Looking at the company’s recent financing activity, the picture is somewhat fragmented. Roughly $370 million in MSTR common stock sales and just $7 million in preferred shares were used for recent BTC purchases. So STRC still represents a small slice. But Le’s message is clear: that slice will grow.

At this point, Michael Saylor also stepped in. Strategy’s executive chairman reiterated that the company has no plans to sell its BTC holdings.

MSTR Under Pressure: Another 5% Lower

Market sentiment is even more tense.

MSTR shares dropped another 5.16% on Wednesday to $126.14. Year to date, the stock is down about 20%. Since the October crypto crash, the picture is harsher: losses are approaching 70%.

Strategy’s market capitalization has fallen to around $40 billion during this period.

Bitcoin’s slide from a peak above $126,000 to below $65,000 has directly impacted the company’s balance sheet. In Q4 2025 earnings:

- Net loss: $12.4 billion

- Loss per share: $42.93

- Unrealized loss from digital assets: $17.4 billion

This quarter doesn’t look much different. Strategy is currently sitting on nearly $6 billion in unrealized losses on its BTC positions.

BTC purchases funded through ongoing share dilution are naturally weighing on investor psychology. Analysts are cutting targets. Volatility isn’t just showing up in crypto—it’s echoing across the MSTR chart as well.

Bitcoin Holds the $66K Zone

Bitcoin has slipped another 1% over the past 24 hours and is trading around $66,803 at the time of writing. The intraday range stands between $65,757 and $68,650.

What’s notable: trading volume is up more than 20%. Dip buyers are active. Still, on-chain data tells a more cautious story.

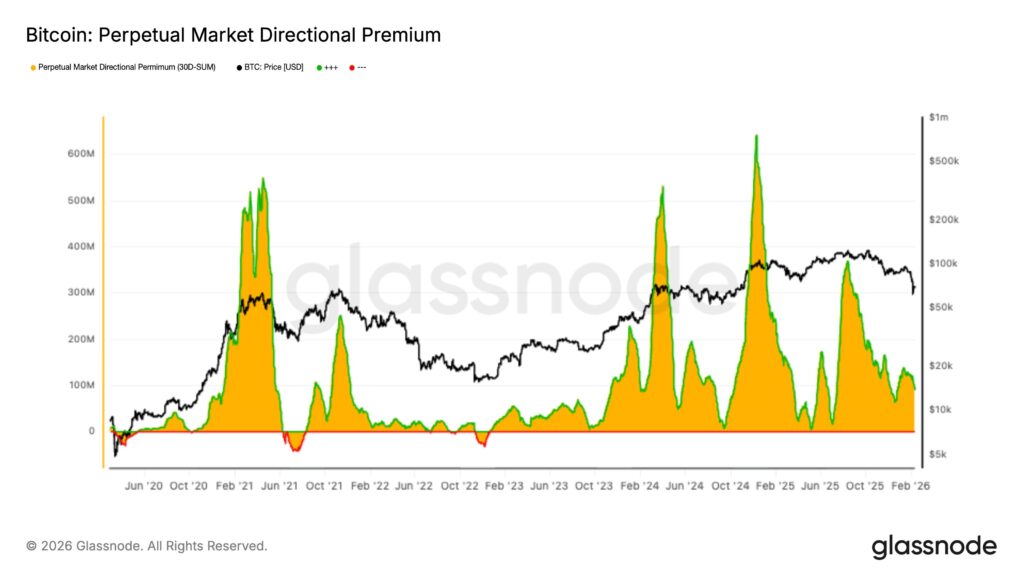

According to Glassnode, Bitcoin is showing structural weakness. Price remains defensive within the $60K–$72K range. Spot volumes are reactive, futures markets are cooling, and treasury outflows are suppressing demand.

CoinGlass data paints a similar picture. Selling pressure returned in derivatives markets over the past few hours. Total BTC futures open interest rose 1% over 24 hours but dropped 1% in the last four hours to $45.21 billion, with declines seen on both CME and Binance.

A Small Side Note

Strategy’s approach is increasingly shifting away from a traditional corporate model toward a kind of “Bitcoin proxy.” Tools like STRC aim to soften that structure. Will it work? Time will tell.

What’s clear is this: despite short-term balance-sheet pain, Phong Le and Michael Saylor are not backing away from their long-term BTC thesis. MSTR is swinging, Bitcoin is choppy, investors are uneasy. Yet Strategy is holding its course.

The market, for now, remains unconvinced.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.