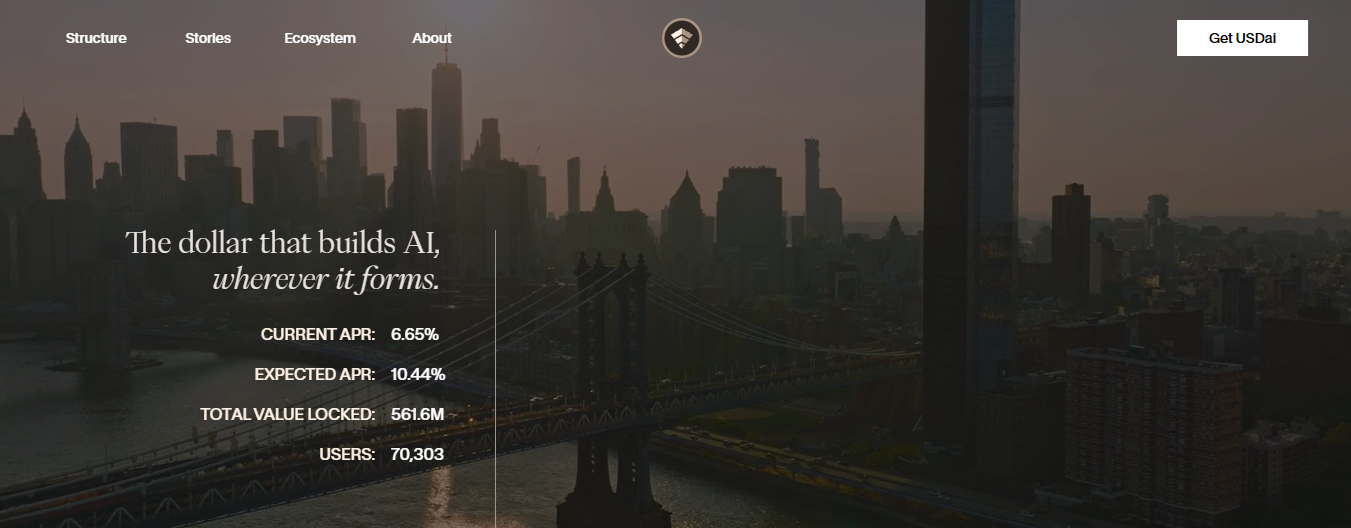

USD.AI (CHIP) is a decentralized synthetic dollar protocol that aims to finance artificial intelligence infrastructure. By structuring traditional financial assets and real-world collateral on the blockchain, it offers both a stable dollar derivative and a yield-generating model. The protocol operates through two core tokens: USDai and sUSDai. This structure diverges from the classic stablecoin approach, creating a credit-based, asset-backed, and DeFi-integrated financing layer.

The long-term vision of USD.AI is to become a fully decentralized credit aggregator supported by various collateral types, governed by token governance.

What Does USD.AI (CHIP) Offer?

USD.AI goes beyond the classic stablecoin approach and is a synthetic dollar model targeting the financing of artificial intelligence infrastructure. While USDai provides a liquid and low-risk dollar derivative, sUSDai delivers yield through a hardware-collateralized credit structure.

Thanks to the CALIBER, FiLo, and QEV architecture; tokenization, risk curation, and liquidity management are structured on-chain.

Considering the increasing capital needs of artificial intelligence infrastructure, the space USD.AI is positioned in can be evaluated not only as a DeFi product but also as a next-generation physical infrastructure financing model.

What are USDai and sUSDai?

There are two main tokens in the USD.AI ecosystem:

USDai USDai is a fully collateralized synthetic dollar. It is primarily backed by U.S. Treasury bills (T-Bills). It has a low-risk profile and is designed to be always redeemable. USDai holders do not earn direct yield; instead, they benefit from high liquidity advantages. It aims to provide deep secondary market liquidity on DeFi and CeFi platforms.

USDai is not structured like fiat-backed stablecoins such as USDC or USDT; it is based on a synthetic dollar model.

sUSDai sUSDai is the staked and yield-bearing version of USDai. This token is backed by U.S. Treasury bills as well as tokenized artificial intelligence infrastructure loans (GPU-collateralized loans). sUSDai holders earn yield in exchange for additional risk. However, since these assets have lower liquidity compared to stablecoins, redemption processes are subject to certain waiting periods.

The protocol is positioned with an annual target APR of 10–15%. The yield is generated from hardware-collateralized loans provided to artificial intelligence infrastructure. Idle capital is invested in U.S. Treasury bills to prevent cash drag.

How Does USD.AI (CHIP) Work?

The protocol is shaped around three main participants:

- Depositors: Deposit USDC/USDT to mint USDai and stake it into sUSDai to earn yield.

- Borrowers: Typically infrastructure operators that are not hyperscalers. They require financing for GPUs and similar hardware.

- Curators: Provide the first-loss capital, earn from risk premiums, and legally separate the capital from the operator during the tokenization process.

USD.AI is not a traditional credit protocol. It does not lend to businesses or individuals; it directly provides liquidity to the asset itself. This model offers a structure that prioritizes the collateral rather than the user.

Asset tokenization is carried out through the CALIBER framework. Hardware collateral is legally structured and transformed into an investable form. This approach is based on an abstraction logic similar to how mortgage-backed securities scaled real estate financing.

USD.AI (CHIP) Three Core Building Blocks: CALIBER, FiLo, and QEV

The USD.AI architecture is built on three fundamental components:

CALIBER

Tokenization and Yield Infrastructure A framework capable of bringing hard-to-tokenize assets on-chain. It enables oracle-less credit structures for low-liquidity assets.

FiLo

Risk Curation and Scaling Enables the evaluation and public funding of future asset financing demand.

QEV (Queue Extractable Value)

Liquidity and Redemption Mechanism Provides fair and transparent liquidity distribution during redemption processes. Prioritization is done through an epoch-based auction system. Staking users can participate in QEV auctions to gain priority access to liquidity. Passive participants can also earn a share from auction fees.

This structure aims to optimize liquidity through market mechanisms, differentiating it from classic RWA projects.

InfraFi and AI Infrastructure Financing

USD.AI focuses on a new category called “InfraFi”: the financing of artificial intelligence infrastructure. While global-scale AI projects require hundreds of billions of dollars in capital, this financing is predominantly provided through traditional debt instruments.

USD.AI aims to fill this gap by directing crypto-native liquidity toward hardware-collateralized infrastructure financing. The model draws inspiration from examples such as Tether’s massive positions in U.S. Treasury bills thanks to its stablecoin dominance and Bitcoin mining’s creation of a hardware-collateralized debt market.

In this context, USD.AI positions itself as a synthetic dollar protocol that aims to provide a financial layer for the artificial intelligence super cycle.

Stackable DeFi Primitives and Development Process

USD.AI can be described as an evolved version of the MetaStreet architecture. It is built on oracle-less credit mechanisms, tranche structures, and tokenized credit products.

In its development stages, the following components have been introduced:

- Oracle-less credit infrastructure

- Yield-bearing credit tokens (LCT)

- Modular asset valuation systems

- Yield stripping mechanisms

- Multi-collateral supported synthetic dollar model

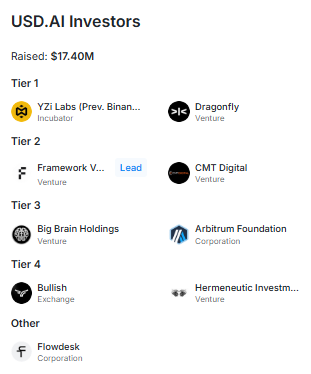

USD.AI (CHIP) Investors

USD.AI has raised a total of $17.40 million to date. The protocol has received support from both crypto-native funds and institutional investors.

Tier 1

- YZi Labs (formerly Binance Labs) – Incubator

- Dragonfly – Venture

Tier 2

- Framework Ventures – Venture

- CMT Digital – Venture

Tier 3

- Big Brain Holdings – Venture

- Arbitrum Foundation – Corporation

Tier 4

- Bullish – Exchange

- Hermeneutic Investments – Venture

- Flowdesk – Corporation

USD.AI (CHIP) Founding Team

USD.AI has been developed by an experienced founding team:

- David Choi – Co-Founder

- Conor Moore – Co-Founder

- Ivan Sergeev – Co-Founder

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.