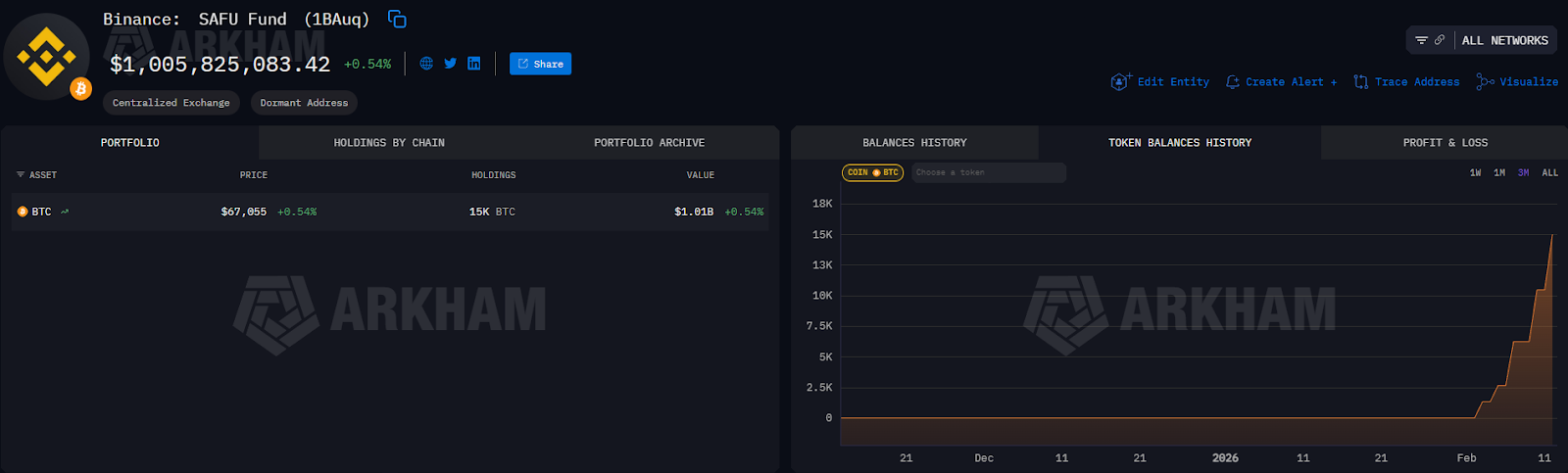

Binance has finalized the full conversion of its $1 billion Secure Asset Fund for Users (SAFU) into Bitcoin, marking a significant shift in the composition of its emergency reserve. With its latest purchase of approximately $304 million worth of BTC, the exchange has brought the fund’s total holdings to 15,000 Bitcoin. The aggregate value of the reserve now exceeds $1 billion, with an average acquisition cost of $67,000 per coin.

Binance SAFU Fund Surpasses $1 Billion!

The most recent acquisition came just three days after a separate $300 million Bitcoin purchase earlier in the week. Binance had originally announced on January 30 that it would gradually convert the $1 billion fund into Bitcoin within a 30-day window. However, the process was completed in less than two weeks. The exchange also stated that it would rebalance the fund if market volatility pushes its value below $800 million.

By restructuring the SAFU reserve entirely into Bitcoin, Binance signaled its conviction that BTC remains the most robust long-term reserve asset in the digital asset ecosystem.

Market Sentiment at Record Lows

The timing of the conversion is notable, as it coincides with historically weak investor sentiment across the crypto market. After Bitcoin briefly fell below the $60,000 level on February 5, sentiment indicators deteriorated sharply. By Thursday, the widely followed crypto sentiment index dropped to a reading of five — the lowest level ever recorded — reflecting extreme fear among market participants.

This index aggregates multiple variables, including volatility, trading volume, social media activity, and overall market momentum, to gauge investor psychology.

Click here to register on Binance Exchange with a 20% commission discount!

Smart Money Positions for Downside

On-chain analytics and capital flow tracking platforms show that experienced, high-performing traders — often referred to as “smart money” — are positioning defensively. These participants collectively hold a net short exposure of $105 million in Bitcoin. Most major cryptocurrencies also show net short positioning among this group, with Avalanche standing out as an exception, registering approximately $10.5 million in net long exposure.

Meanwhile, the recent correction has pushed roughly 16% of Bitcoin’s circulating supply into unrealized losses. This represents the most significant market pain point since the collapse of the Terra ecosystem in May 2022.

Derivatives Market Shows Early Stabilization

Despite the prevailing pessimism, derivatives data suggests tentative signs of stabilization. Funding rates remain neutral to slightly negative, indicating subdued leverage demand. Open interest, measured in native BTC terms, has returned to early-February levels, suggesting consolidation rather than renewed speculative expansion.

Although sentiment remains fragile, structural indicators imply that the market may be entering a phase of cautious stabilization rather than accelerating downside momentum.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.