For years, Bitcoin was framed as “digital gold” — a scarce, decentralized asset designed to hedge against inflation and monetary instability. Its fixed supply and independence from central banks positioned it as a modern store of value in an increasingly uncertain macroeconomic environment. However, recent market behavior suggests that this narrative is facing growing scrutiny.

As institutional participation has expanded — particularly through exchange-traded products and traditional financial channels — Bitcoin’s price action has increasingly aligned with broader risk assets. Rather than behaving like a defensive asset during market stress, Bitcoin has often moved in tandem with growth-oriented equities. This shift has reignited debate over whether Bitcoin functions primarily as a hedge or as a high-beta technology exposure.

Rising Correlation With Growth Stocks

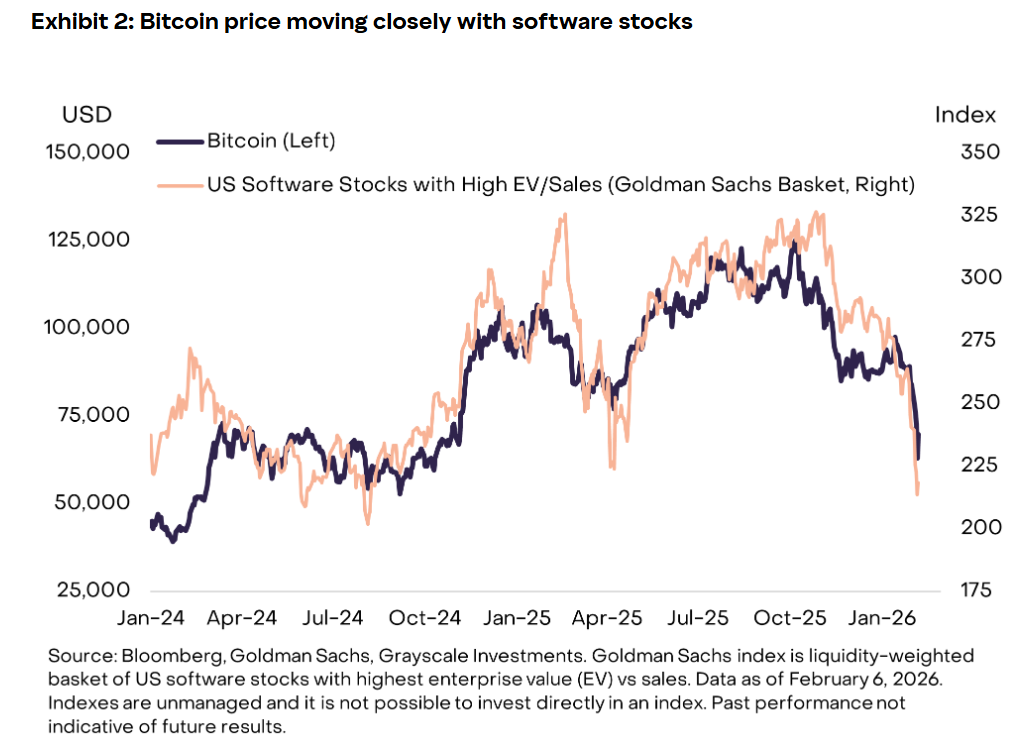

A recent research report from Grayscale highlights this evolving dynamic. While the firm maintains that Bitcoin’s long-term fundamentals support its role as a store of value, short-term trading patterns tell a different story. Over the past two years, Bitcoin has demonstrated a notable correlation with software and high-growth technology stocks.

The latest wave of volatility in the software sector — driven by renewed concerns about how artificial intelligence may disrupt existing business models — has been mirrored in crypto markets. As software equities faced selling pressure, Bitcoin experienced a similar pullback. This synchronized movement underscores how macro sentiment and sector-specific developments increasingly influence Bitcoin’s short-term valuation.

The data suggests that, at least in the near term, Bitcoin behaves more like a growth asset than a defensive monetary hedge.

BitMine Expands Ether Holdings Amid Market Weakness

During the recent market downturn, Ether-focused treasury firm BitMine Immersion Technologies added 40,613 ETH to its balance sheet. This purchase brought the company’s total Ether holdings to more than 4.326 million ETH, valued at approximately $8.8 billion at current market prices.

Despite the expansion, the company is reportedly facing around $8.1 billion in unrealized losses relative to its cost basis. The firm’s stock price has declined sharply in recent months, drawing criticism from investors. Nevertheless, management has reiterated that its strategy is aligned with Ether’s long-term growth trajectory, aiming to benefit from future recoveries. BitMine’s broader crypto and cash portfolio is estimated at roughly $10 billion.

Reassessing Bitcoin Role in Modern Portfolios

Bitcoin’s increasing correlation with technology stocks challenges the simplicity of the digital gold thesis. Institutional capital flows, macroeconomic shifts, and sector-specific developments are reshaping its market behavior.

While Bitcoin’s foundational characteristics — limited supply and decentralized design — remain intact, its short-term performance increasingly reflects risk appetite and growth expectations. Whether it ultimately solidifies its status as a long-term store of value or continues trading like a tech-driven growth asset will depend largely on evolving market structure and institutional adoption trends.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.