The structure of the cryptocurrency market has changed significantly in recent years, reshaping expectations around altcoins. According to some market analysts, these structural shifts may prevent the majority of alternative cryptocurrencies from ever revisiting their previous all-time highs.

Why Market Dynamics Have Shifted

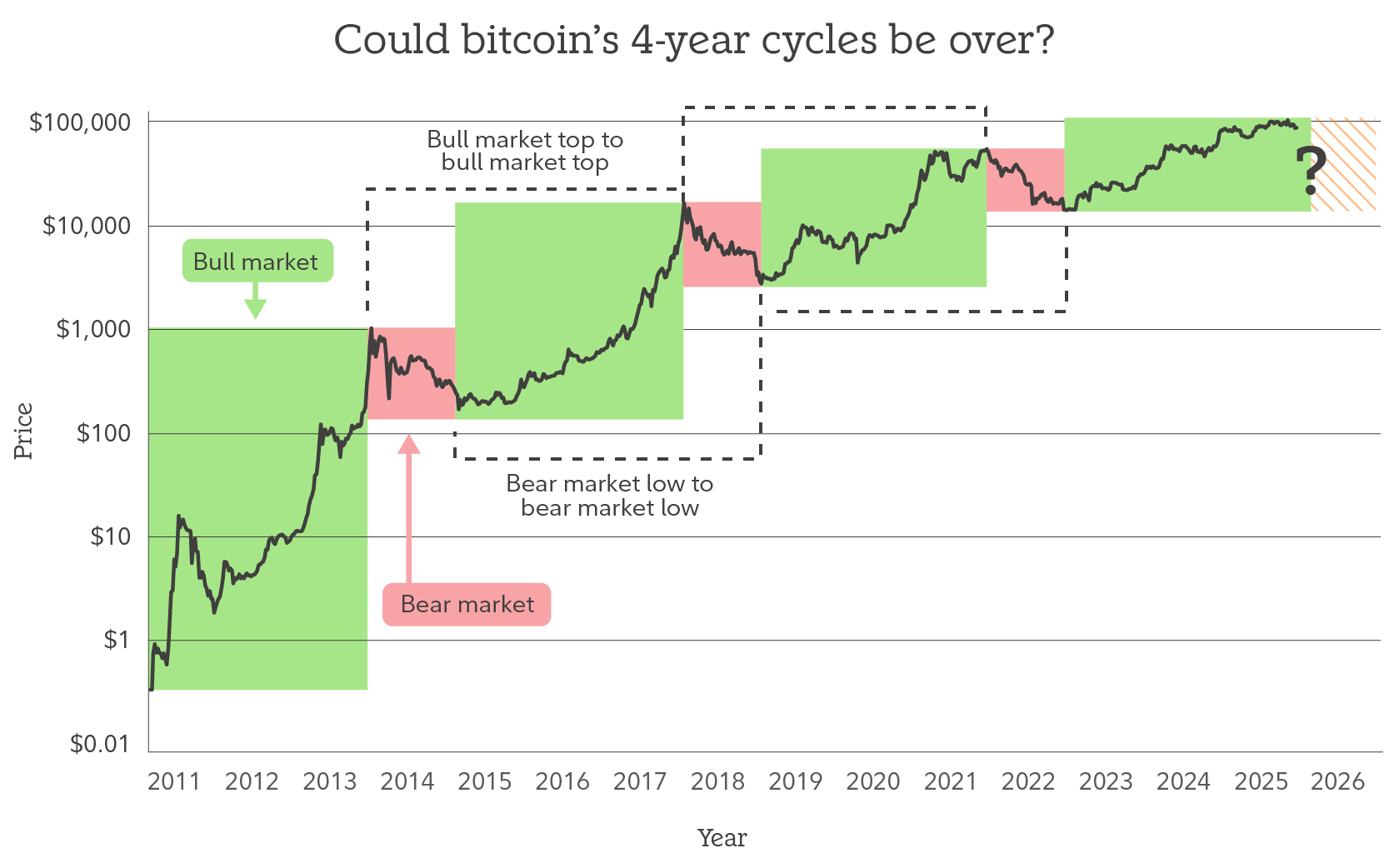

Back in 2018, roughly 1,000 cryptocurrencies were actively traded, and market cycles appeared more predictable. Investors closely followed Bitcoin halving events, which often served as psychological anchors for broader bull and bear cycles. After major post-halving rallies, traders typically rotated capital between Bitcoin and altcoin pairs, locking in gains as momentum slowed.

Through 2021, market activity remained largely retail-driven. The four-year cycle model—anchored around Bitcoin halvings—was widely accepted as a reliable framework for anticipating market peaks and corrections.

However, analyst Inmortal argues that this framework no longer reflects today’s environment. Institutional capital has entered the market at scale, directing billions of dollars primarily toward large-cap assets such as Bitcoin, Ether, and Solana. At the same time, thousands of new tokens were launched in 2025 alone, spreading liquidity across an increasingly fragmented landscape.

Liquidity Fragmentation and Diminishing Upside

Many retail participants expected institutional inflows to lift the entire market. Instead, large funds have concentrated exposure in a handful of major assets, while retail investors have chased short-term narratives across smaller tokens.

This dispersion of liquidity has reduced the probability of explosive rallies across the broader altcoin market. Under current conditions, the analyst projects that as many as 99% of altcoins may never return to their former peaks. The traditional four-year cycle model, once used as a strategic compass, may no longer provide reliable signals.

Is the Four-Year Cycle Breaking Down?

Historically, halving-driven cycles worked partly because limited awareness made patterns self-reinforcing. As more participants began anticipating these cycles, their predictive power weakened. Some projections made in 2022 pointed to a late-2025 peak, which broadly aligned with the market high seen in October 2025.

Unlike the 2018–2021 cycle, which featured a sharp 75% drawdown followed by prolonged sideways movement, the current correction has unfolded more rapidly. Yet long-term support levels, such as the 200-week moving average, remain intact.

The analyst suggests that 80–90% of the expected decline may already be complete, potentially followed by around 200 days of consolidation before expansion resumes. If accurate, this would represent a mid-cycle reset rather than a prolonged bear market. Even so, the outlook for most altcoins remains challenging, as capital concentration in major assets continues to limit broader recovery potential.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.