Crypto markets are searching for direction ahead of today’s FOMC minutes. If the January meeting notes pull rate-cut expectations forward, Bitcoin and altcoins could stage a relief rally. A hawkish tone, however, may revive selling pressure across digital assets.

As of February 18, 2026, markets are fully locked on messages from the Federal Reserve. The minutes will not only reflect what policymakers said — they will determine how far traders shift their interest-rate projections.

Crypto crawl boost paragraph

Crypto markets have entered a high-volatility window ahead of today’s FOMC minutes, with Bitcoin futures open interest rising and spot volumes accelerating across major exchanges. Traders are watching Fed language closely for rate-cut clues, as short-term positioning in BTC and altcoins has become increasingly sensitive to shifts in monetary policy expectations.

With the U.S. session approaching, algorithmic trading activity is expected to accelerate. Futures volumes are already building from Asia into Europe, while desks rebalance exposure ahead of the release. Early reactions to Fed phrasing could trigger sharp intraday swings.

How could the minutes impact crypto?

The critical factor isn’t just the wording — it’s how much market expectations move.

If policymakers appear more comfortable with rate cuts or express concern about slowing growth, summer easing bets could strengthen. That scenario would likely support Bitcoin and risk assets.

But if the minutes emphasize patience and upside inflation risks, rate cuts may be pushed further out. This would likely pressure Bitcoin prices and weigh more heavily on higher-beta altcoins.

In a post on X, analyst MANI outlined two scenarios: a hawkish tone suggesting rates stay higher for longer could spark selling across crypto, while dovish signals pointing toward cuts may help prices recover.

From the previous meeting, Fed Chair Jerome Powell said there was “no rush to cut rates.” MANI warned the release could increase volatility and urged traders to manage risk carefully. The next official rate decision arrives on March 18.

Inflation data reshaped expectations

January U.S. CPI rose 2.4% year-over-year, below the 2.5% forecast. It marked the lowest reading in more than four years and suggested inflation is moving closer to the Fed’s 2% target.

Markets are now pricing roughly 2.5% of cumulative rate cuts through 2026 — the largest total since the Fed last met in December. Analyst Liz Thomas said this forward-looking view remains intact despite stronger employment data and still-elevated supercore inflation. She added that if growth stays firm, current expectations may be too dovish.

The federal funds rate remains between 3.5% and 3.75%. After multiple cuts late in 2025, the central bank paused its easing cycle. The January FOMC minutes should provide detail on that internal debate and how officials view growth and inflation risks.

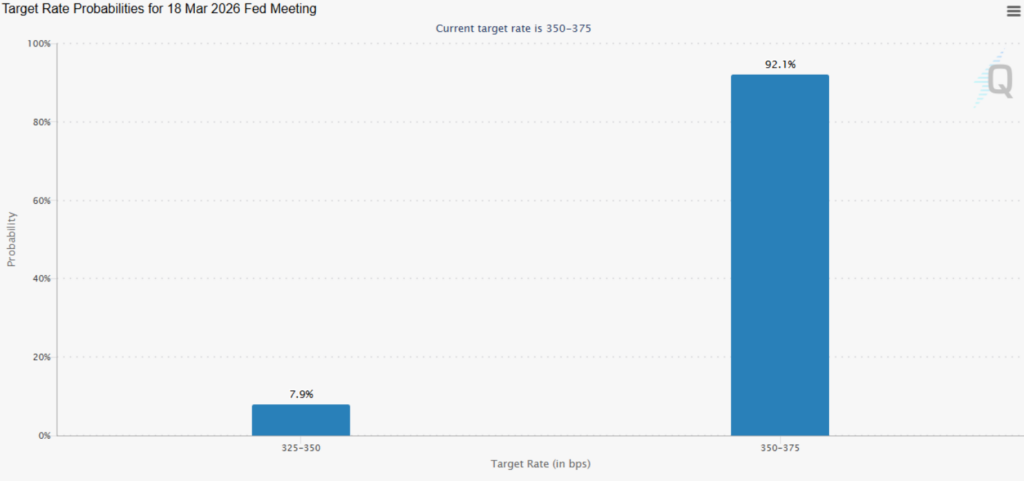

What does CME FedWatch show?

Market pricing shifted sharply after the latest labor report. Ahead of January payrolls, traders assigned about a 40% probability to a 25-basis-point cut in March. But after nonfarm payrolls rose by 130,000, odds of a rate hold jumped above 92%.

According to CME FedWatch, expectations now strongly favor unchanged rates in March. That repricing has reinforced caution across crypto markets.

Fortune cited Schwartz as saying the employment data “flipped the no hiring/no firing narrative” many Fed watchers had adopted.

Short-term crypto outlook

Today’s FOMC minutes could define near-term direction for Bitcoin and altcoins. If rate-cut expectations move forward, crypto may see a relief bounce. If Fed messaging turns hawkish, renewed pressure on risk assets is likely.

In short, crypto is sitting in a data-driven transition zone. The tone of the minutes won’t just shape today’s price action — it could reset perceptions around the entire 2026 rate path.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.