Bank of America’s (BofA) February investor survey points to a notable trend in Bitcoin and global markets. According to the survey, investors’ positions towards the US dollar have fallen to their most negative level since at least early 2012. Net positioning is at a historically high “reduce weight” level.

The primary driver behind this pronounced bearish stance on the dollar appears to be growing concern over the U.S. labor market. Investors increasingly believe that potential weakness in employment data could pressure the Federal Reserve into cutting interest rates. Expectations of monetary easing have, in turn, fueled broader dollar pessimism.

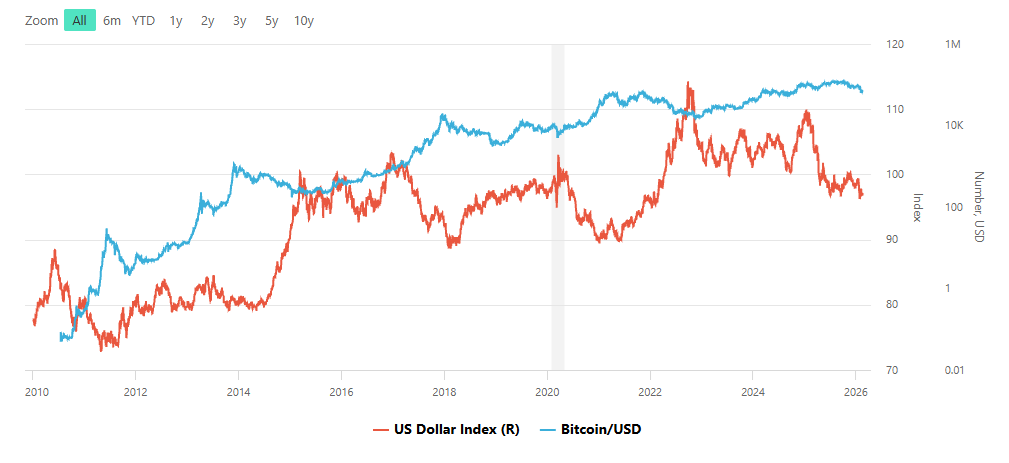

Bitcoin and the Dollar: A Historically Inverse Relationship

Since its inception, Bitcoin has generally exhibited an inverse correlation with the U.S. Dollar Index (DXY). When the dollar weakens, Bitcoin has often strengthened; when the dollar appreciates, risk assets—including cryptocurrencies—tend to face headwinds.

There are two core explanations for this pattern. First, Bitcoin is priced in dollars, so a weaker dollar effectively makes the asset relatively more attractive. Second, a strong dollar typically tightens global financial conditions, weighing on higher-risk assets.

Viewed through this traditional lens, record bearish positioning against the dollar could be interpreted as a tailwind for Bitcoin.

A Changing Correlation Dynamic

However, recent market behavior complicates the narrative. Since the beginning of 2025, Bitcoin and the dollar have displayed an unusual positive correlation. While the DXY declined by more than 9% last year and is down roughly 1% this year, Bitcoin has not benefited. Instead, it has fallen 6% over 2025 overall, with losses reaching approximately 21% year-to-date.

The 90-day correlation coefficient has climbed to 0,60, marking its highest level since April 2025. This shift suggests that the conventional inverse relationship may no longer be reliable in the current macro environment.

If this positive correlation persists, further dollar weakness could have the opposite of its typical effect, potentially weighing on Bitcoin rather than supporting it.

Volatility Risks and the Short Squeeze Scenario

At the same time, extreme short positioning in the dollar raises the risk of a sharp reversal. A sudden rebound in the dollar could trigger a short squeeze, forcing investors to rapidly cover positions and driving the currency higher. In such a scenario, Bitcoin could move upward alongside the dollar, reflecting the current correlation structure.

With dollar sentiment stretched to historic extremes, volatility risks are elevated. Bitcoin’s trajectory will depend not only on the direction of the dollar, but also on how this evolving correlation dynamic unfolds.

This content is not investment advice.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.