Bitcoin short-term holder stress has dropped to levels not seen since 2018, hinting that the market may have capitulated and potentially bottomed.

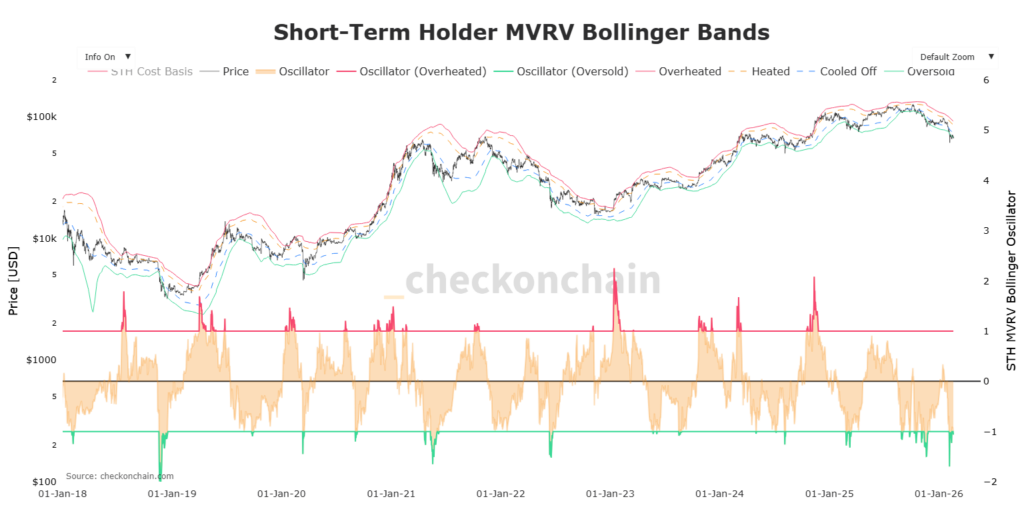

On-chain data shows that the Short-Term Holder (STH) Bollinger Band oscillator, which measures the gap between Bitcoin’s price and the cost basis of wallets holding BTC for less than 155 days, has plunged into deep oversold territory. In simple terms, Bitcoin is trading well below what recent buyers paid, beyond normal volatility, a signal historically aligned with macro bottoms.

2018 Rally Setup

A similar oversold signal appeared in late 2018 and preceded a roughly 150% rally within a year, eventually leading to a 1,900% increase over three years. The same indicator also flashed ahead of the November 2022 bottom, preceding a 700% rally to near $126,270.

Since October 2025, when Bitcoin peaked near $126,500, the asset has lost more than 50% of its value, dropping to around $60,000. The market is now on track for a fifth consecutive weekly loss—the first time since the March-May 2022 period. Monthly losses have also piled up for five straight months since October, marking the second-longest declining streak after the six-month drop between 2018 and 2019.

Bitcoin vs. Gold

Against gold, Bitcoin has underperformed for seven consecutive months, representing one of the longest stretches of weak performance in the BTC/Gold pair.

Wells Fargo strategist Ohsung Kwon noted to CNBC that higher-than-expected US tax refunds in 2026 could funnel roughly $150 billion into equities and Bitcoin. That could absorb remaining sell pressure and increase the chances of Bitcoin bottoming in the coming weeks.

Short-term holder stress is easing, whales haven’t capitulated yet, and liquidity may flow in by the end of March. Conditions for a rebound are gradually forming, though volatility remains high and sudden price swings are still possible.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.