The US Supreme Court struck down a significant portion of President Donald Trump global tariff regime in a 6–3 decision, ruling that emergency powers under the International Emergency Economic Powers Act (IEEPA) do not authorize the president to impose broad import tariffs. The decision marks one of the most consequential legal limits on executive trade authority since Trump began his second term in January.

This was not merely a technical legal dispute. It quietly redraws the boundary between presidential power and congressional authority over taxation and trade. And in Washington, those boundaries matter more than ever when trillions in global commerce are involved.

Why the Court intervened: A clear limit on executive authority

The US Constitution explicitly grants Congress the authority to impose tariffs and regulate trade. However, the Trump administration relied on IEEPA, a law designed to allow the president to respond to “unusual and extraordinary threats” during national emergencies.

The Supreme Court focused on that distinction. The justices concluded that while IEEPA allows economic regulation in emergencies, it does not explicitly authorize the president to impose sweeping global tariffs affecting nearly all imported goods.

This interpretation aligns with the Court’s broader approach in recent years. Under what is often referred to as the “major questions doctrine,” the Court has emphasized that policies with vast economic and political consequences require clear authorization from Congress, not unilateral executive action.

Which tariffs were struck down and which remain

Importantly, the ruling does not invalidate all tariffs imposed during Trump’s administration.

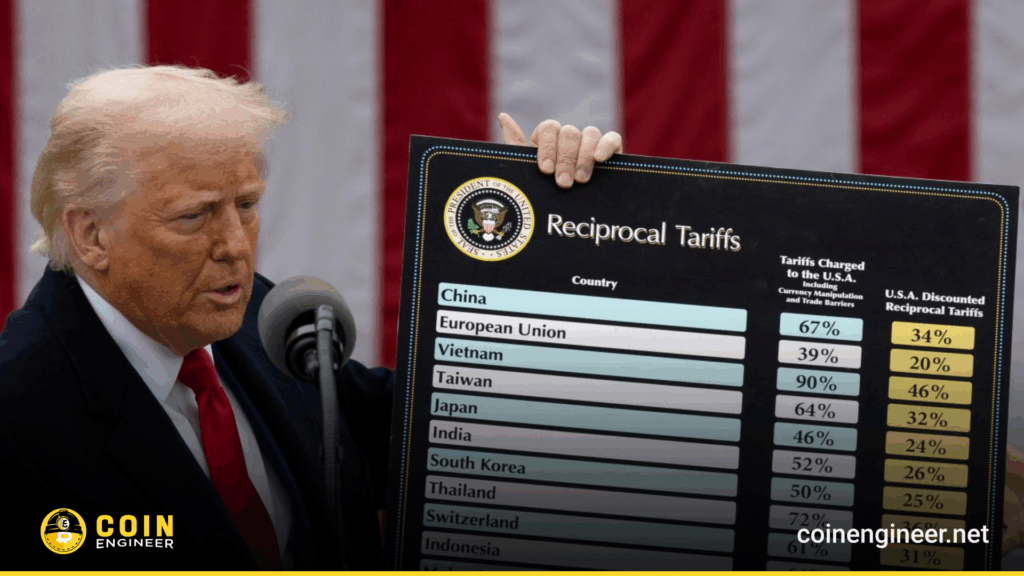

Two major categories were directly affected. The first involves country-based “reciprocal tariffs,” which ranged from a baseline of approximately 10% on most countries to as high as 34% on imports from China. These tariffs were central to the administration’s broader trade confrontation strategy.

The second category includes 25% tariffs imposed on certain goods from Canada, China, and Mexico. The administration justified these measures as part of efforts to combat fentanyl trafficking and related national security concerns.

However, tariffs imposed under different legal authorities, including those targeting steel and aluminum imports, remain in effect. In other words, the ruling limits the legal mechanism used, not the entire trade strategy itself.

The $130 billion question: Will businesses receive refunds?

According to US Customs and Border Protection data, the now-invalidated tariffs generated approximately $130 billion in revenue. That number alone highlights the enormous financial implications of the Court’s decision.

Businesses that paid these tariffs may now seek refunds. Importers across multiple industries—including manufacturing, consumer goods, and wholesale distribution—could potentially recover billions of dollars.

Such refund claims typically involve lengthy legal and administrative processes. But even the possibility of reimbursement has already begun influencing corporate expectations and financial planning.

Market reaction: Risk assets find support

Financial markets responded quickly to the ruling. Companies heavily dependent on imported goods saw improved outlooks as expectations shifted toward lower import costs.

Lower tariff burdens could ease pricing pressures across supply chains. That, in turn, may reduce inflationary pressure on certain goods, at least in the near term.

The US dollar, meanwhile, faces a more complex outlook. Reduced tariffs may weaken certain structural trade advantages, potentially placing modest downward pressure on the currency over time.

Risk-sensitive assets, including equities and cryptocurrencies, tend to benefit when trade tensions ease. Early market signals suggest that investors are beginning to price in a less restrictive trade environment, though uncertainty remains.

The administration may pursue alternative tariff paths

Despite the setback, the Trump administration retains options. Officials may attempt to reintroduce tariffs using alternative legal authorities that more clearly authorize such actions.

This means the broader trade conflict framework is not necessarily over. Instead, the legal pathway has narrowed, forcing future tariff decisions to rely more directly on congressional authorization or different statutory tools.

Washington’s institutional balance has shifted, at least for now. The Supreme Court has reinforced the constitutional role of Congress in shaping trade policy, while placing meaningful limits on emergency executive economic authority.

Following the decision, global trade expectations began adjusting almost immediately. Import cost projections shifted downward, while uncertainty surrounding future tariff strategies remains elevated.

Markets are recalibrating in real time. The immediate tone suggests relief, but the longer-term trajectory will depend heavily on how policymakers respond.

One thing is already clear: the Supreme Court has reshaped the legal foundation of US tariff policy. And that shift will influence executive power, global trade, and financial markets for years to come.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.