Bitcoin (BTC) closed 2025 with an underwhelming performance amid high volatility and increasing selling pressure. Despite reaching new highs during the year, sharp pullbacks—especially in the final quarter—caused BTC to end the year on a weak note. Nevertheless, as Bitcoin enters 2026, it has begun to show signs of recovery, with price action indicating renewed market strength. Historical data suggests that periods in which BTC closes the year in negative territory are often followed by strong and sustained recovery phases. According to analysts, this recurring cycle strengthens expectations that a similar bullish trend could begin in 2026.

Why Did Bitcoin Close 2025 in Negative Territory?

Although Bitcoin managed to reach new all-time highs (ATHs) in 2025, it faced increasing selling pressure in the final months of the year. Profit-taking from peak levels, a decline in overall risk appetite, and global macroeconomic uncertainty placed significant pressure on BTC. Expectations surrounding interest rate policies and volatility in traditional financial markets led investors to adopt a more cautious stance.

As a result of these factors, Bitcoin ended the year with negative returns, temporarily losing its strong upward momentum. However, analysts point out that such corrections have historically occurred ahead of much larger recoveries.

A Historical Pattern Stands Out

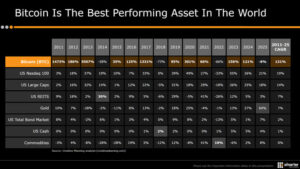

Jesse Myers, Head of Bitcoin Strategy at Smarter Web Company, highlighted an important historical pattern by examining Bitcoin’s past cycles. According to Myers, Bitcoin has typically delivered strong rallies following years in which it closed with negative annual returns.

“Historically, Bitcoin has shown strong recoveries in the years following annual losses. It would not be surprising to see a similar structure form again in 2026.”

According to data shared by the analyst, Bitcoin recorded gains of:

- 35% after 2014

- 95% after 2018

- 156% after 2022

Bitcoin closing 2025 in negative territory has now added a new link to this historical chain.

Bitcoin Started 2026 Strong

In the first days of 2026, Bitcoin climbed above the $94,000 level, signaling a strong start to the year. Although the price has pulled back toward the $90,000 range over the past 24 hours, this move is largely viewed as a healthy correction. The broader market outlook indicates that buyers remain in control and that the bullish bias is being preserved. Price fluctuations supported by high trading volume suggest that investors are gradually building positions in anticipation of a potential new rally. According to analysts, such pullbacks are common during the formation of strong trends and indicate that the market is still searching for direction.

Average Returns and the 2026 Outlook

According to Myers, the average gain following these recovery phases stands at approximately 95%, raising the possibility that Bitcoin could enter a strong upward trend in 2026. While historical patterns do not guarantee future performance, they serve as an important reference point for long-term investors.

Expectations for Bitcoin in 2026 are grounded in a rare bullish model supported by historical data. The negative close in 2025 mirrors previous cycles, while the strong start to 2026 makes this scenario even more compelling. Although experts emphasize that volatility may persist, medium- and long-term bullish expectations for Bitcoin have strengthened significantly.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.