Spot crypto ETFs have turned positive again in the cryptocurrency market. According to data released on January 12, Bitcoin, Ethereum, XRP, and Solana spot ETFs recorded notable net capital inflows in total. This development signals a renewed strengthening of market sentiment following recent outflows. In particular, the strong recovery in Bitcoin ETFs indicates a revival of institutional investor interest and is seen as an important sign of increasing risk appetite across the broader market.

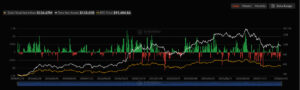

Four-Day Outflow Streak Ends for Bitcoin ETFs

On January 12, Bitcoin ETFs recorded a total net inflow of $116.67 million, ending a four-day streak of consecutive net outflows. This shift suggests renewed institutional interest in Bitcoin. Analysts note that these inflows could have a supportive short-term impact on Bitcoin’s price and emphasize that institutional demand via ETFs plays a critical role in overall market stability.

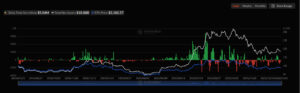

Ethereum ETFs Return to Positive Territory

Ethereum ETFs also broke a three-day net outflow streak. By the end of the day, Ethereum ETFs saw net inflows of $5.04 million. This data indicates that institutional demand for Ethereum remains intact and that the market is showing renewed signs of recovery. According to experts, this turnaround in Ethereum ETFs reflects continued long-term confidence in the DeFi and smart contract ecosystem.

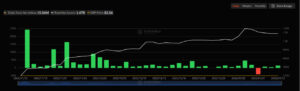

Strong Capital Inflows into XRP ETFs

Following Bitcoin and Ethereum, XRP ETFs also showed increased investor interest. On January 12, XRP spot ETFs recorded total net inflows of $15.04 million. This development signals sustained institutional demand for XRP and shows that investors are closely monitoring regulatory developments and market expectations. Analysts suggest that ETF-driven inflows could enhance XRP’s market visibility and liquidity.

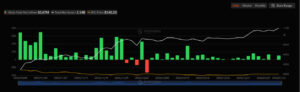

Ecosystem Impact Stands Out for Solana ETFs

On the same day, Solana ETFs recorded net inflows of $10.67 million. This interest in Solana is believed to be directly linked to the network’s expanding use cases and growth in the DeFi and NFT ecosystems. Experts state that capital inflows into Solana ETFs demonstrate continued investor interest in high-performance blockchain projects and growing confidence in the ecosystem.

Institutional Demand Strengthens Market Sentiment

These ETF inflows indicate that institutional investors are beginning to reposition in the crypto market. Spot ETFs offer a regulated and secure alternative for investors who prefer not to hold crypto assets directly. Market experts note that if the positive trend in ETFs continues, medium-term bullish expectations for cryptocurrencies could strengthen. In particular, large inflows into Bitcoin ETFs stand out as a key indicator of rising risk appetite across the market.

Overall, the net inflows into Bitcoin, Ethereum, XRP, and Solana spot ETFs on January 12 reinforced signs of recovery in the cryptocurrency market. The return of institutional capital via ETFs is considered a critical development for price action and investor confidence.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.