Significant fund movements reflecting investor behavior were observed in spot cryptocurrency ETFs in January. While Bitcoin and Ethereum spot ETFs recorded net outflows, XRP spot ETFs managed to stand out positively, albeit modestly. This picture indicates that institutional investors are maintaining a cautious stance in their short-term risk perception.

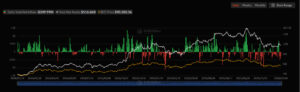

Million-Dollar Net Outflows in Bitcoin ETFs

Throughout January, U.S. spot Bitcoin ETFs recorded total net outflows of $249.99 million. This situation shows that price volatility in Bitcoin and macroeconomic uncertainties have put pressure on institutional investors. Expectations regarding interest rate policies and weakening global risk appetite are among the main reasons behind the fund outflows from Bitcoin ETFs. Despite this, some funds managed to differentiate positively, albeit in a limited way.

Among Bitcoin spot ETFs, Fidelity’s FBTC fund stood out with a $7.87 million net inflow in a single day, marking the highest daily net inflow among Bitcoin spot ETFs for that day. According to experts, this suggests that some institutional investors view current price levels as a medium- to long-term buying opportunity. This interest in FBTC indicates that despite overall outflows, the market is not entirely driven by selling pressure.

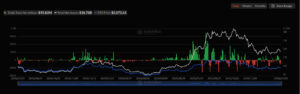

Selling Pressure Continues in Ethereum ETFs

In January, spot Ethereum ETFs experienced total net outflows of $93.82 million. This situation on the Ethereum side points to weakening short-term expectations. Network fees, staking dynamics, and overall market conditions are cited as the main factors limiting interest in Ethereum ETFs. Analysts believe that the outflows from Ethereum ETFs are largely driven by portfolio rebalancing and risk-reduction strategies.

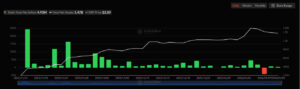

XRP Spot ETFs Stood Out Positively

Another notable development in January was the $4.93 million net inflow into XRP ETFs. Despite the broader market selling pressure, these inflows on the XRP side reflect the impact of regulatory developments and growing institutional interest. This limited but steady inflow into XRP ETFs is considered a positive divergence signal among altcoins.

Assessment

January data points to a cautious but not entirely pessimistic investor profile in the crypto ETF market. While net outflows continue in Bitcoin and Ethereum ETFs, inflows into Fidelity’s FBTC and XRP spot ETFs show that selective buying activity is ongoing. In the coming period, macroeconomic developments and regulatory steps are expected to play a critical role in determining the direction of fund flows in crypto ETFs.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.