Ripple (XRP) has officially announced a major step as part of its expansion strategy in the European market. The company has received preliminary approval from Luxembourg’s financial regulator, the Commission de Surveillance du Secteur Financier (CSSF), paving the way for institutional-scale expansion across the European Union. This development stands out as a concrete indicator of Ripple’s goal to strengthen its presence in the EU market and offer its Ripple Payments product to a broader user base. At the same time, this preliminary license approval is considered a critical step that will enable Ripple to deepen collaborations with financial institutions in Europe and expand its digital asset infrastructure at an institutional level.

Ripple’s Move into the European Union

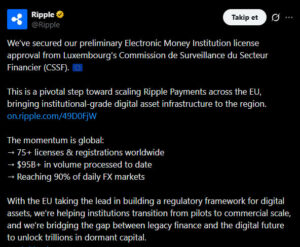

Ripple officially announced that it has received preliminary approval for an Electronic Money Institution (EMI) license from Luxembourg’s financial regulator, the CSSF. This milestone is seen as a critical threshold for Ripple to scale its operations institutionally within the European Union and to provide digital payment solutions more comprehensively across the region.

Once the licensing process is fully completed, the company plans to roll out its Ripple Payments product to a wider user base and institutional audience across Europe. This will allow banks and financial institutions to use Ripple’s infrastructure more efficiently and securely for cross-border payments, accelerating transaction times and optimizing costs. This step represents a key pillar of Ripple’s strategy to strengthen institutional digital asset infrastructure in Europe.

In its statement, Ripple emphasized that the European Union is a global leader in establishing a clear and comprehensive regulatory framework for digital assets. The company noted that this regulatory clarity is accelerating the transition of financial institutions from pilot projects to full-scale commercial applications. Through the EMI license, Ripple aims to deliver its institutional-grade digital asset infrastructure to a broader customer base across Europe. This move stands out as an important step in strengthening the integration between traditional finance and blockchain-based solutions.

Latest Status of XRP Price

Following these institutional developments, XRP recorded a 1.62% increase over the past 24 hours. Market participants believe that such regulatory progress from Europe could create a positive foundation for XRP in the medium and long term.

The preliminary EMI license approval obtained by Ripple in Luxembourg marks tangible progress in the company’s European Union expansion strategy. Targeting institutional-scale growth in the EU market—where regulatory clarity is high—has the potential to create long-term value for Ripple Payments and the XRP ecosystem. Ripple’s European expansion is emerging as a development worth closely monitoring in terms of XRP adoption, digital asset infrastructure, and institutional blockchain solutions.

Ripple’s Global Strength Draws Attention

According to data shared by the company, Ripple has to date:

- Obtained more than 75 licenses and registrations

- Managed over $95 billion in transaction volume

- Achieved access to approximately 90% of global FX markets

These figures demonstrate that Ripple has become a strong player not only in the crypto sector, but also within the global financial infrastructure.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.