The cryptocurrency market experienced a sharp downturn ahead of Federal Reserve Chair Jerome Powell’s highly anticipated speech scheduled for Tuesday, December 2. As Bitcoin fell below $86,500, more than $144 billion was wiped from the total crypto market capitalization within just a few hours. Ethereum, XRP, and Solana were also dragged downward by the wave of selling, increasing overall market tension.

Why Is the Crypto Market So Sensitive to Powell’s remarks?

Bitcoin’s decline indicates that traders are shifting into risk-off mode as they prepare for Powell’s comments. Rising macroeconomic uncertainty and mounting pressure have pushed investors to unwind leveraged positions and move into stablecoins. The upcoming speech may play a decisive role in determining the direction Bitcoin and altcoins will take in the coming weeks.

Why Is the Crypto Market Crashing Today?

Several key factors have triggered today’s sell-off:

- China FUD: Renewed negative statements from Chinese authorities have shaken market confidence.

- Whales Moving to USDT: Large investors have rotated into stablecoins to reduce risk ahead of Powell’s speech.

- Excessive Leverage: As BTC fell, heavily leveraged long positions triggered mass liquidations.

- Seasonal Trends: Historically weak performance in November often leads to early-December sell-offs.

Within just five hours, Bitcoin dropped from $91,300 to $86,300, erasing approximately $99.3 billion in BTC market capitalization and $40 billion from altcoins.

What Does Powell’s Speech Mean for Crypto?

Powell is expected to speak on the economy, inflation, unemployment, and the future of monetary policy. His remarks coincide with the official end of the Federal Reserve’s three-year quantitative tightening (QT) program — a shift that historically has been followed by bullish periods in the crypto market.

Markets are especially focused on the following topics:

- Signals of future interest rate cuts

- The possibility of renewed quantitative easing (QE)

- The Fed’s assessment of employment and inflation

If Powell hints that rate cuts are approaching, Bitcoin and altcoins could see a rapid relief rally. However, a more “hawkish” tone prioritizing inflation could deepen the downturn.

Meanwhile, major global economies such as Japan, Canada, and China have already begun easing monetary policy. A similar signal from the Fed could strengthen global liquidity expectations — and crypto markets are typically among the first to react to such shifts.

Rate Cut Expectations Are Rising

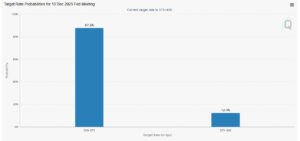

Recent data suggests the market has already priced in much of the expected December rate cut. The probability of a 25 bps cut currently stands at 87%. This expectation, combined with:

- Today’s PCE data

- ISM and ADP reports

- Jobless claims

- And Powell’s upcoming remarks

will help determine the next direction for the crypto market.

Market analysts summarize the situation as follows:

“Powell’s speech tomorrow could determine nearly all crypto pricing for the final weeks of the year. The Fed’s tone may trigger either a sharp rebound or a deeper correction.”

Conclusion

Federal Reserve Chair Jerome Powell’s speech on December 2 has become one of the most significant catalysts behind the growing stress in the crypto market. The massive sell-off that wiped hundreds of billions off Bitcoin’s market cap reflects investors’ cautious positioning. The messages conveyed in the speech — regarding rate cuts, inflation, and the Fed’s policy stance will be critical.

Depending on Powell’s tone, the market may either prepare for a strong recovery rally or face the increasing likelihood of retesting lower price levels. For this reason, December 2 stands out as a crucial turning point for the crypto market..

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.