There’s a subtle but significant shift happening in the crypto market. Altcoin trading volumes have plunged sharply, while capital quietly but decisively rotates back into Bitcoin. The latest correction makes this behavior even clearer. Investors’ moves are cautious, measured, yet unmistakably firm.

Bitcoin now trades in a range between $65,000 and $72,000. It may look like an ordinary consolidation zone, but behind the scenes, something else is happening. Whales, long-term holders, and institutional players are active here. No sudden spikes, no dramatic crashes. But accumulation is taking place—slow, patient, often at levels typical for market bottoms.

In periods like this, market reflexes tend to be predictable. Risk aversion kicks in. Capital flows away from more volatile assets toward those seen as safer. In crypto, that “safe haven” is often Bitcoin.

Binance Data Shows Clear Rotation

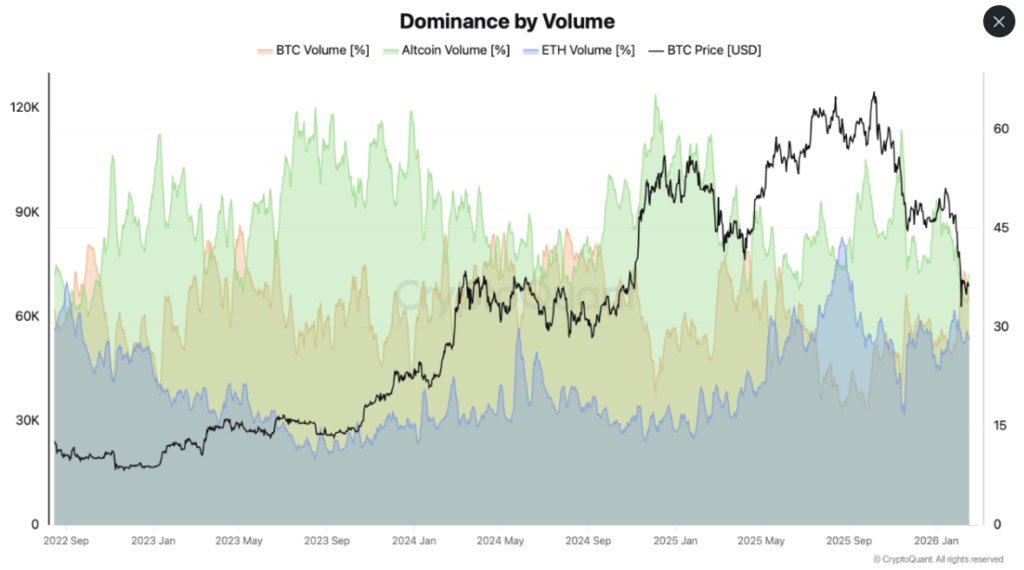

Binance, one of the exchanges with the largest volumes, clearly reflects this rotation. Trading volumes split between BTC, ETH, and other altcoins show Bitcoin reclaiming dominance.

According to CryptoQuant, since February 7, Bitcoin has regained the lead with a 36.8% share of Binance’s total volume. Altcoins, which held a massive 59.2% dominance in November, have shrunk to just 33.6% by February 13—roughly a 50% drop in activity in just a few months. Historical corrections—August 2024, April 2025, and the late 2022 bear market—show similar patterns: when stress rises, capital naturally moves toward “digital gold.”

The sharp decline in altcoin volumes is more than numbers; it signals a clear drop in risk appetite.

History Repeats

Patterns like this have appeared before: August 2024, April 2025, and late 2022. Each time, altcoin activity contracts, and capital flows toward Bitcoin. A defensive reflex. When uncertainty rises, investors seek deeper, more liquid, less fragile assets. Bitcoin has long played this role.

Once BTC surpassed $60,000 again, the trend accelerated. Volume distribution quietly shifted. Speculative altcoin momentum faltered, while Bitcoin remained stable. This contrast became a key factor determining capital allocation.

Altcoins Still Under Pressure

The altcoin market has not fully recovered since 2024. Sporadic rallies happen, but overall momentum is weak. The euphoric peaks of 2021 remain far away for many projects.

Liquidity is limited, speculative interest is low, and investors are more selective. Many altcoins still trade well below historical highs, shaping a cautious market sentiment.

CryptoQuant analysis confirms this picture: Bitcoin’s current consolidation acts more as a strategic accumulation zone than speculative playground. Large players typically act in such phases—not the short-term, rapid-profit crowd, but patient capital.

This signals a shift in market character: noise decreases, but movement continues.

Bitcoin’s Role Strengthens Again

It’s not new that Bitcoin’s volume share rises in times of market stress. But this rotation is sharper and faster than usual. A roughly 50% drop in altcoin activity highlights how investors reprioritize.

Bitcoin remains the market’s center. Liquidity pools here, risk-averse flows anchor here, and it continues to be the reference point. Altcoins are not entirely sidelined, but for now, most capital prefers Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.