Some market observers claim that altcoins are slowly fading into irrelevance — but the broader picture is more nuanced.

What’s the Current Outlook for Altcoins?

A recent Bloomberg report casts a shadow over the altcoin market, even as Bitcoin approaches one of its strongest monthly closes ever. Smaller and mid-cap cryptocurrencies seem unable to match BTC’s bullish momentum.

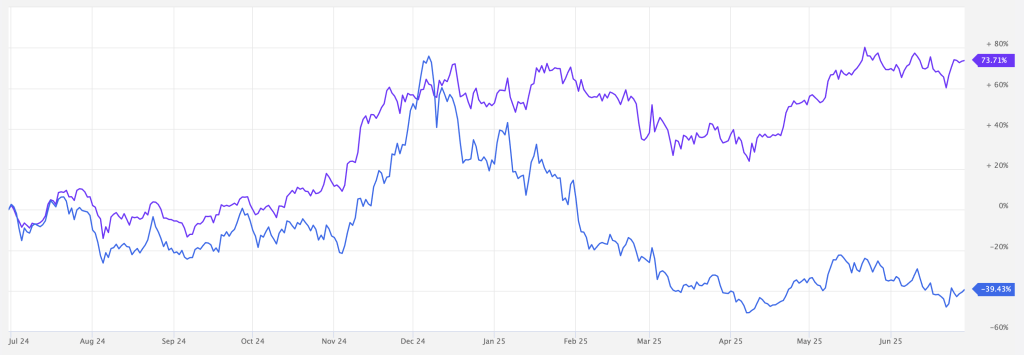

A striking chart from MarketVector illustrates the divergence: the purple line shows Bitcoin, while the blue line represents small-cap altcoins. Both surged in November, following Donald Trump’s reelection. But since then, they’ve taken opposite paths — Bitcoin has climbed 73% in the past year, while smaller altcoins have dropped roughly 40%.

This small-cap index includes lesser-known tokens like Maker, Worldcoin, BONK, and Fartcoin. Notably, major altcoins like Ethereum, XRP, and Solana are excluded from this basket.

How Are Leading Altcoins Performing Compared to BTC?

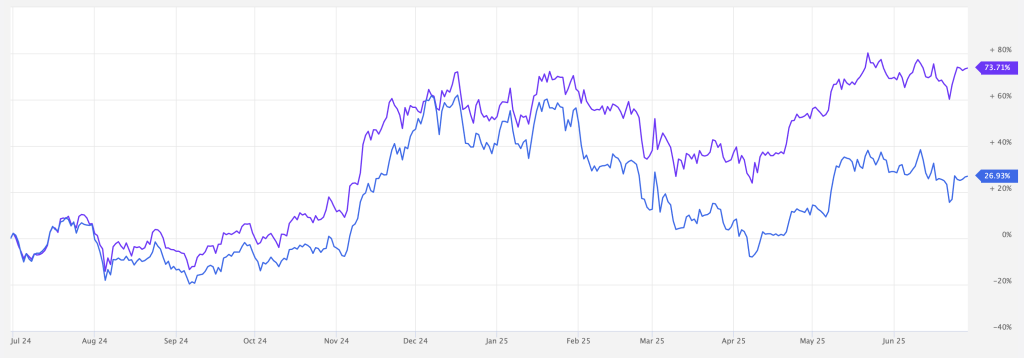

The MarketVector Digital Assets 10 Index, which includes top-tier cryptocurrencies, shows a different story. BTC holds a 31% weight in this index, followed by ETH at 30%, XRP at 13%, BNB at 9.5%, and Solana at 8%.

Key takeaways include:

-

Altcoin exposure diluted the index’s performance

-

Ethereum, down 26.5% since June 2024, dragged returns significantly

-

XRP, with a massive 363% rally, contributed the most despite its modest share

-

Solana struggled as hype around meme coins diminished

Nick Philpott, co-founder of Zodia Markets, gave a blunt assessment:

“I think they’ll just die out. Technically, many of them will just sit there collecting dust forever.”

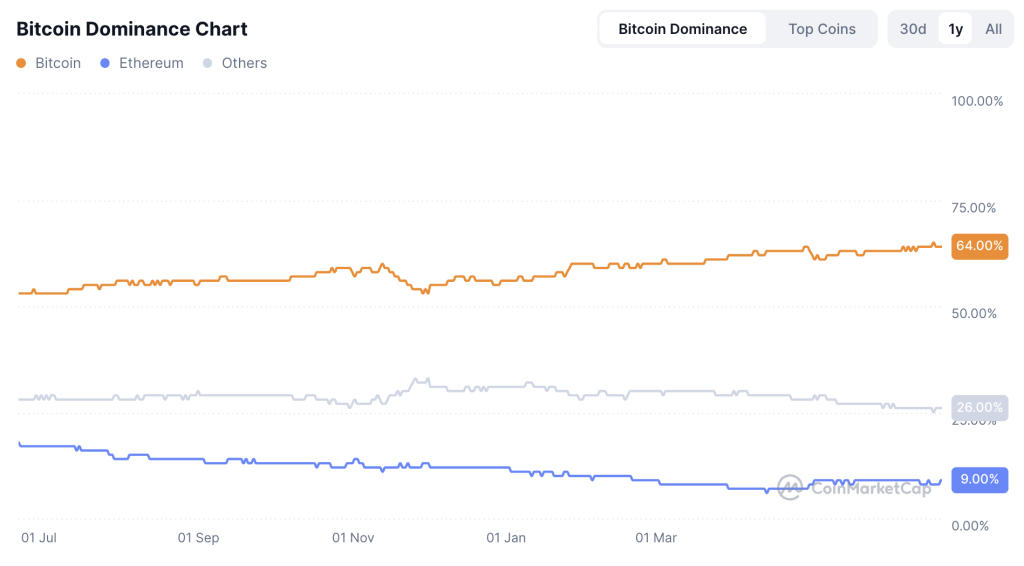

Unfortunately, some metrics back this up. Bitcoin dominance — the percentage of the total crypto market it commands — has grown from 53% to 64% over the past year. This came largely at Ethereum’s expense, as its share shrank from 18% to 9%.

Still, the rest of the altcoin market has maintained a relatively stable 26% share.

Data from CoinGecko shows a significant spike in dead tokens. Since 2021, over 3.7 million altcoins have launched, and more than half have failed. Alarmingly, 1.8 million tokens collapsed in just the first quarter of 2025. A major reason? The pump.fun platform, which lets anyone create a coin — resulting in an oversupply of low-quality meme tokens.

Is Another Altseason Possible?

Analysts remain split. Some, like Blockstream’s Adam Back, believe altcoin speculation is over, urging investors to focus on BTC and treasury-heavy firms like MicroStrategy and Metaplanet.

Others, like Xu Han of HashKey Capital, say only a few selected altcoin projects might deliver substantial gains — suggesting the days of broad-based speculative rallies are behind us.

For some altcoins, securing ETF approval could be the only path to survival. Mergers and consolidations may also reshape the altcoin landscape moving forward.

According to CoinMarketCap, we are firmly in a “Bitcoin season” — and that doesn’t appear likely to change anytime soon.

This content is not intended as investment advice. Cryptocurrency markets are high risk and it is important to do your own research before making any investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.