The cryptocurrency markets were challenging for many investors last year. Altcoins, in particular, suffered heavy losses; many tokens lost almost 90% of their value from peak prices. Analysts note that the performance of some altcoins was even worse than during the 2022 bear market. This raises an important question in the crypto world: Are altcoins completely finished, or are they quietly preparing for a comeback in 2026?

Why Most Altcoins Will Never Recover

Not all altcoins were designed to withstand long-term cycles. In 2017, nearly every coin rose during the market boom. By 2021, only strong projects with solid narratives retained value, while others lagged or disappeared from the market.

History makes this clear:

- Solana rose approximately 250x from its bottom to its peak.

- Avalanche achieved a 55x return.

- Litecoin gained about 17x in the last cycle, falling behind both Bitcoin and the best-performing altcoins.

- Older hype coins, such as NEO, performed even worse compared to newer networks.

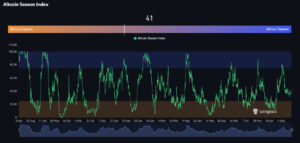

The reason is simple: hype alone no longer works. Large holders and older projects that don’t solve real problems lose significance without growth and adoption. Currently, the Altcoin Season Index is around 41/100, meaning Bitcoin still dominates the market compared to altcoins.

Alpha and Beta: Why Only a Few Altcoins Make Big Gains

Analysts often refer to two key concepts in crypto investing: alpha and beta.

- Alpha represents returns gained from the overall market uptrend.

- Beta refers to additional returns a project delivers by outperforming the market.

In the last cycle, Solana provided high beta by outperforming the market significantly. In contrast, Litecoin and other altcoins lost value because they failed to outperform. As a result, only a small number of altcoins offer life-changing gains for investors.

Why 2026 Could Be Different

Despite all the negativity, the altcoin market appears to be approaching a turning point. Valuations have fallen to some of the lowest levels after previous major market crashes, signaling both risk and opportunity for investors. Analysts emphasize that this does not guarantee an immediate recovery. However, at current levels, downside risk is lower, and a gradual recovery may begin. If liquidity conditions improve and strong, innovative projects continue to grow, next-generation altcoins could perform better in 2026.

This process depends not only on price movements but also on fundamentals such as network adoption, user growth, and on-chain metrics. Analysts suggest that these indicators could trigger recoveries in solid projects and create new opportunities for investors.

Only the Strongest Will Survive

The realistic picture is that most altcoins will not survive. Crypto is still a young technology, and progress comes through trial and error. New networks tend to outperform older ones because they are more efficient, scalable, and user-focused. However, a small group of altcoins that demonstrate real adoption, increased usage, and strong on-chain data can still offer significant profit potential for investors.